Lease accounting is an important aspect of financial reporting that affects both public and private sector entities. In the United States, lease accounting is governed by different standards for different types of entities.

For public entities, including state and local governments, the Governmental Accounting Standards Board (GASB) establishes the financial accounting and reporting standards. For private entities including private companies, public business entities, not-for-profit entities, and employee benefit plans, the Financial Accounting Standards Board (FASB) establishes the financial accounting and reporting standards under the Accounting Standards Codification (ASC).

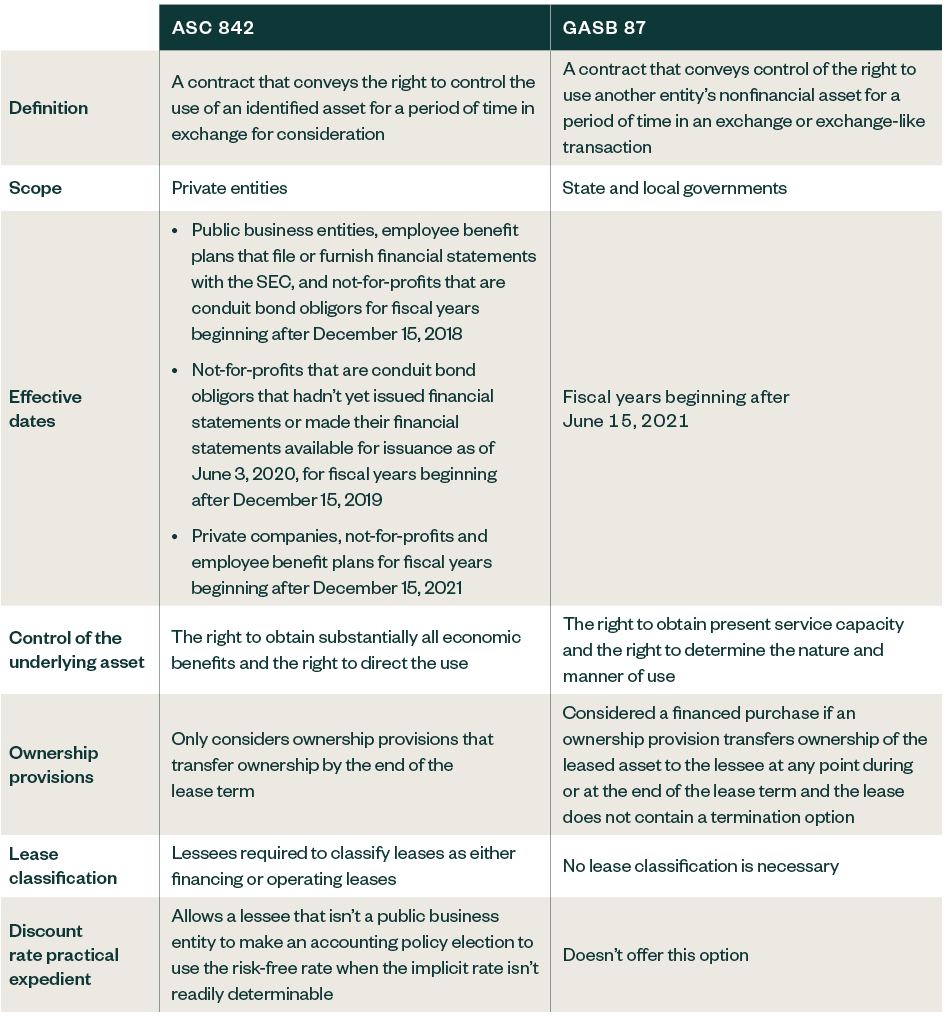

This article focuses on the differences in lease accounting between ASC 842 and GASB 87 related to accounting for lessees.

Overview of ASC 842 and GASB 87

ASC 842, Leases, is the lease accounting standard issued by the FASB, which applies to private entities in the United States. It replaced the previous standard, ASC 840, and was effective for public companies, certain not-for-profit entities and certain employee benefit plans for fiscal years beginning after December 15, 2018, and for private companies for fiscal years beginning after December 15, 2021.

GASB 87, Leases, is the lease accounting standard issued by the GASB, which applies to state and local governments in the United States. It replaced the previous standard, GASB 62, and was effective for fiscal years beginning after June 15, 2021.

Comparison of ASC 842 and GASB 87

Six Key Differences in Lease Definition

Definitions

One of the key differences between ASC 842 and GASB 87 is how each defines a lease. ASC 842 defines a lease as a contract, or part of a contract, that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. GASB 87 defines a lease as a contract that conveys the right to control the right to use of a nonfinancial asset for a period in an exchange-like transaction.

This subtle difference may cause contracts to be considered leases under ASC 842 but not under GASB 87.

Control of the Underlying Asset

Another difference relates to control of the underlying asset. Under ASC 842 control is defined as substantially all economic benefits and the right to direct the use of the identified asset. Under GASB 87, control is defined as the right to obtain present service capacity and the right to determine the nature and manner of use.

A key difference is that the right of substitution impacts the control assessment under ASC 842 but doesn’t under GASB 87.

Ownership Provisions

Another key differentiating factor between the two standards is how they handle ownership provisions.

Under ASC 842, if a lease includes a transfer of ownership of the leased asset to the lessee by the end of the lease term, the lease is classified as a finance lease. The ownership provision is considered a bright-line test. Finance leases represent an installment purchase by the lessee where ownership of leased asset remains with the lessee at the end of the lease. The lessee recognizes both the leased asset, the right-of-use asset, and the lease liability on the balance sheet.

GASB 87 treats ownership provisions differently. GASB 87 requires that if a lease includes an ownership provision that transfers ownership of the leased asset to the lessee at any point during or at the end of the lease term and doesn’t contain termination options, the lease is considered a financed purchase.

Lease Classification

An additional crucial distinction between ASC 842 and GASB 87 is the approach to lease classification. ASC 842 requires lessees to classify leases as either financing or operating leases whereas GASB uses a singular approach where no classification is necessary.

Under ASC 842, a lease is classified as a finance lease if it meets any of the following criteria:

- Transfers ownership of the underlying asset to the lessee by the end of the lease term

- Grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise

- Lease term is for a major part of the remaining economic life of the underlying asset

- Present value of the lease payments and any residual value guarantees equals or exceeds substantially all of the fair value of the underlying asset

- Underlying asset is of such a specialized nature that only the lessee can use it without major modification—in other words, the lessor expects to have no alternative use for the leased asset at the end of the lease

All other leases are classified as operating leases.

Discount Rate Practical Expedient

ASC 842 permits nonpublic business entities to make an accounting policy election by class of underlying asset to use the risk-free discount rate instead of the incremental borrowing rate when the implicit rate is not readily determinable. GASB 87 does not offer this option, however organizations should look to GASB 62 for guidance on imputing an interest rate when the contract does not have an implicit rate.

Calculating the Rate Implicit in a Lease

The implicit rate is based on the internal rate of return on all cash flows of the lease contract and is the rate that causes the following.

Lease Disclosures

While both standards require similar disclosures in some areas, there are some differences in lease disclosures between ASC 842 and GASB 87 that organizations should be mindful of to ensure compliance and transparent financial reporting. The following are some of the key differences.

In the maturities schedule included in financial statement notes, GASB 87 requires disclosures maturities for the next five years, and then in five-year increments until the lease expires. Under ASC 842, maturities are required to be disclosed for the next five years and then the remaining in a single thereafter figure.

Under GASB 87, leased assets are considered capital assets resulting in inclusion into net investment in capital assets as part of net position in addition to the required roll-forward of capital assets required under GASB. In contrast, ASC 842 requires the lessee to disclose right-of-use assets separate from capitalized physical assets either on the face of the financial statements or within the footnotes.

Under ASC 842, the weighted average of discount rates is required to be disclosed which is not required under GASB 87.

Understanding the key differences in lease recognition between GASB 87 and ASC 842 is crucial for organizations that lease assets, whether they are private companies or state and local governments. Failing to comply with the appropriate standard can have significant implications on financial statements, financial ratios, and compliance with debt covenants.

We’re Here to Help

For help with ASC 842 and GASB 87, contact your Moss Adams professional.

For more information, visit our Technical Accounting Service.