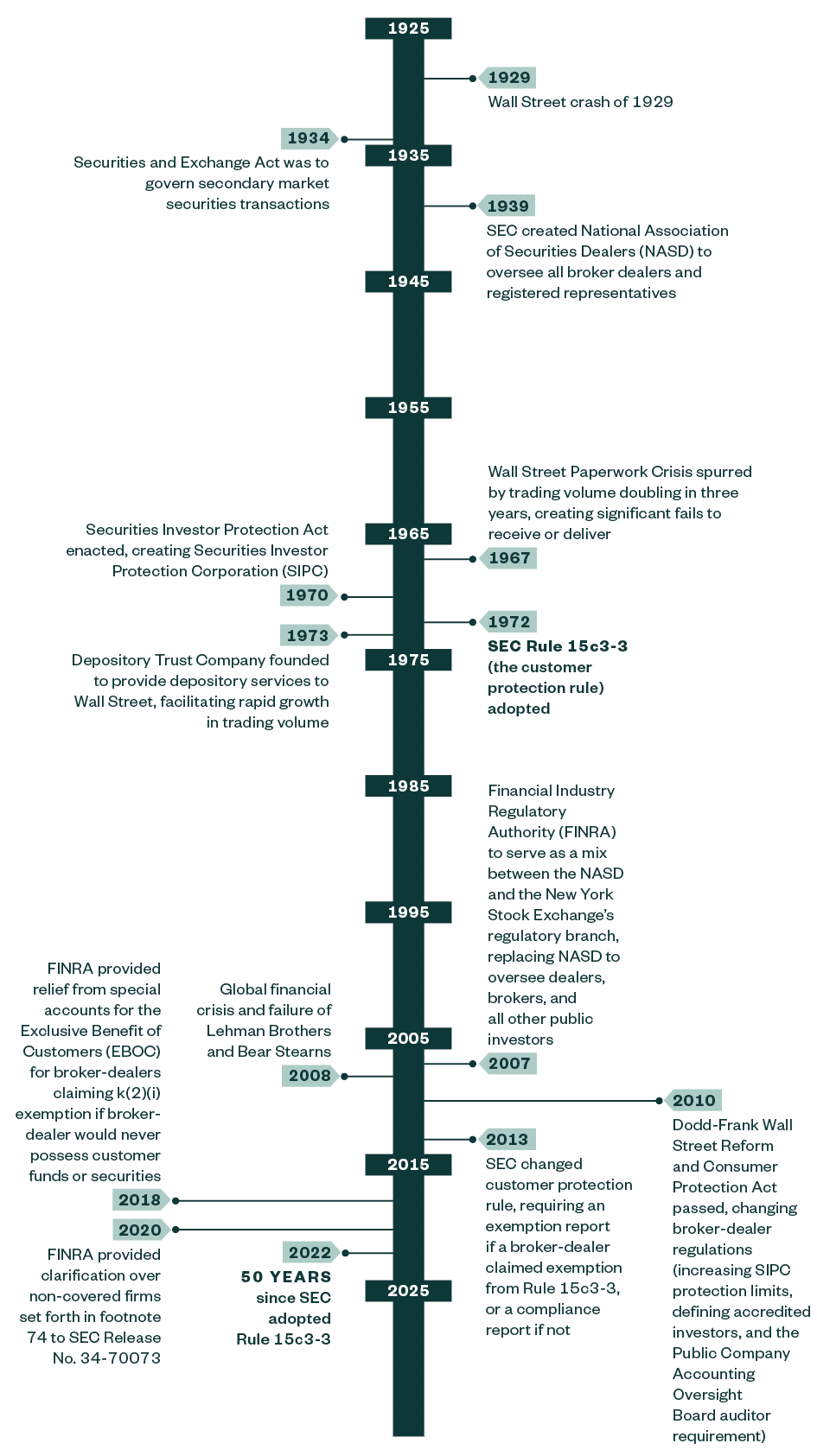

November 10, 2022, marks the 50th anniversary of SEC Rule 15c3-3, the customer protection rules that date back to 1972. To acknowledge this milestone, below is a historical timeline tracking how the progression of customer protection has evolved over the years.

What Is SEC Rule 15c3-3?

SEC Rule 15c3-3 imposes certain requirements on broker-dealers designed to protect customer funds and securities. Broker-dealers are obligated to maintain custody of customer securities and safeguard customer cash by segregating these assets from their proprietary business activities, and promptly deliver to their owner upon request.

Adoption of SEC Rule 15c3-3

Before computers were standard office equipment and trading was done on paper, the increased trade volume of the late 1960s soon outpaced the ability of firms to manage transactions, leading to the Wall Street Paperwork Crisis that prompted this rule. Rule 15c3-3 has changed how customer protection has worked ever since.

SEC Historical Timeline of Customer Protection

We’re Here to Help

If you have questions about SEC Rules or would like to speak to someone regarding Broker Dealers, contact your Moss Adams professional.