In response to inflation rates in 2022, the IRS increased the estate, lifetime gift, and generation-skipping transfer (GST) tax exemption amount and annual gift exclusion amount for 2023 to $12.92 million and $17,000, respectively. These historically high exemption amounts offer individuals and families unique estate planning opportunities.

Increased Exemptions from Inflation Adjustment

The increase in the exemption amounts for 2023 will allow individuals and families to transfer more wealth to younger generations without incurring any estate, gift, or GST tax.

Proactive planning during this time can help reduce the overall tax burden on families and transfer wealth in a way that’s consistent with their wishes. Many of the wealth transfer techniques outlined below can be tailored for increased flexibility to help meet individual goals.

The increase in the exemption amounts can also be used to engage in business succession planning strategies. For example, a business owner may be able to use their lifetime exemption to transfer interests in their business to their children or other family members with little or no gift tax liability.

In many cases, they can retain some control of the business, as well as maintain an ongoing income stream. This can help keep the business in the family and provide for a more hands-on transition while maintaining the business owner’s income.

Estate and Gift Planning Opportunities for Increased Exemptions

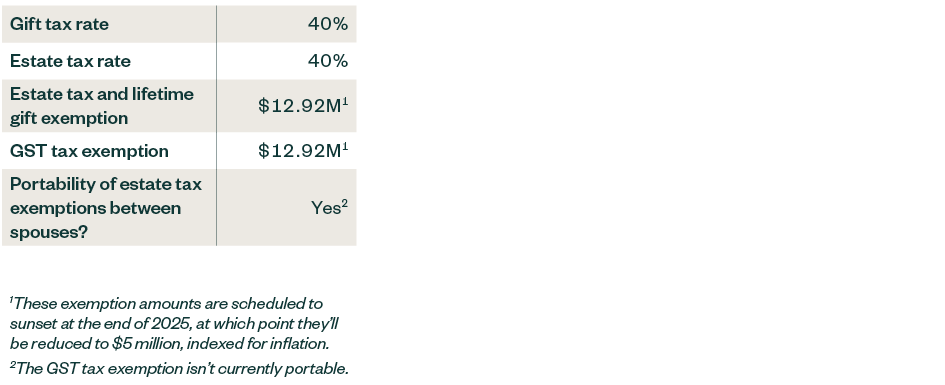

The inflation adjustments for the 2023 tax year were made to over 60 tax provisions and include updates to the income tax brackets and increases to the standard deduction amount. Two areas of particular note are the increases to the estate, gift, and GST exemption amount and to the gift tax annual exclusion amount.

The estate, gift, and GST tax exemption amounts are the maximum amounts that can be transferred tax-free by gift or through inheritance. The annual gift exclusion amount is the maximum amount that can be gifted to an individual recipient without the requirement of filing a gift tax return to report the gift.

With high rates now in effect for estate, gift, and GST taxes, estate planning can provide significant flexibility; however, the increased exemption amounts are scheduled to sunset at the end of 2025, at which point they’ll revert to $5 million, indexed for inflation.

Estate and Gift Tax Rates and Exemptions for the 2023 Tax Year

Tax Planning Opportunities Using Annual Exclusions and Lifetime Exemptions

In 2023 the annual exclusion amount increased from $16,000 to $17,000 per recipient, and the estate, gift, and GST exemption amount increased from $12.06 million to $12.92 million per individual.

With the estate and gift tax amount currently scheduled to sunset at the end of 2025, and with an estate tax rate of 40% on all amounts over the estate tax exemption, consider estate planning opportunities to take advantage of this elevated exemption before it sunsets. If you plan to give, consider the following strategies:

- Use the full $17,000-per-recipient annual exclusion and note that gifts can be made outright or in trust for minor beneficiaries to control distribution and protect beneficiaries from creditors.

- If you’re married, your spouse can also gift $17,000 per recipient, or you can split gifts with your spouse.

- Plan the timing and type of gifts.

- When considering lifetime gifts above the annual exclusion, plan carefully to chart a tax-efficient course of action while considering your personal cash flow needs and long-term estate planning goals.

- Mind state inheritance and estate tax issues. Some states have an inheritance or estate tax of their own, and the exemption amount can be much less than the federal amount. As such, lifetime gifts can help reduce your taxable estate for state inheritance and estate tax purposes.

- Transfer assets before they rise in value. If you’re holding any assets you believe will significantly appreciate, consider making a lifetime gift or sale to your beneficiaries now, so the assets can grow outside of your taxable estate.

Gifting Through Trusts and Entities

The strategies outlined below highlight the wide variety of gifting options available as well as the ways they can be tailored to meet individualized goals. Depending on your circumstances, strategies may be combined to increase the effectiveness of using your estate and gift tax exemption.

Contribute Property to a Family-Controlled Entity

A family limited partnership (FLP) is often the preferred vehicle for this tax planning technique. It provides the transferor continued control of the assets held in the FLP and gifts a portion to the next generation.

Give Gifts of Fractional Interests in Property

Gifts of fractional interests in property can allow for a valuation discount to be taken, further leveraging the amount of assets that can be transferred tax free.

Contribute Property to a Spousal Lifetime Access Trust (SLAT)

Using a SLAT strategy, a grantor gifts assets to a trust established for the benefit of their spouse and descendants. The spouse can receive trust income and principal, giving the grantor indirect access to the trust assets for as long as they remain married. The spouse can also serve as trustee if distributions are limited to an ascertainable standard. Funding a SLAT can enable a grantor to capture the current elevated estate and gift tax exemption amount before it’s scheduled to sunset at the end of 2025.

Have Each Spouse Fund a SLAT

Consider having each spouse fund a SLAT for the other spouse’s benefit to capture both spouses’ exemption amounts. The trusts should contain substantial differences, so the IRS doesn’t consider them to be reciprocal and include the trust assets in the grantor’s estate.

Form a Grantor-Retained Annuity Trust (GRAT)

This technique works best with assets that have the potential to appreciate rapidly. In this technique, a grantor gifts assets to a GRAT, which is created for a specified term.

In turn, the GRAT pays the grantor an annuity stream based on the value of the assets plus the Internal Revenue Code (IRC) Section 7520 interest rate over that term period. At the end of the term, any appreciation on the assets beyond the Section 7520 rate are then distributed to the grantor’s beneficiaries gift tax free.

The GRAT may be zeroed- out so the value of the assets gifted to the trust is returned to the grantor via the annuity, and there’s essentially no gift into the trust.

Transfer Property to an Intentionally Defective Grantor Trust (IDGT) Through a Gift or Sale

In this technique, a trust is seeded with a gift of around 10% of the value of the asset to be transferred, and the IDGT then buys the remaining asset in exchange for a promissory note.

During the term of the note, the IDGT provides the trust grantor with an ongoing income stream. An additional benefit of the IDGT is its structure as a grantor trust, meaning the grantor, not the trust, pays any income tax on the trust income. This allows the grantor to make additional tax-free gifts to the trust through the payment of trust income taxes.

Other Considerations

Inflation has caused volatile financial markets, which has led to distressed values for some assets. Many of these assets are likely to rebound in the future, but by gifting them when their value is low, you can freeze their value and shift all the appreciation out of your estate.

When utilizing any gifting strategy, consider future capital gains tax implications. Gifted assets retain the grantor’s cost basis and generally don’t receive a step-up in basis at the death of the grantor, since they aren’t included in the grantor’s estate. If you have depreciated assets with a low basis, consider gifting the assets to a grantor trust that includes swap powers.

This power allows you to exchange individually owned assets with trust assets, provided the assets are of equal value. Further, you can determine the appropriate time to swap assets. If you swap individual assets for low basis trust assets, the low basis assets would now be included in your taxable estate and therefore receive a step-up in basis at your death. With proper planning and timing, you can leverage low basis depreciated assets to reduce both estate and income taxes.

With estate tax rates at 40%, consider shielding as much wealth as possible from future estate taxes. Gifting your distressed assets now can be a great way to accomplish this goal.

529 Plan Superfunding with Annual Exclusions

Another useful gifting vehicle is a 529 plan, which is a tax efficient way to save for college. The investments in a 529 plan grow tax-free, and withdrawals are tax-free if they’re used for qualified education expenses.

Superfunding is a strategy that allows you to contribute five years' worth of annual exclusion gifts to a 529 plan in one year. With the increased annual gift exclusion amount, you can contribute up to $85,000 for single filers or $170,000 for married couples to a 529 plan in one year without having to pay gift tax.

Superfunding a 529 plan can be a useful strategy to capture tax savings. By contributing a large sum of money upfront, you can take advantage of compounding interest and grow your savings faster. Plus, you’ll avoid having to pay taxes on the growth of your investments.

If you’re already saving for college in a taxable account, you may want to consider superfunding a 529 plan. By transferring your funds to a 529 plan, you can avoid future taxable income and grow your savings faster.

Keep Your Estate Plan Current

In addition to the specific estate and gift planning opportunities discussed above, remember to regularly evaluate your comprehensive estate plan, or create one if you don’t have one in place. Below are a few reminders.

- Understand and revisit your goals

- Confirm powers of attorney are in place, wills are up to date, and review your beneficiary designations to ensure they’re consistent with your estate planning documents

- Plan for transitions

- Understand how federal and state estate tax laws could affect you

Inflation Adjustment FAQ

Below are some frequently asked questions and their respective answers.

How Much More Can Be Gifted in 2023?

In 2023, the amount you can give during your lifetime without incurring any gift tax has increased by $860,000 per individual and is currently $12.92 million. A married couple has a total exemption of $25.84 million. The annual gift exclusion amount has also increased by $1,000 and is currently $17,000 per recipient. A married couple can transfer $34,000 per recipient.

What Is the Best Way to Utilize Additional Lifetime Exemptions?

The additional exemption amount can be utilized through careful gifting strategies. By making gifts to trusts, it’s possible to capture the current high exemption amount while still retaining some level of control over the assets.

Trusts can also protect your beneficiaries from creditors and future transfer taxes. The estate planning strategies and trust structures most appropriate for your goals and objectives should be evaluated based on your unique circumstances.

What Happens If the Exemption Amount Goes Down?

In 2019, the IRS issued final regulations creating a rule to address what happens if there’s a decrease to the exemption amount in the future, referred to as the Anti-Clawback Rule.

This rule ensures an individual or estate won’t be taxed on completed gifts that were tax free and made before 2026. As previously outlined, the estate and lifetime gift tax exemption is schedule to revert to its previous $5 million amount—indexed for inflation—in 2026. While the exemption currently remains elevated, we’re afforded a rare estate planning opportunity.

The estate tax savings realized by utilizing the exemption now is demonstrated in the table below. If we assume an estate is valued at $15 million, the full 2023 exemption was used to gift $12.92 million, and there’s no growth on the remaining assets, then the taxable estate in 2026 would be valued around $2.08 million.

When the sunset occurs in 2026, the potential estate tax liability would be $832,000. On the other hand, if no gifts were made, then at the sunset in 2026, the taxable estate would remain at $15 million. In that case, the potential estate tax liability would be $3.2 million. This demonstrates how significant the tax savings can be.

Estate Tax Savings Example

We’re Here to Help

To learn more about inflation adjustments and how they could change your estate, gift, and GST tax, reach out to your Moss Adams professional for more information.