Period 4 reporting for the Provider Relief Fund (PRF) Phase 4 Distribution and American Rescue Plan (ARP) Rural Distribution is underway.

Both distributions were part of a single application process in fall 2021. Most Phase 4 awards were received on December 16, 2021, and ARP Rural awards were received on November 23, 2021.

If the total PRF payments received in Period 4, July 1–December 31, 2021, were at least $10,000, then Period 4 reporting is required.

Updated Guidance

There continues to be updated guidance and additional information to track regarding reporting. The Health Resources and Services Administration (HRSA) released an updated Post Payment Notice of Reporting Requirements on October 27, 2022.

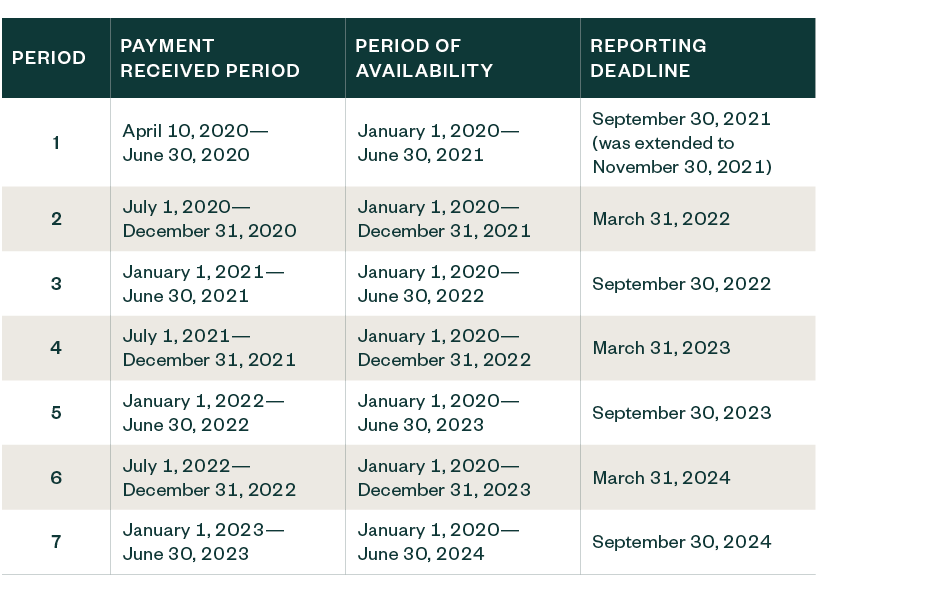

One notable update is the addition of three supplementary reporting periods—Period 5, 6, and 7. This extends the payment received period to June 30, 2023, for Period 7.

This, in turn, extends the period of availability to June 30, 2024, for Period 7.

Important Dates

See the table below from HRSA to note the dates and amounts of funds received to avoid missing reporting deadlines.

Other Notable Changes

HRSA has also indicated the option to use PRF for lost revenues will no longer be available at the end of the quarter in which the public health emergency (PHE) concludes. The Office of Management and Budget announced on January 30, 2023, that the PHE will end on May 11, 2023.

The terms and conditions document for both the Phase 4 and ARP Rural Distributions contain bullet points not found in prior phases or distributions.

Review these documents and monitor for ongoing compliance.

New bullet points include elements such as the requirement to maintain distributions in an interest-bearing account unless specific exceptions are met.

ARP Rural Distribution

The ARP Rural Distribution recipient entity must report on the usage of the funds to HRSA. If a parent received the ARP Rural Distribution on behalf of a subsidiary, it must transfer the funds to the subsidiary for usage by the subsidiary, however, the parent must submit the report to HRSA.

ARP Rural payments are to be used only for the tax identification number (TIN) that qualified for the payment.

Audit Requirements

The PRF and ARP funds continue to be subject to audit requirements based on periods of availability within an entity’s fiscal year. So, for a December 31, 2022, year-end, if an entity met the threshold of having reported on funds equal to or more than $750,000 in either Period 3, Period 4, or in both, in total, the entity is subject to audit requirements.

Not-for-profit and governmental agencies are subject to the single audit requirements and must file their audit through the Federal Audit Clearinghouse. Commercial entities have an additional option for a financial audit in accordance with government auditing standards.

HRSA created a Commercial Audit Reporting Portal commercial entities are required to use to submit audits. This portal uses the same credentials as the PRF Reporting Portal. If an entity hasn’t previously registered in the PRF Reporting Portal, they must continue submitting audits via email to PRFaudits@hrsa.gov.

Compliance Precautions

Entities should continue to monitor guidance from HRSA to ensure compliance with the terms and conditions of the PRF General and Targeted Distributions and ARP Rural Distributions.

Retain supporting documentation for any eligible expenses reported attributable to coronavirus—meaning, to prevent, prepare for, or respond to—including documentation that the eligible expenses are net of other sources of reimbursement.

Revenues reported in the lost revenue calculation must align with audited financial statements, and adjustments must be well-substantiated.

We’re Here to Help

If you have questions about the Period 4 reporting for the PRF Phase 4 Distribution and ARP Rural Distribution, please contact your Moss Adams professional.