In an effort to continue economic growth, Arizona administers several incentive programs that could apply to both local businesses and out-of-state expansions into the state. Below is an overview of Arizona’s five most widely used incentive programs.

- Quality jobs tax credit (QJTC)

- Quality facility tax credit (QFTC)

- Computer data center (CDC) program

- R&D tax credit

- Transaction privilege tax (TPT) exemption for manufacturing equipment

Quality Jobs Tax Credit (QJTC)

The QJTC is a nonrefundable tax credit created to encourage business investment and the creation of high-quality employment opportunities in Arizona. This credit can be used to offset a company’s income or premium tax liability, with excess credits carried forward for up to five consecutive years.

Potential Benefit

The QJTC offers up to $9,000 of credit per net new job. The credit for each net new job is claimed over a three-year period in annual installments of $3,000 for an eligible business.

Eligibility Requirements

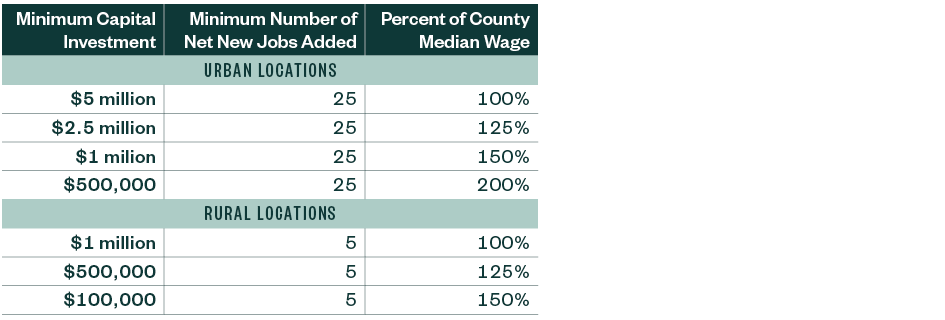

Companies making the minimum investment in Arizona and creating the minimum number of net new qualifying jobs can apply. Eligibility qualifications are different for rural and urban areas as described below.

How to Apply for Program Benefits

Companies creating net new jobs and making a capital investment at a business location can qualify for the QJTC.

Preapproval

Companies can request a username and password on the ACA’s easy portal and file an online application indicating the capital investment and hiring expectations at the designated business location over a three-year period. If approved, the company will receive a preapproval letter along with a priority placement number.

Post-approval

Post-approval applications must include capital investment and employment documentation proving the company met the program eligibility requirements. Upon acceptance, the company will receive a tax credit allocation letter identifying the credit the taxpayer can claim.

Companies using the credit against its income tax liability must file an application within six months after the end of the taxpayer’s taxable year when the jobs were created. Companies applying the credit to their premium tax liability must apply by March 1 of the year after the calendar year when the jobs were created.

Qualified Facility Tax Credit (QFTC)

The QFTC provides a refundable income tax credit against Arizona tax liabilities for qualifying capital investment and net new jobs. A business location may qualify for multiple credit allocations as long as each allocation includes separate capital investment and net new job creation.

Potential Benefit

The QFTC offers a refundable income tax credit equal to the lessor of:

- 10% of the qualifying capital investment

- $20,000 per net new full-time job at the facility if the total qualifying investment is less than $2 billion

- $30,000 per net new full-time job if the qualifying investment is greater than $2 billion

- $30 million per taxpayer, per year

Eligibility Requirements

A company may be eligible for QFTC tax credits if it meets the following requirements:

- Makes a capital investment of at least $250,000

- 80% or more of the property and payroll is dedicated to manufacturing, headquarters, or manufacturing R&D facilities

- 51% or more of the net new jobs must be at least 125% of the state’s median production wage in an urban location or at least 100% of the state’s median wage in a rural location

- 65% or more of the project sales or revenue are to customers outside of Arizona

- Net new jobs only count after the project capital investment has begun

- At least 65% of the health insurance premiums for all net new full-time jobs are paid by applicant

How to Apply for QFTC Benefits

Companies planning to create net new jobs and make capital investments at its business locations can qualify for the QFTC.

Preapproval

Companies must request preapproval for tax credits as outlined below:

- Request a letter of good standing from the Arizona Department of Revenue (DOR) by submitting a tax clearance application prior to applying to the Arizona Commerce Authority (ACA)

- Submit a request for preapproval to the ACA to apply for tax credits

Within 30 days of receiving a complete request for preapproval, the ACA will notify the company of preapproval or denial. The ACA will then issue preapprovals to eligible companies and transmit a copy to the DOR.

Preapproval doesn’t guarantee the receipt of any tax credits. Eligibility will ultimately be determined after a company applies for post-approval of the tax credits.

Post-Approval

A company would submit for post-approval after the project is completed through the process outlined below:

- After beginning operations, the company must enter into a written managed review agreement with ACA. At the company’s expense, the company will select a certified public accountant licensed in Arizona and approved by the ACA, to conduct the written managed review.

- After the certified public accountant furnishes its findings in writing to the ACA, the company must submit an application for post-approval to the ACA.

- The ACA may issue post-approval to the company after reviewing the application and verifying the company’s eligibility. Once post-approval is received, a company must claim the tax credits in five equal annual installments on an original Arizona tax return.

Computer Data Center (CDC) Program

This program is designed to encourage CDC operations and expansions in Arizona. The program provides TPT and use tax exemptions at the state, county, and local levels on qualifying purchases of CDC equipment, with TPT being a state and local sales tax imposed on the seller for doing business in Arizona.

Potential Benefit

An owner, operator, or qualified colocation tenant of a certified CDC can receive tax exemptions for up to 10 full calendar years following the year of the CDC certification. If the CDC qualifies as a sustainable redevelopment project, the program tax exemptions are available for up to 20 full calendar years.

Eligibility Requirements

Applicants must have CDC facilities that meet one of the following location criteria:

- Maricopa or Pima county: Must invest at least $50 million within five years of the date of the CDC certification from the ACA

- Outside Maricopa or Pima county: Must invest at least $25 million within five years of the date of the CDC certification letter from the ACA

- Existing CDC regardless of location: Have made an investment of $250 million during the period between September 1, 2007, and August 31, 2013

If the CDC is a greenfield sustainable redevelopment project, a capital investment of at least $200 million must be made and the CDC must attain certification under the energy star or green globes standard within five years or the CDC’s certification.

Company Requirements

The company must receive a CDC certification and make a capital investment to receive tax exemptions through this program.

How to Apply for Benefits

- ACA is authorized to accept applications for certification of a CDC dating back to September 1, 2013, and going forward to December 31, 2033

- Owner or operator may apply for certification of a CDC by completing the electronic application for CDC certification

- ACA will notify the owner or operator of certification or denial within 60 days of receiving the application

- Owner, operator, or qualified colocation tenant may pursue TPT and use tax exemptions once certified

R&D Tax Credit

The R&D program provides an income tax credit for increased R&D activities conducted within the state, which includes research conducted at a state university and funded by the company.

This program has a nonrefundable component and a refundable component. The nonrefundable component is administered by the DOR, and the refundable component is administered by the ACA. The maximum refund amount per taxpayer is $100,000 in a single year, with no cap for the nonrefundable credit.

Potential Benefit

A company may receive a nonrefundable income tax credit equal to 24% of the first $2.5 million in qualifying expenses, plus another 15% of qualifying expenses of more than $2.5 million for years 2011 through 2030.

In 2031, tax credit rates will decrease to 20% of the first $2.5 million in qualifying expenses, plus 11% of the qualifying expenses more than $2.5 million. An additional nonrefundable credit amount is allowed if the taxpayer made payments to a university under the jurisdiction of the Arizona Board of Regents, which allows a R&D tax credit of up to 34%. Any unused credit can be carried forward for 15 consecutive years.

A taxpayer qualifying for the nonrefundable tax credit and who employs less than 150 full-time employees worldwide can apply to ACA for a refund. The refundable tax is equal to the lesser of either:

- 75% of the current year’s tax credit minus the current year’s tax liability

- Maximum refund amount on the certificate of qualification from the ACA

Eligibility Requirements

Arizona allows credits for research and development activities defined in Arizona Revised Statuses (ARS) Sections 43-1168 A1.

How to Apply for Benefits

Taxpayers can claim the nonrefundable R&D tax credit against its income tax liability.

Taxpayers can submit an application to ACA requesting a partial refund of the R&D credit. Applications are submitted electronically on or after the first business day following the close of the previous calendar year. Refundable credits are approved on a first-come, first-served basis and are usually exhausted within the first 15 minutes after the application becomes available.

TPT Exemption for Manufacturing

Arizona allows a TPT exemption on machinery and equipment purchases directly used in a manufacturing process.

ARS Section 42-5061(B) defines eligible manufacturing processes to include processing, fabricating, job printing, refining, metal working, mining, electrical power transmitting, and oil and gas extraction.

Manufacturers should receive an exemption on manufacturing equipment purchased from their vendors. They can confirm receipt of this exemption by providing their vendors with a TPT exemption certificate. Upon receipt of this certificate, the vendor will mark the manufacturers account as exempt from TPT.

We’re Here to Help

To discuss your company’s eligibility for these or other tax credits and incentives, or guidance on claiming program benefits contact your Moss Adams professional.