A version of this article was published in the August 2023 edition of Healthcare News.

There are several factors that increase the likelihood of a successful project when planning to construct a new health care facility, improve an existing hospital or long-term care facility, or develop a strategic capital improvement plan.

Project Strategy

Before undertaking a construction project, leadership and stakeholders should understand and align their final project goals and agree on a strategy.

A feasibility study can help align the organization before committing business resources, time, and budget.

Leadership should discuss processes and controls to manage the various teams and deliverables. They should also keep stakeholders informed of progress at every stage.

Project Planning

Ask these questions to clarify project planning:

- What’s the purpose of the project?

- Where’s the best location?

- What’s the budget, funding sources, and proposed timeline?

- How will you track and communicate progress, safety, and quality?

- Who will be on the team? What will their responsibilities be?

- What are the end user needs to ensure the facility is functional and practical?

The planning phase, arguably the most crucial and often the most neglected, is essential for project success.

Without a cohesive and comprehensive project plan, the risk of regulatory violations, inefficient operations, project delays, and budget concerns increases.

Plan Early

Planning major construction projects can be demanding as your hospital works to simultaneously meet current needs and future challenges that have yet to even present themselves.

Take steps early in the process to envision how new construction will operate and serve your community. Focus on grant compliance and contracting strategies that can help bring major advantages to the construction process and final product.

Common planning steps include:

- Perform a needs assessment such as site selection

- Prepare funding alignment and explore grant and New Market Tax Credit Opportunities

- Facilitate project scope definitions, requirements, and prioritization sessions with key stakeholders

It’s important you align with the master capital plan, strategic plan, and track performance to support transparency and accountability.

Site Selection

Identify ideal locations for your business’s next phase of growth and expansion with a site selection analysis.

Site selection studies can help inform location choice through quantitative and qualitative analysis of critical factors.

Leverage negotiations with states and municipalities and pursue tax credits and incentives, while working within your decision-making process with guidance from our professionals.

How Selection Studies Help Improve Decisions

A site selection analysis can provide a company with important insights regarding critical location factors, including:

- Workforce costs and availability

- Suitable space for operations and assess proximity to customers, suppliers, transportation hubs, and more

- Analysis of new or strategic geographic regions critical to business growth

- State and local tax impacts of the jurisdictions business is in

- Financial incentives available to offset costs

Additionally, a site selection analysis can offer the following benefits:

- Manage timing

- Engage key stakeholders

- Improve outcomes

- Maintain compliance

Financing

Understanding the available funding options will determine the proper finance channel. Whether business loans, grants, or municipal bonds, it’s important to understand the risks, stipulations, and requirements of each financing type.

Private Loans

To secure a private loan, organizations will need to provide their lender with detailed information such as construction timeline, floorplans, suppliers, contractors, and more.

Lenders often send representatives to the job site to confirm the project is progressing as promised before issuing funds for subsequent phases. This makes it imperative that companies manage each phase of construction to meet agreed-upon checkpoints, timelines, and budgets as to not default on loan requirements.

Public Financing

Public financing options such as grants require extensive applications. These funds also usually have audit and compliance requirements. Organizations will need to have quality controls in place to meet grant stipulations.

New Markets Tax Credit

The Community Development Financial Institutions (CDFI) Fund, a division of the US Department of Treasury, announced $5 billion in New Markets Tax Credit (NMTC) allocation authority on October 28, 2022.The NMTC program is authorized through 2025, with $5 billion of allocation authority awarded annually to highly qualified Community Development Entities (CDEs), which in turn use that authority to catalyze investments in traditionally underserved communities throughout the United States.

The annual NMTC allocation awards draw attention within the NMTC industry with CDEs looking for projects that can benefit from NMTC financing.

The following questions can help determine if this powerful financing tool will help an organization realize its goals.

- Is the business looking to expand or relocate?

- Is the business seeking to purchase equipment or in need of working capital?

- Is the organization looking to expand services in the community?

Regardless of whether a project is privately or publicly owned, it’s helpful to engage a qualified advisor who assists in the development of your budget and navigate the complexities of securing funding.

They can also review the funding compliance requirements and confirm they are met. The construction advisor should have experience working with various lenders and fully understand the construction process—from inception to completion.

Secure Experienced Construction and Grant Compliance Specialists

Eligible entities that receive funds under these programs must understand grant compliance procedures and applicable compliance requirements of the award to support successful construction implementation. It’s key to establish an adequate internal control system to account for, monitor, and report on the use of the funds.

Whether you’re a large or small organization, you can make compliance and related monitoring a priority. It doesn’t always have to be burdensome, complex, or overtax limited resources.

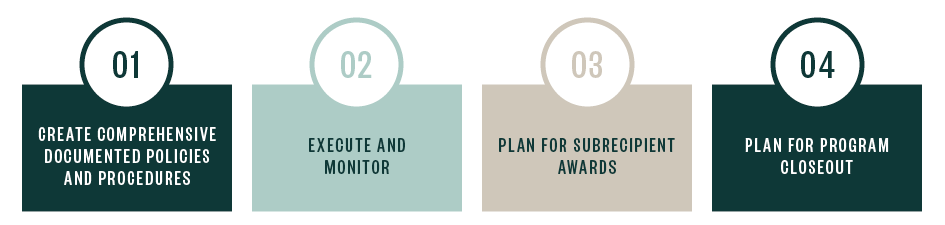

Following are four steps your organization can take.

Additionally, hospitals should assess whether their team includes experienced construction professionals who can help programs and projects stay on track and within budget and comply with grant and contract requirements.

Key project management personnel need a thorough understanding of the objectives.

Managing a capital project or program requires making strategic and informed decisions about:

- Construction delivery methods

- Vendor selections

- Project budgets

- Phasing schedules

Common program pitfalls might include cost overruns resulting from ineffective procurement practices, schedule delays that impact development, excessive change orders due to limited end user involvement during planning, or penalties for noncompliance with funding source requirements for federal regulations.

Defined roles and oversight at every step in the process are critical for any project.

Successful project management results in finishing your project within the original budget and timeline. Unsuccessful project management results in construction delays and budget expenditures that could negatively impact the project.

Below are some strategies to consider.

Define Roles and Delegate Duties

Each person should understand what’s expected of them, and the deliverables needed from them at every phase of the project.

Leadership roles should be clearly defined for decisions made throughout the project, and communication should ultimately flow up to your organization’s stakeholders.

Ensure Competitive Bid Procedures and Apparency

If you’re an owner or developer, you’ll want to obtain comparative bids on all work. Requiring three bids is a good starting point.

Incorporating a clause stating that project costs are auditable establishes the expectation that all costs sent to the owner or developer can be reviewed, audited, and validated for contract compliance.

Leverage Consistent and Real-time Communication

A clearly defined communication process provides transparency and controls and ensures all the different teams are on the same page. Construction management technology can help to centralize communication, documents, and calendars.

Maintain Thorough Documentation

Documentation of the project life cycle should be put in place from the start, updated regularly, and easy to track.

Ensure there are sign-off procedures for major milestones or changes that may arise.

Policies, Controls, and Metric Tracking

Once construction starts, the goal is to make sure everything progresses according to plan.

Often, a project will get derailed by minor complications rather than one large issue. Carefully analyzing progress reports, keeping an eye on the budget and schedule, and managing financial risks are imperative.

Understanding key performance indicators (KPIs) will provide support to your organization and aid in the detection and mitigation of potential risk areas. Based on the Government Finance Officers Association (GFOA), common financial and project activity information should include:

- Project plan that identifies all required resources, milestone work products, and assurance that the project plan is being followed

- Confirmation that the project’s scope has been clearly identified upon completion of final design and that the project stays within scope or changes that scope to remain consistent with an established process

- Review of project-related financial transactions to support budget review, auditing, and asset management

- Review of expenditures, both in relation to the current budget, and over the entire project life

- Review of any project retainages, warranties, or other conditional performance schedules

- Review of encumbrances and estimates of planned expenditure activity

- Continued availability of appropriate revenue sources identified in the capital budget

- Cash-flow adequacy in relation to project requirements

- Review of timing of investment maturities compared to planned project disbursements

- Review of sources and project uses of bond proceeds and grants

- Results compared to established measures of performance, including at minimum, cost and schedule performance indices

While your contractor will monitor these issues carefully, leadership should also have a clear understanding of quality and timeline metrics and ask for consistent progress reports.

We’re Here to Help

If you have any questions about site selection and policy and procedure development, please contact your Moss Adams professional.