California offers a range of tax incentives for businesses considering relocating to California, hiring and retaining new employees, working to reduce greenhouse gas emissions, installing electric vehicle (EV) charging stations, and more.

Top California business incentives include:

- California Competes Tax Credit (CCTC)

- California Employment Training Panel (CA ETP)

- California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA)

- California Electric Vehicle Infrastructure Project (CALeVIP)

- New Employment Credit (NEC)

Other programs include California Air Resources Board (CARB) related EV programs and California Energy Commission EV manufacturing grants.

California Competes Tax Credit (CCTC)

Administered by the Governor’s Office of Business and Economic Development (GO-Biz), the CCTC program aims to attract and retain high-value employers in California that provide strong wages and benefits. The CCTC is available to businesses—regardless of size or industry—with plans to grow new full-time jobs in California.

Companies can apply for this income tax credit during any of the three predefined application rounds each year. As more organizations look for ways to reduce costs, CCTC funds are increasingly competitive to secure.

How Much Money Could Be Available?

In the budget, which has been passed for fiscal year (FY) 2023–24, GO-Biz has been allotted just over $490 million in tax credits over three application periods. Applicants may request up to 20% of the total amount available each year.

Is the CCTC Refundable?

The CCTC isn’t refundable, but each year of the credit allocation can be carried forward for six years.

How Do You Qualify for the CCTC?

The CCTC is open to businesses of any industry, size, or location that meet one of the following criteria:

- California-based companies planning to expand

- Companies contemplating leaving California

- Out-of-state companies planning to relocate operations to California or start business operations there

The credit is awarded through a competitive application process where applications are reviewed on several factors, including the number of full-time jobs being created, and the proposed wages paid to those employees.

GO-Biz will analyze the amount of investment and review any training programs conducted by the applicant. GO-Biz will also weigh the strategic importance of the applicant’s industry to the state or region.

Recommendations for Applicants

For FY 2023–2024, GO-Biz will accept applications for the CCTC during the following periods:

- July 24, 2023–August 14, 2023

- January 2, 2024–January 22, 2024

- March 4, 2024–March 18, 2024

The application process for the CCTC is typically very competitive. Note the following characteristics that could help create a potentially successful application:

- Out-of-state competition. Compelling demonstration that job growth will be in jeopardy of being placed outside California without incentives. Companies actively engaged in a site selection analysis generally make good candidates.

- Job retention. Ability to demonstrate how receipt of credit will keep jobs in California.

- High paying jobs. Majority of projected increase in headcount with wages over $75,000 annually.

- Job training Offer robust employee development and training programs.

California Employment Training Panel (ETP)

The ETP provides funding to employers to assist in upgrading the skills of their workers through training that leads to well-paying, long-term jobs.

How Much Money Could Be Available?

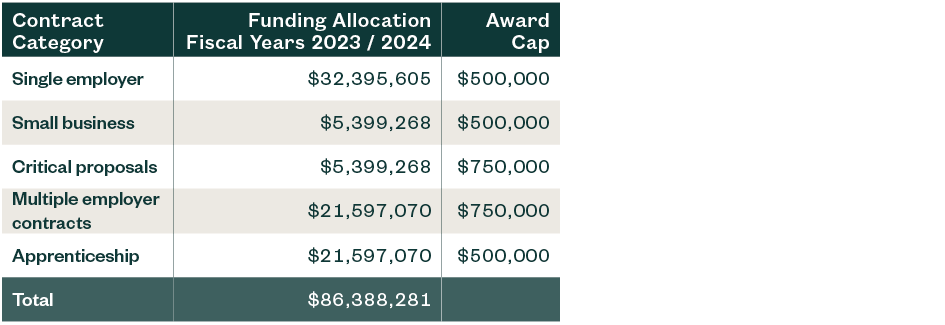

For FY 2023–24, the ETP has the following funding allocations available by contract category. Each contract category also has a maximum reimbursement per awardee.

The ETP can generally be used to fund training delivered via:

- Classroom

- Simulated laboratory

- Productive laboratory

- Instructor-led distance learning (e-learning)

- Computer-based training

The reimbursement rate paid by the ETP varies depending on multiple factors, including the type of training, course material, and the delivery method. Reimbursement rates range from $9–$23 per hour per employee.

How Do You Qualify for the Program?

The program is open to any size of business across multiple industries. The program has placed a moratorium on providing awards to some specific industries, including adult entertainment, gambling, and multilevel marketing, and has also outlined the following priority industries:

- Accommodation and food services

- Administrative and support and waste management and remediation services

- Agriculture, forestry, fishing, and hunting

- Arts, entertainment, and recreation

- Construction

- Finance and insurance

- Health care and social assistance

- Information

- Manufacturing

- Mining, quarrying, and oil and gas extraction

- Professional, scientific, and technical services

- Transportation and warehousing

- Utilities

- Wholesale trade

Applicants should review their training programs and ensure that each employee being trained meets the following requirements:

- Completes a minimum of eight hours and a maximum of 200 hours of training

- Be a full-time equivalent employee working 35 hours a week

- Completes a post-training employment retention period, generally 90 days after the date of training

- Be paid at least the ETP minimum wage during retention. The wage amount generally varies by year, county of employment, and whether the trainee is a new hire or incumbent employee.

The ETP has also historically pushed for veteran hiring. The panel may be more inclined to approve applications for companies that have a veteran hiring process in place.

What’s the Process of Claiming the Incentive?

There are multiple phases to the application process.

- Preliminary application. Panel staff determines basic eligibility.

- Regional office site visit. If the preliminary application is deemed eligible, the ETP regional office will contact the company to schedule a site visit to review the applicant’s training program and discuss contracting requirements.

- Application for funding. After the site visit, an ETP analyst will assist the company with their application and help finalize contract terms and conditions.

- Panel approval. The panel will review all training applications at regular monthly meetings. A company representative may be required to attend the panel meeting for a brief presentation or to address questions.

Funded training can begin once the company is officially notified that the panel approved the training proposal. Any training that has been conducted prior to official approval won’t be reimbursed.

All applications are submitted via the panel’s online system. The application consists of roughly 20 mandatory steps or questions, depending on the contract type.

ETP training contracts are performance-based and are meant to offset training costs. To receive payment, your organization will submit invoices to panel staff who review the underlying documents for compliance with contract terms. After review, funds will be mailed to your organization.

Recommendations for Applicants

A competitive application would have approximately 20,000 hours of training (10,000 hours per year). The panel is currently experiencing a large backlog, and it can be upwards of twelve months from the time of application submittal to the panel hearing.

The compliance required for the ETP can be administratively burdensome. Having an established tracking system in place for gathering the rosters helps the process run smoothly. Otherwise, it can place a significant time commitment on a company’s internal resources.

California Alternative Energy and Advanced Transportation Financing Authority (CAEATFA)

CAEATFA collaborates with public and private partners to provide financing solutions for California’s industries, assist in reducing the state’s greenhouse gas emissions by increasing the development of renewable energy sources, energy efficiency, and advanced technologies to reduce air pollution, conserve energy, and promote economic development and jobs.

Sales Tax Exclusion (STE) for manufacturers is among the programs that CAEATFA offers.

What Benefit Could Be Available?

CAEATFA offers a sales and use tax exclusion to manufacturers that promote alternative energy and advanced transportation. For 2023, the program had a statutory cap of $115 million that will likely be mostly exhausted as of CAEATFA’s July 2023 board meeting.

In 2024, the program will be funded for another $115 million, which includes $15 million set aside for lithium battery manufacturers. CAEATFA also sets aside $20 million of the $115 million total allocation for smaller projects seeking an STE award of $2 million or less. Applicants are limited to $10 million of STE in a given calendar year.

How Do You Qualify for the Benefit?

A taxpayer qualifies to apply for the STE if the project facility is located in California and is described as one of the following categories of manufacturers in California:

- Alternative source product. Technologies related to renewable electricity and fuel generation or energy efficiency technologies.

- Advanced transportation technologies. Emerging transportation-related technologies that enhance California’s commitment to energy conservation, pollution and greenhouse gas emissions reduction, and transportation efficiency.

- Advanced manufacturers. Improving or creating materials, products, or processes in the fields of macro or nano electronics, additive manufacturing, and industrial biotechnology, among others.

- Recycled feedstock. Manufacturing or utilizing recycled feedstock in the production of another product or soil amendment. Recycled feedstock refers to materials that would otherwise be destined for disposal, having completed their intended end use and product lifecycle.

The project should also provide for an increase in the California workforce within these sectors, with wages paid to project employees matching or exceeding the median wages for the project location.

What’s the Process of Claiming the Benefit?

Taxpayers must apply to the CAEATFA board during one of the application periods. The application submitted by the taxpayer will be composed of two parts:

- Part A includes a project narrative, legal questionnaire, and applicant certification. The project narrative includes information about the applicant and the proposed project, including the timeline and status of required permits.

- Part B consists of a self-scoring Excel spreadsheet designed to measure and quantify the net fiscal and environmental benefits of the proposed project. Based on the inputs provided by the applicant, the spreadsheet calculates the number of points received by the project. The formulas for determining the points awarded may be found in CAEATFA Regulation Section 10033(c).

CAEATFA staff review each application for completeness and reasonableness of the assumptions provided in the application. During the review process, staff may request supporting documentation and additional details on the manufacturing process. Applicants may also be asked to provide other information including business plans, pro-forma financial statements, etc.

Taxpayers must pay an application fee when submitting. The fee is calculated as .05% of the value of the property included in the application. The minimum fee is $250, capped at $10,000.

If the taxpayer is awarded the STE, it can provide documentation in the form of an exemption certificate to its vendors when purchasing property included in the application. This certificate will exempt the taxpayer from sales taxes on its purchase of the qualified property.

Recommendations for Applicants

Successful applicants can demonstrate the value of the project through:

- Percentage of property to be purchased from California suppliers

- Percentage of sales to California residents

- Expansion of the California workforce with wages at or above median wages for the project location

- Environmental benefits measured as the reduction in use of water or fossil fuels and the pollution avoided, among other metrics

As this program is an exclusion from paying sales tax, and not an income tax credit, a successful applicant need not be in a taxable income position. Loss companies can equally benefit from the STE program. Annual certification documentation must be submitted to the board for review, so an awardee will need to maintain adequate documentation of the purchases made and progress toward project completion.

California Electric Vehicle Infrastructure Program (CALeVIP)

CALeV addresses regional needs for electric vehicle charging infrastructure throughout California for Level 2 and direct-current (DC) fast charging stations, while supporting state goals to improve air quality, combat climate change, and reduce petroleum use.

Participating locations include, but may not be limited to, counties located in the following metropolitan areas, as well as others:

- Los Angeles

- San Luis Obispo

- Santa Barbara

- Napa

- San Diego

- Fresno

- Monterey

- Sacramento

How Much Money Could Be Available?

Available funds depend on which region a project is located and what type of charger station is being installed. The CALeVIP website tracks funds by location and charger type (DC or L2) and will show which funds are reserved provisionally, reserved for disadvantaged communities, issued, and remaining available.

How Do You Qualify for the Benefit?

Eligibility requirements vary based on project location, but each location has its own project cost, applicant, installation site, equipment, and meter requirements. Only certain equipment costs are eligible for rebate funds. These costs are determined on a location-by-location basis.

What’s the Process of Claiming the Credit?

The process to claim a credit varies depending on project location. All locations require that the taxpayer be an eligible applicant with a qualified installation site and file a formal application by a specific deadline.

Recommendations to Applicants

Understanding viable locations for your EV charging station installation project, if your charging station is eligible for the location specific program, if you’re an eligible applicant, and the application deadlines and available funds will allow taxpayers to be successful in the CALeVIP program.

New Employment Credit (NEC)

Credits on California income taxes may be available to taxpayers that hire a qualified full-time employee and pay or incur qualified wages attributable to work performed by the employee in a designated census tract or economic development area.

To be allowed a credit, the qualified taxpayer must have a net increase in the total number of full-time employees in California. The credit is 35% per year for wages between 150% and 350% of the state minimum. The credit may be claimed only for wages paid for 60 months from the original date of hire.

How Much Money Could Be Available?

The amount of credit is impacted by:

- Number of qualified employees

- Qualified wages paid to those employees

- Total number of full-time employees during base year (qualified or not)

- Total number of full-time employees during current taxable year

- Maximum credit per employee ($58,000 over the 60-month credit generation period)

How Do You Qualify for the NEC?

An employer must be engaged in a trade or business in California within a designated geographic area (DGA), pay qualified wages, not be an excluded business, and must have a net increase in jobs.

Governor Gavin Newsom signed Senate Bill 131 into on July 10, 2023, which removes the DGA requirement for companies in the semiconductor manufacturing, lithium production, lithium battery manufacturing, and electric airplane manufacturing industries.

For purposes of the NEC, a qualified employee is someone who performs at least 50% of their services in a DGA, receives wages that are at least 150% of the California minimum wage at the time of hire, is hired for full-time work, and meets one of the following criteria:

- Unemployed for the previous six months or more

- A veteran separated from the United States Armed Forces in the last 12 months

- Received federal earned income credit in the previous tax year

- An ex-offender convicted of a felony; or

- A current recipient of the CalWORKS program or general county assistance

Qualified wages refer to that portion of wages paid or incurred that exceed 150% of California minimum wage, but don’t exceed 350% of California minimum wage. The qualified wages are based on the actual wages paid, including overtime and commissions.

Excluded businesses for purposes of the NEC include:

- Temporary help

- Retail trade

- Theater companies or dinner theaters

- Food services

- Casinos

- Establishments serving alcoholic beverages

What’s the Process of Claiming the Credit?

A Tentative Credit Reservation (TCR) from the Franchise Tax Board (FTB) is needed to qualify an employee before receiving the credit. An applicant must request a TCR within 30 days of completing the Employment Development Department new hire reporting requirements.

Any unused credit may be carried forward up to five years on an original return. However, if a qualified employee is terminated within the first 36 months after beginning employment, you may be required to recapture previously taken credits. The amount of credit that may be recaptured is the amount for that taxable year and all prior taxable years attributed to qualified wages paid to that employee.

California Air Resources Board (CARB) Related EV-Related Programs

CARB provides a variety of programs related to EVs and the purchase of vehicles with lower greenhouse gas emissions to further the state’s goal of reduced emissions and lowered environmental impact. These programs include:

- Clean Mobility Options Voucher

- Clean Off-Road Equipment Voucher

- Clean Truck and Bus Vouchers

- Clean Vehicle Rebate Project

Each of the above programs offers resources for California-based businesses to further expand and electrify their existing fleets of vehicles at a lower cost. Eligibility criteria and benefit amounts vary by program. These programs are generally administered via online applications, or interested parties can work directly with their dealers.

California Energy Commission (CEC) EV Manufacturing Grants

The CEC’s Clean Transportation Program provides funding to support in-state manufacturing of zero-emission vehicles (ZEVs) and ZEV-related supply chains. To meet these goals, grant funding opportunities are active and under development to:

- Increase in-state manufacturing of ZEVs, ZEV components, and ZEV infrastructure

- Attract new and expand existing ZEV-related manufacturing in California

- Increase the number and quality of direct and indirect ZEV-related manufacturing jobs in California

- Bring positive economic impacts to the state by attracting private investments in manufacturing capacity

- Contribute to California’s goals of zero-emission transportation

The CEC recently approved $118 million in funding for ZEV manufacturing, among other ZEV infrastructure funding totaling $2.9 billion. However, additional details on applying for such funding are in development and more details will need to be released.

We’re Here to Help

For more information about clean energy tax credits in California, please contact your Moss Adams professional.