During the COVID-19 pandemic, the Governmental Accounting Standards Board (GASB), issued GASB Statement No. 95, Postponement of the Effective Dates of Certain Authoritative Guidance.

While this delay in implementing GASB Statement No. 87 (GASB 87), Leases, may have provided some relief to Tribal governments and enterprises, GASB 87 needs to be adopted for the fiscal years ending in 2022.

The basic concepts and impacts of GASB 87, along with some example journal entries, are explored below.

What Is GASB 87?

GASB 87 establishes the foundational lease-accounting principle that leases finance the right-of-use of an underlying asset. A lessee must recognize a lease liability and intangible right to use a leased asset, and a lessor recognizes a lease receivable and deferred inflow of resources.

GASB 87 Reporting Standards

GASB 87 requirements apply to reporting periods beginning after June 15, 2021, which means entities with fiscal years ending in June 2022, September 2022, or December 2022 should already be implementing this standard.

The adopted requirements should be applied retroactively by restating all applicable prior periods, meaning that entities with comparative financial statements would restate to the beginning of their 2021 year-ends (YE).

Examples

The following scenarios show example journal entries and financial statement impacts for Tribal organizations.

Lessee Example: Gaming Machine Contract

Details

- December 31, 2022, YE with comparative financial statements

- 36-month contract for gaming machines

- November 1, 2020, contract start date

- 34 months remaining in lease as of January 1, 2021

- $10,000 monthly payments previously accounted for as operating expense, with monthly charges to rent expense

- 1.5% discount rate

Journal Entries

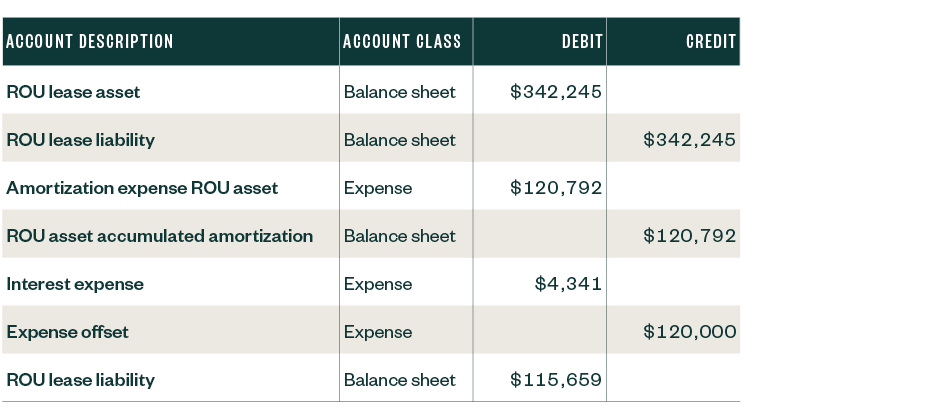

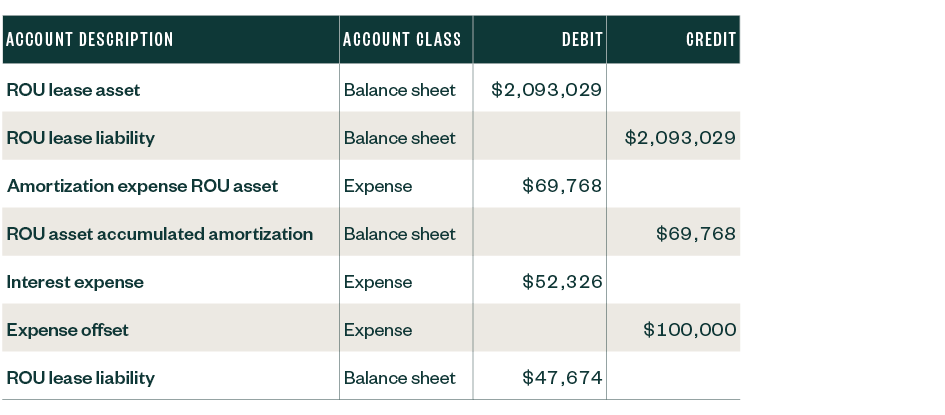

Tribe journal entries with adjustments made after December 31, 2022

- Recorded net present value (NPV) of lease payments as of January 1, 2021

- Right of use (ROU) lease asset is equal to the ROU lease liability with no net impact to beginning net position as of January 1, 2021

- Recorded activity for 2021 and 2022 is amortization of ROU asset for the rest of lease, recognizing interest expenses and reducing ROU liability for payments made.

The expense offset account listed below reduces operating expenses that were previously recorded as rent expense.

Journal Entries YE December 31, 2021

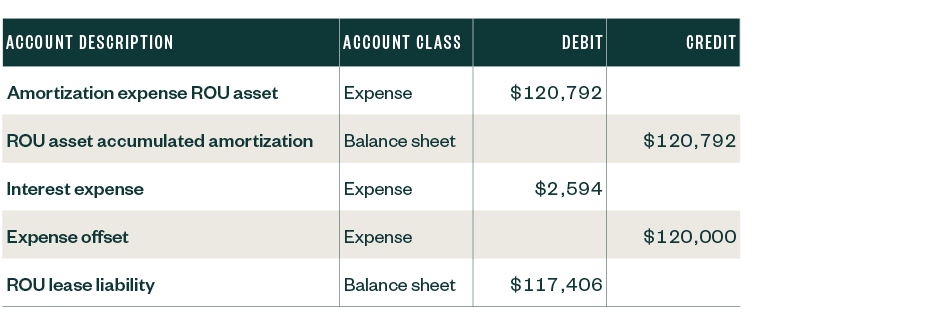

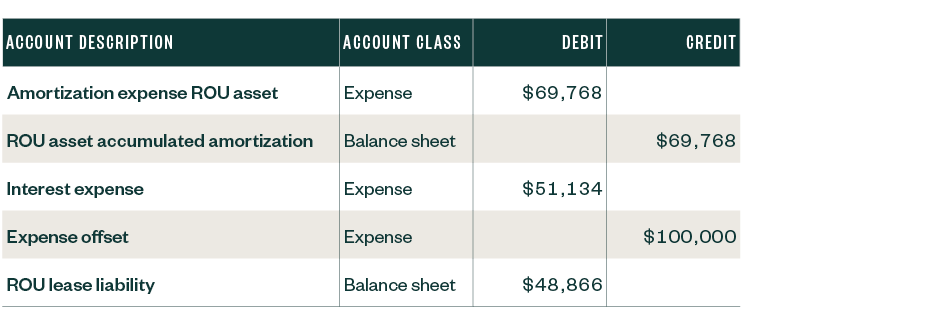

Journal Entries YE December 31, 2022

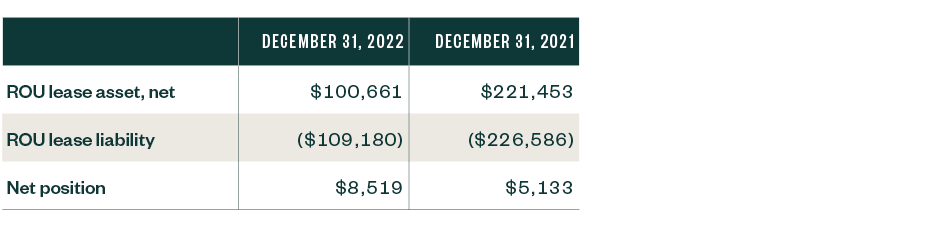

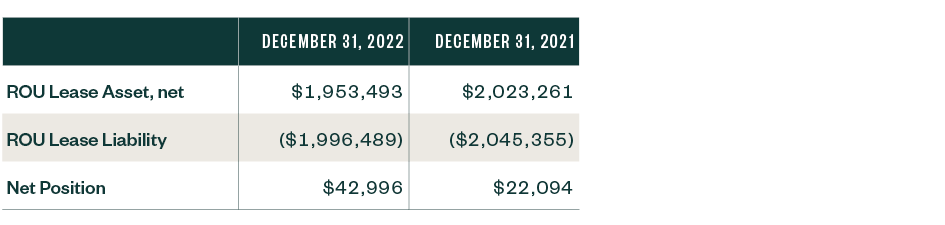

Financial Statement Impact Balance Sheet

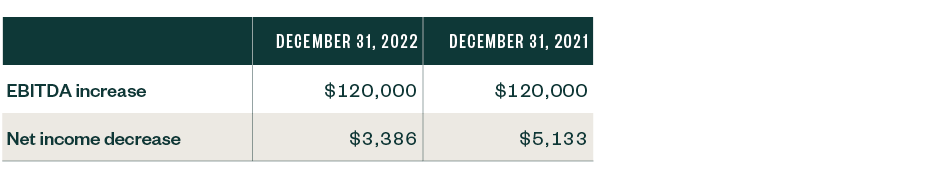

Income Statement

Operating expenses are decreased by previously recognized rent expenses, while nonoperating expenses increase for the amortization of ROU assets and imputed interest. This affects both earnings before interest, taxes, depreciation, and earnings before income, tax, depreciation, and amortization (EBITDA), as well as net income as shown below.

Cash Flow Statement

Cash flows from operations will increase by $120,000 each year. Payments on long-term ROU lease liability will be reported as capital financing outflows on the cash flow statement.

Lessee and Lessor Example: Casino Leases Land from Tribe

Details

- December 31, 2022, casino YE, comparative financial statements

- 25-year lease with option to extend 10 years, casino is reasonably certain to continue

- 20-year contract start date January 1, 2016, plus 10-year extension period results in 25 years remaining on the lease as of January 1, 2021

- Annual payments of $100,000 previously accounted for as operating expense, with annual charges to rent expense

- 2.5% discount rate

- Lease is considered to be exchange or exchange-like, meaning that rates would approximate something close to market values, if it isn’t considered an exchange or exchange-like rate, the lease standard would not apply

The structure of the Tribe would determine how the intra-entity lease would be reported, in consideration of the casino meeting one or more of the following conditions:

- Casino is a blended component unit. Treated like a normal lease in stand-alone statements, but such internal leasing activity would be eliminated before consolidating in the aggregated (Tribe-wide) financial statements

- Casino is a discretely presented component unit. Treated like a normal lease, but with receivables and payables as separate line items on the financial statements, also presented on aggregated financial statements

- Casino is an enterprise fund of the Tribe. Not to be recorded as an intra-entity lease on stand-alone or aggregated (Tribe-wide) financial statements

Journal Entries

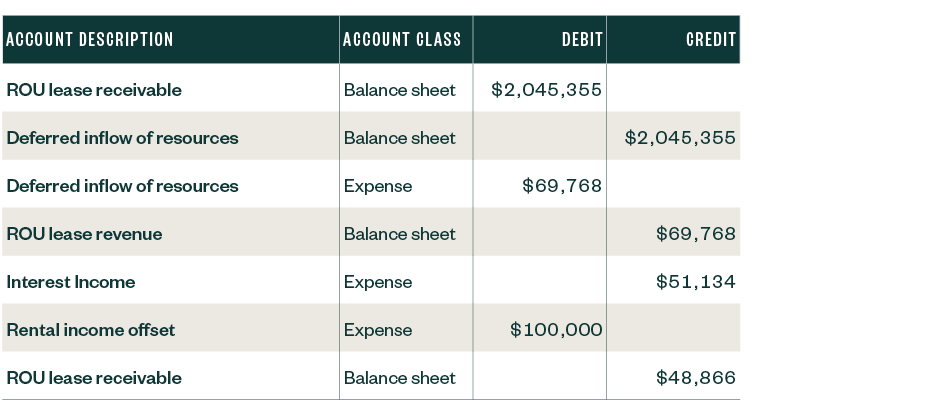

Tribe journal entries with adjustments made after December 31, 2022.

Journal Entries YE December 31, 2021

Journal Entries YE December 31, 2022

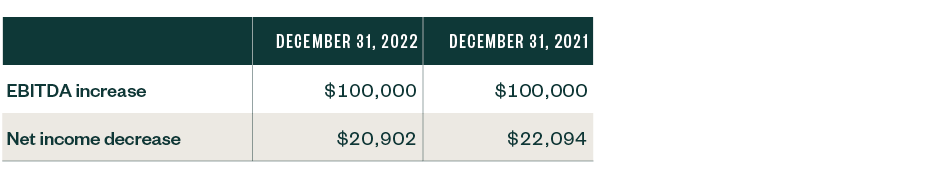

Financial Statement Impact Balance Sheet

Income Statement

Operating expenses are decreased by rent expense previously recognized and nonoperating expenses increase for the amortization of the ROU asset and imputed interest.

Cash Flow Statement

Cash flow from operations increases $100,000 annually. Payments on the long-term ROU lease liability and interest are reported as capital financing outflows on the cash flow statement.

The GASB hopes to promote symmetrical accounting between lessee and lessor.

In the above example, the Tribe would record a lease receivable asset equal to the NPV of future payments to be received, while recognizing a deferred inflow of resources equal to the lease receivable, under the assumption that the Tribe’s financial statements aren’t comparative and thus date back to December 31, 2021, not January 1, 2021.

Journal Entries YE December 31, 2022

Factors to Consider

The financial statement impacts of implementing GASB 87 are most significant on the balance sheet where the ROU assets and liabilities are recorded.

There’s also an impact as to where expenses are recognized in the statement of revenues, expenditures, and changes in net position, with amounts shifting from operating to non-operating. If your entity has debt be sure you are carefully reading your agreements and talking with your lender about how these changes may impact covenants and key ratios.

As noted in the land lease example above, Tribes and their component units should communicate about interest rates, lease terms, and expectations of how each of the standards will be implemented. Often these intra-entity agreements don’t have stated interest rates, so all parties should collaborate to ensure they’re using the same rate and records.

Looking Ahead to GASB Statement No. 96

GASB Statement No. 96 (GASB 96), Subscription-Based Information Technology Agreements (SBITA) aims to better meet the information needs of financial statement users by implementing each of the following actions for all SBITAs.

- Establish uniform accounting and financial reporting requirements

- Improve comparability of financial statements among governments

- Affirm understandability, reliability, relevance, and consistency of information

GASB 96 requirements apply to reporting periods beginning after June 15, 2022, though entities may elect early adoption. Tribal enterprises should discuss any plans to implement with their Tribal government to ensure consistency in reporting.

The accounting, journal entries, and financial statement impacts of GASB 96 are essentially the same as GASB 87.

We’re Here to Help

To understand more about how GASB 87 or GASB 96 could impact your enterprise or your Tribal organization, please contact your Moss Adams professional.