The fintech industry has experienced significant growth over the past decade and has become more relevant to everyday life.

From banking to mobile payments to buy now, pay later (BNPL) services, fintech has enhanced the speed and efficiency at which businesses and consumers are able to interact.

Investors and shareholders have already shifted the way they look at fintech companies—now with an emphasis on profitability rather than just growth. As a result, it’s more important than ever for founders and executives to track the value of their business.

Fintech encompasses technology designed to improve financial task processes. If the processes improve, value can increase and should be measured frequently for various purposes.

But with unpredictable monetary policy and volatile markets leading to ever changing valuations, when is a valuation needed? What methods and models are used to determine value? What do recent trends tell us about current valuations?

We’ll explore the answer to these questions below.

When Is a Valuation Needed?

Although knowing the value of your business is important at every stage of development, from founding to exit, determining value can be critical at certain stages and is even required at times. Some of these key stages include:

- Fundraising

- Equity compensation

- M&A

- Estate and gift reporting

- Corporate planning

- Lending and compliance

- Litigation

Fundraising

When securing funding from investors, a valuation is generally required to determine the amount of equity investors will receive.

This valuation is sometimes done internally but engaging third-party business valuation services can lend credibility to the value conclusion and aid in negotiations.

Equity Compensation

Granting equity incentives to lure key employees to a company is prevalent. This added portion of total compensation has become essential to attract and retain the best and brightest minds. These equity incentives generally come in the form of stock options or restricted stock units.

When equity compensation is issued, a company must determine its fair market value for tax reporting and fair value for financial reporting to comply with Internal Revenue Code (IRC) Sections 409A and Accounting Standards Codification (ASC) 718, respectively.

This valuation is commonly done prior to issuing stock options and used to set the exercise price of the options or to determine the number of shares that will be granted. This is because the difference between an option’s exercise price and the current fair market value of the stock is considered compensation, which is taxable to the person receiving it.

M&A

Companies can grow organically or by merging with or acquiring another company. This inorganic growth may serve many purposes, such as:

- Acquiring new technology or expertise

- Expanding into new geographies or territories to increase market share

- Preventing competitors from gaining a competitive advantage

Whatever the reason, when a transaction is completed, a purchase price allocation valuation is required by ASC 805 to determine the fair value of assets acquired.

This valuation is used to record identifiable tangible and intangible assets on the books of the acquiring company, with the remainder of the purchase price being booked as goodwill.

Additionally, management of the company on either side of the transaction often engages a third-party business valuation service to provide a fairness opinion. In a fairness opinion, a valuation provider does a deep dive into a specific transaction and opines on whether the price and terms of the transaction are reasonable. This can provide management with added assurance that no over- or under-payment is occurring.

A valuation provider can help management create an exit strategy to determine what might result in the best possible outcome for stakeholders.

Estate and Gift Reporting

Founders and shareholders in the business generally require a valuation for estate and gift reporting purposes when ownership in the business is passed on or gifted to heirs or trusts.

In the case of gifting, valuation providers work closely with a client’s estate planning attorney to strategize how much of the business should be gifted and when.

When minority interests are gifted, valuation providers apply discounts for lack of marketability and discounts for lack of control that reduce the tax burden on the gift. The magnitude of the discounts depends on various factors, including the:

- Size of the gift given

- Degree of control that the person or party receiving the gift will be granted

- Terms specified in a company’s bylaws or operating agreement

- Business’s financial condition and performance

Corporate Planning

A valuation is also useful when making crucial internal decisions. Whether that be assessing if a company has reached targeted milestones and should proceed with a scheduled product development or release, or simply keeping a pulse on the health of the business.

Lending and Compliance

A valuation may also be required when securing debt funding or a line of credit from a bank. These valuations vary in scope depending on the bank providing the loan and the terms.

Litigation

Intellectual property disputes, shareholder disputes, breaches of contract, and various other legal disputes may require the help of a business valuation professional. The valuation performed could be used to refute or support claims made as part of legal proceedings.

What Methods and Models Are Used to Determine Value?

There are various methods used to value fintech companies, and the approach used will depend on circumstances.

Some of the determining factors include the company’s stage of development, whether the company is profitable, the availability of information, and various other considerations. However, the primary methods are discussed below.

- Income approach

- Market approach

- Guideline public companies

- Guideline M&A transactions

- Subject company transactions

- Asset-based approach

Income Approach

In the income approach, expected future returns from an investment in the form of cash flows are discounted to present value at an appropriate rate of return for the investment.

The selected discount rate or rate of return should reflect the degree of uncertainty or risk associated with future returns and returns available from alternative investments. Higher uncertainty or risk leads to a higher expected rate of return, which produces a lower value for the investment.

Income approach valuation methods include discounted cash flow and capitalization of cash flow analyses. In the discounted cash flow analysis, future cash flows are discounted to present value using an appropriate discount rate or rate of return.

Cash flows are forecast for a period of years then projected to grow at a constant rate in perpetuity. The capitalization of cash flow analysis uses forecast cash flow for the next period, which is converted to present value using an appropriate capitalization rate, equal to the discount rate minus the expected growth rate in perpetuity.

There are also other income approach methods used to value intangibles assets such as the relief from royalty method and the multi-period excess earnings method.

Market Approach

The market approach is based on the premise that an asset can be valued by comparing it to the selling prices of other assets, with adjustments made to account for the differences between the assets or the transactions.

In the case of businesses, the comparisons could be:

- Companies being acquired

- Publicly traded companies

- Transactions in the company’s own equity

Guideline Public Companies

This approach relies on an analysis of publicly traded companies similar in industry and business model to the company. Market multiples of total enterprise value or total equity using the following data is applied to the company's corresponding financial metrics:

- Revenue

- Earnings before interest and taxes (EBIT)

- Earnings before interest, taxes, depreciation, and amortization (EBITDA)

- Net income

- Tangible book value

Since no two companies are perfectly comparable, premiums or discounts may be applied to the indicated market multiples if the company’s position or attributes are significantly different.

Guideline M&A Transactions

This approach uses prices paid in merger and acquisitions targeting companies similar to the subject company. The acquisition values, in conjunction with the transaction targets’ financials, are used to calculate implied exit multiples. These multiples are then applied to the company's corresponding financial data. Premiums or discounts may be applied to the indicated transaction multiples if the company’s position or attributes are significantly different.

Subject Company Transactions

This approach involves examining any transactions involving the equity of the business being valued. Utilizing the price at which a recent equity class was issued or transacted between third-parties, the total equity value of the company can be determined using allocation methodologies considering the rights and preferences of each class of equity. This process is referred to as backsolving.

Subject company transactions may not provide meaningful valuation information for one or more of the following reasons:

- There was only one or a small number of transactions, or the transactions are spread over too much time

- The transaction didn’t involve the same class of stock, such as preferred stock instead of common stock

- The transaction involved other considerations—for example, it was part of a strategic relationship, or another party was attempting to acquire control

- The transaction was for a large block rather than a minority interest

- The transaction was arranged under duress—for example, financial difficulty on the part of the seller

Asset-Based Approach

The asset-based approach is based on the premise that the value of a business is the cost of replacing all the assets of that business, both tangible and intangible. It involves estimating the cost of reproducing or replacing all property in the business, less depreciation for physical deterioration and functional obsolescence.

This approach is frequently used in valuing holding companies or capital-intensive businesses, but not for companies with significant intangible assets, such as unique software code and patents, because those cannot be reliably valued without reference to the income and market approaches.

In addition, one technique used under the asset-based approach, a liquidation valuation, can’t be used unless the shareholder interest being valued has the legal power to force a liquidation.

What Do Recent Trends Tell Us About Current Valuations?

Fintech valuations have been extremely volatile since the Federal Reserve began tightening monetary policy in March 2022.

Rising rates have led to significant uncertainty within fintech companies as the cost of capital has dramatically increased over a short period of time. As a result, investors and shareholders have begun to look at value differently. Growth at all costs is no longer a viable strategy as profitability has come to the forefront.

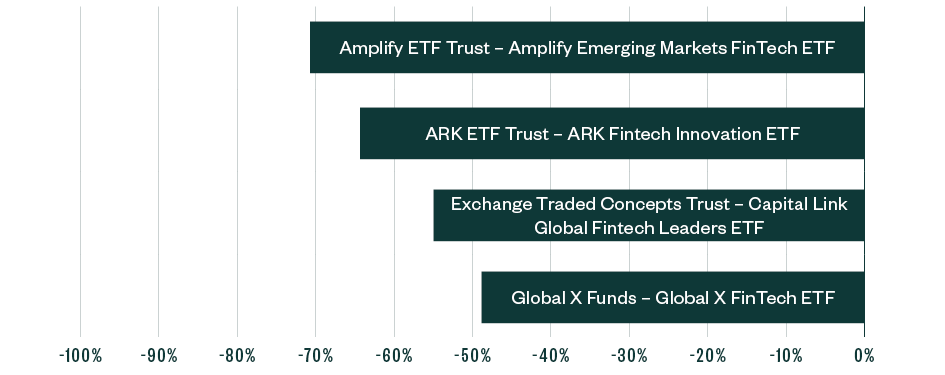

Between January 1, 2022, and May 5, 2023, four of the largest fintech exchange-traded funds (ETFs) were down an average of 59% as measured by the median change in market capitalization and shown in the graph below.

Percentage Change in Market Capitalization: January 1, 2022–May 5, 2023

The largest ETF, and probably most well-known from that group, the ARK Fintech Innovation ETF, was down 63.9% during that period.

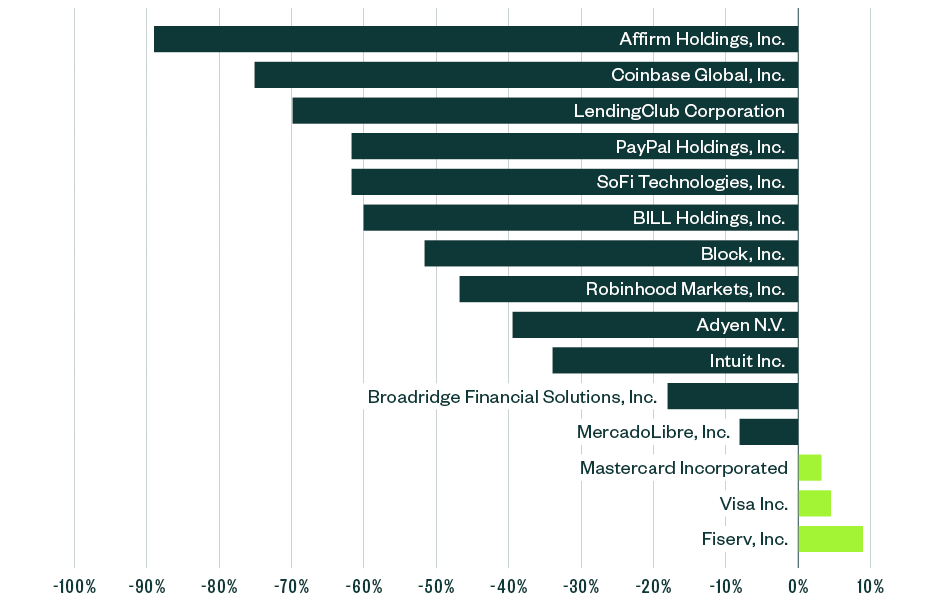

Additionally, a group of some of the largest publicly traded fintech companies were down 56.9%, as measured by the median change in market capitalization, during that period with Affirm, the BNPL provider, down a whopping 88.9% in that period.

Percentage Change in Market Capitalization, Continued: January 1, 2022–May 5, 2023

What Are Investors and Shareholders Looking For?

With fintech companies taking such a large hit since the boom from the COVID-19 pandemic, investors and shareholders are now looking for:

- Profitability

- Positively trending key metrics

- Strong leadership teams

Profitability

During the rapid growth of fintech companies during the COVID-19 pandemic, accelerated growth was the main goal of fintech companies. Investors and shareholders demanded this growth and pushed founders and executives to do whatever it took to achieve this growth.

However, with the shifting economic environment, profitability has become the more important target. To continue progressing and receiving investment, companies must be profitable or be able to tell a compelling story of how they’ll achieve profitability in the near term. Negative margins must quickly turn positive for companies to have a chance at survival and a successful exit.

Positively Trending Key Metrics

In the increasingly data driven world, everything is measured. Investors and shareholders have placed added scrutiny on these companies as a result. One of the most important metrics used when valuing and assessing the financial strength of a fintech company is annual recurring revenue (ARR).

ARR is the sum of all revenue for a product or business over a given year. It’s calculated by adding the total amount of revenue from subscriptions, plus additional revenue from any add-ons less any revenue lost from cancellation of subscriptions. Any non-recurring revenue or fees are excluded from the calculation.

ARR is relatively easy to calculate and allows management and investors to quickly benchmark performance against other similar companies. It also helps management determine which products and offerings should be pursued or phased out. Because it relates to a specific product or subscription, it’s easy to evaluate trends and see if a certain subscription model or product is working better than another.

ARR also aides in forecasting. Because recurring revenue is much easier to predict than one time revenue, forecasting is much more reliable, and in turn leads to better decision making and risk taking.

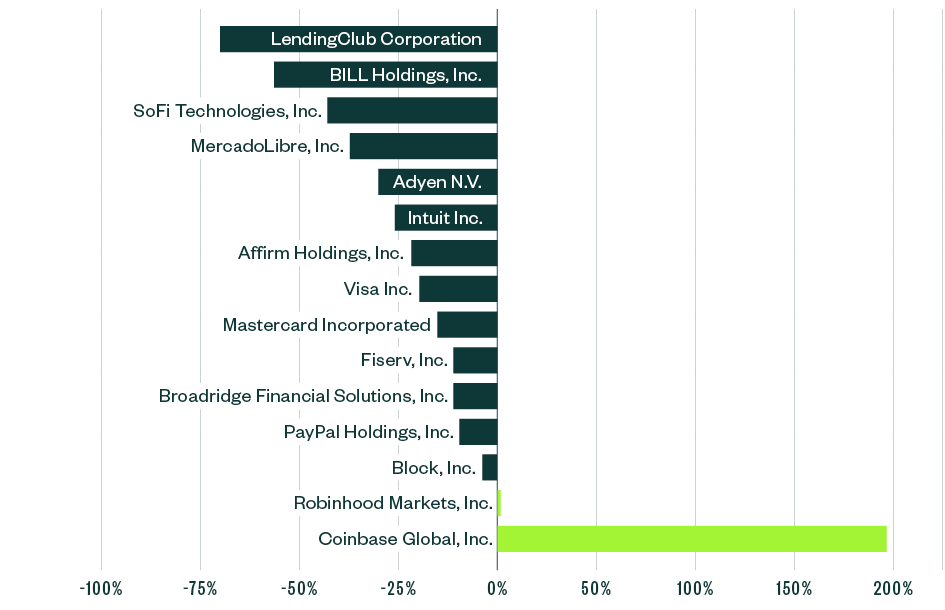

Revenue multiples are often used as a proxy for ARR. The total enterprise valuation (TEV) to revenue multiples for the same publicly traded fintech companies were down 18.1%, as measured by the median change in trailing twelve months (TTM) TEV to revenue multiples between January 1, 2022, and May 5, 2023. During that period, LendingClub Corporation was down the most at 70.8%. Meanwhile, Coinbase Global, Inc. was up 198.5% due to the rebound in cryptocurrency during 2023.

Percentage Change in TTM TEV To Revenue Multiples: January 1, 2022–May 5, 2023

Additionally, the following key metrics are often used in conjunction with ARR to assess the health of fintech companies:

- Customer acquisition cost (CAC)

- Lifetime value (LTV)

- LTV to CAC ratio

Customer Acquisition Cost (CAC)

CAC shows how much it costs to acquire each new customer. To calculate CAC, a company’s total sales and marketing spending are divided by the total number of new customers over a given period. Ideally, this number should decrease over time as a company matures. A declining CAC shows increasing brand awareness and the ability to effectively trim costs.

Lifetime Value (LTV)

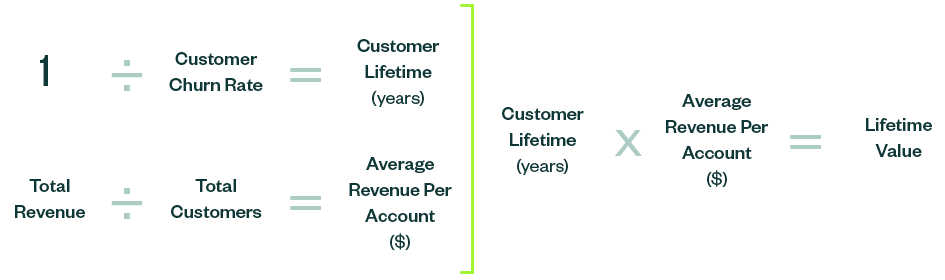

LTV is the average amount of money that customers pay during their lifecycle with a given company. To calculate LTV, a company first finds its customer lifetime by dividing the number one by its customer churn rate. Then, it calculates its average revenue per account (ARPA) by dividing total revenue by total customers. Finally, the company takes its customer lifetime calculated in step one and multiplies it by the ARPA calculated in step two.

This results in a company’s LTV and shows how much each customer is worth. If a company is effectively acquiring and retaining customers, this number should increase over time.

LTV to CAC Ratio

The CAC to LTV ratio displays in a single metric the lifetime value of a company’s customers and the total amount it spends to acquire them. This ratio is useful in helping management teams assess the effectiveness of marketing programs so they can increase activity and spend in programs that are working and discontinue those that aren’t.

The ratio is calculated by dividing the LTV by the CAC. A strong business will usually have an LTV to CAC ratio of three. A lower ratio indicates too much money is being spent to acquire customers, while a higher ratio indicates more money could possibly be spent to avoid missing out on business.

The ideal fintech business will have a CAC trending down over time and an LTV trending up over time until it settles near the target LTV to CAC ratio of three.

In addition to these metrics, other metrics outside the scope of this article are also considered when evaluating the strength of a fintech company, such as:

- Customer churn

- Customer engagement score

- Net promoter score

- Revenue growth rate

Strong Leadership Team

Investors and shareholders are also deeply interested in the strength and ability of the leadership team.

Leadership must develop a concrete and actionable strategy to confront the current headwinds. Leaders with experience in cost cutting and a track record of helping businesses operate efficiently have become more valuable and sought after.

Effective executives are those that have perfected the craft of telling a compelling story that convinces investors and shareholders that the company has positioned itself on the path to a successful exit.

We’re Here to Help

To learn more about how our services can help your fintech business, contact your Moss Adams professional.