During periods of economic downturn, the value of stocks, commodities, productivity, and gross domestic product (GDP) drop. Below is an exploration of how an economic downturn could impact not-for-profit organizations along with strategies to help your organization persevere during a down market.

How Are Not-for-Profits Impacted by an Economic Downturn?

An economic downturn impacts not-for-profit organizations mainly in terms of finance and personnel.

Financial Impacts

With inflation rates soaring to 8.2% as of September 2022, the Federal Reserve has responded by increasing the federal funds interest rate in hopes of cooling down the economy. As this rate increases, the cost of borrowing increases, typically leading to less consumer spending.

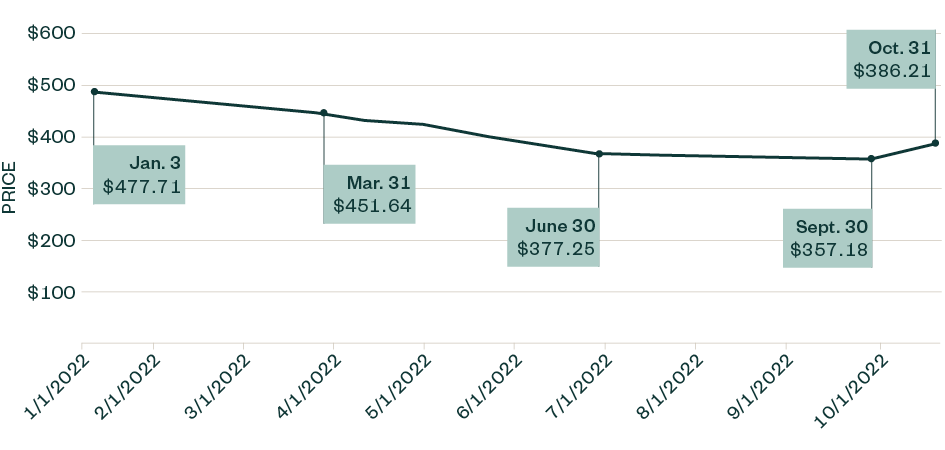

This also means that most Americans will have less disposable income allocated to not-for-profits. Investment income is also threatened. Throughout 2022, the stock market declined from its highs during 2021. The chart below shows the S&P 500 historical prices for this time period.

Reduced funding has a significant impact on most small to midsized not-for-profit organizations. As revenue declines, organizations will need to find ways to manage risk to ensure they can meet financial obligations in a timely fashion while also continuing to fulfill their missions.

Personnel Impacts

Economic downturn often leads to payroll reductions, which can create a stressful work environment for remaining employees. Increased workloads and longer hours can mean more errors from an exhausted and disengaged workforce.

If controls aren’t put in place in the face of higher turnover, the ability to prevent errors greatly decreases. Lastly, the risk of fraud inherently rises, which means effective internal controls may need to be designed and implemented.

Considerations in an Economic Downturn

Risk Management Plan

Developing a comprehensive risk management plan can help not-for-profit organizations to weather an economic downturn. A well-designed plan can help organizations minimize threats in a down market. The following should be considered when developing a risk management plan:

- Identify potential risks

- Evaluate and assess potential risks

- Assign an owner to each identified risk

- Develop a response for risks identified

- Monitor and report periodically

Cost of Debt

Interest rate swaps, now one of the most popular options to hedge against interest rate risk, are contracts where one stream of future interest payments is exchanged for another based on a specified principal amount.

What Is an Interest Rate Swap?

In an interest rate swap, two parties exchange one stream of interest payments for another. The most common traded and liquid rate swaps are known as vanilla swaps, which exchange fixed rate payments for floating-rate payments.

Interest rate swaps help organizations manage their floating rate debt liabilities by allowing them to pay fixed rate and receive floating-rate payments. Discuss with management and the board the idea of how entering an interest rate swap can allow for a predictable interest expense stream and manage the volatility in the market.

Operating Reserves

Many organizations don’t review their reserve, budget, and investment policies to ensure they meet current business and operational needs. Making sure they align with current processes, especially with respect to expenditure authority in the event of an emergency, could help organizations to prepare for times of distress.

During an economic downturn, you may want more flexibility to use operating or other reserves to meet unexpected cash flow needs. Discuss with your management team and board members or finance committee if you want to add any language to the policy about spending approvals or limits.

Once reserves are spent, they’re gone, so a thoughtful approach to spending them is important. Review your spending policy and ensure that there’s a clause for prioritizing reserves for replenishment.

Minimum Distribution and Spending Policies

When preparing for an impending or early phase economic downturn, not-for-profits without a lot of cash on hand may want to consider liquidating investments sooner to meet minimum distribution requirement (MDR) before stock prices further decline. Waiting to liquidate investments to meet its MDR can create a larger decrease in net assets if stock prices continue to fall.

Organizations with endowments are required to establish spending policies under the Uniform Prudent Management of Institution Funds Act (UPMIFA). In a declining economy and market, organizations may want to revisit spending.

Organizations should consider what’s needed to sustain the organization while maintaining the endowment balances. Organizations should carefully consider whether to spend funds if the endowment falls below its original historic dollar value and goes underwater.

Assess Operating Budget

Organizations should reassess their operating budget during an economic downturn and identify potential for the following:

- Cost reduction

- Assets to be liquidated for cash flow

- Budget shortfalls and financing needs

Not-for-profits can have a more proactive response to an economic downturn by increasing fundraising efforts and seeking governmental aid, particularly since additional governmental aid and tax credits are often available during tough economic times.

Understanding any related eligibility and compliance requirements can also provide relief in an economic downturn. Additionally, securing available resources such as a line of credit are critical in the face of harder times.

Financial Reporting

What you report in financial statements is of particular significance during an economic downturn. Here are some matters to focus and address as you work through your financial reporting in a year of a downturn.

Underwater Endowment

An underwater endowment occurs when the current fair value of an endowment is less than the original gift amount. The underwater amount must be reported within net assets with restrictions. Accounting Standards Update (ASU) 2016-14 requires organizations to disclose:

- Policy and any action taken during the period that concerns appropriation from underwater endowment funds

- Amount by which the funds are underwater

- Original gift amount or amount required to be maintained by donor or law

- Any governing board policy or decisions to spend, or not spend, from such funds

Allowance for Doubtful Accounts

When preparing financial statements, management should evaluate the collectability of receivables. Everyone—including donors, directors, and trustees—is impacted as is their liquidity for paying commitments.

It’s important for management to evaluate the aging of receivables and likelihood of donor and customer ability to make payments. Some items to consider in calculating the allowance for doubtful accounts include payment history and external factors that might impact the ability to make payments.

Commitments and Contingencies

In times of economic turmoil, litigations, claims, and fraud also typically increase. Contingencies to consider could include operational closures, litigation matters, reduction in workforce agreements, and severance pay.

Going Concern Accounting

Continuation of an entity as a going concern is presumed as the basis for financial reporting unless the entity’s liquidation becomes imminent. Even if the entity’s liquidation isn’t imminent, there may be conditions and events, when considered in the aggregate, that raise substantial doubt about the entity’s ability to continue as a going concern.

Financial Accounting Standards Board Accounting Standards Certification® (ASC) 205-50 provides guidance on how to evaluate events and conditions in management’s going concern assessment and the impact on the organization’s financial statements and disclosures when substantial doubt is raised.

Internal Controls

After experiencing significant turnover, it’s important to revisit the organization’s internal control procedures. Maintaining strong internal controls is important for safeguarding assets, ensuring reliable financial reporting, complying with laws and regulations, and reducing fraud risk and misstatements.

Assessing internal controls means that your organization should:

- Identify areas of risk in the organization (see Risk Management Plan above)

- Ensure segregation of duties

- Train new employees

- Develop and update written policies and procedures

- Perform timely reconciliations

- Maintain proper documentation of reviews and approvals

- Implement IT access controls, such as determining who has access

We’re Here to Help

For guidance on identifying and implementing strategies to protect your organization during an economic downturn, contact your Moss Adams professional. You can also visit our Not-for-Profit Practice page for additional resources.