During a transaction, earnouts can bring significant reporting and valuation challenges that could impact the deal’s final results.

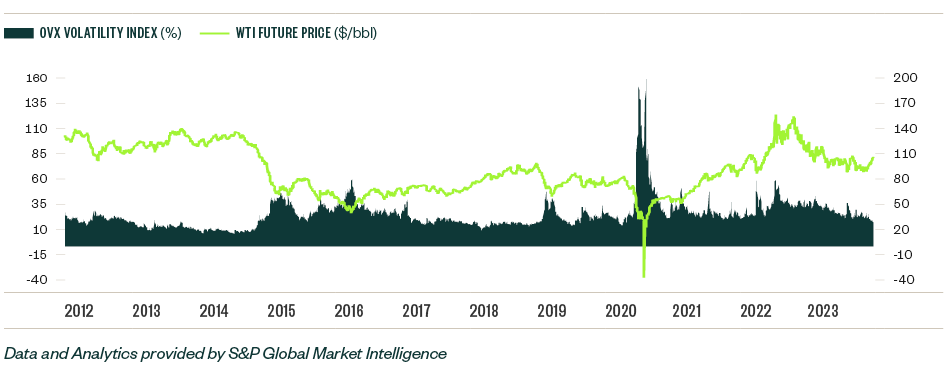

Oil and gas companies need to carefully review earnouts, especially during current market volatility as world events impact oil pricing.

Explore options to approach your accounting treatments, valuation approaches, and more to help reduce risk and prepare for potential future transactions.

What Is an Earnout?

Earnouts are contingent, deferred payments used in transactions to reconcile differences in opinion between the buyer and the seller regarding the fair value of an asset.

Earnouts are contingent upon a metric or threshold being met in the future.

An earnout can help mitigate the buyer’s risk of overpaying and defer payment of a portion of the total consideration allowing for more financing options.

An earnout can give the seller the potential to increase the total consideration in exchange for delaying a portion of the payments.

In oil and gas, different types of earnouts are used depending on the stage of development of the asset:

- Commodity price. Based on the price of a commodity index such as West Texas Intermediate (WTI) crude oil.

- Operational. Based on achieving milestones such as production volumes, earnings before interest, taxes, depreciation, and amortization (EBITDA) targets, and similar.

- Geological. Based on meeting exploration targets. Typically used in offshore assets.

Buyers and sellers should specify any calculations or features of the selected metric.

For example, if a commodity price is used, the agreement should specify the contract—prompt month, 12-month strip—as well as the publication source, such as NYMEX or Platts, and the time of the publication, such as daily closing price or average of the month.

Any ambiguity could lead to material disagreements and potential litigation.

Earnouts Used to Mitigate Price Volatility

Crude oil prices react to a variety of geopolitical and economic factors. The conflict in Ukraine and slowdown in global economic activity recently drove up volatility.

Oil and gas reserves are closely correlated to commodity prices, and high volatility significantly increases uncertainty around the fair value of an asset. This adds considerable valuation risk for the buyer and puts pressure on the seller to help mitigate this risk.

Market participants in the oil and gas industry use earnouts to mitigate commodity price volatility. In some cases, as much as a third of the value of the transaction can be in the form an earnout, with a long-term payout structure stretching from three to five years.

Accounting Treatment

Earnouts usually represent a significant portion of the overall transaction value.

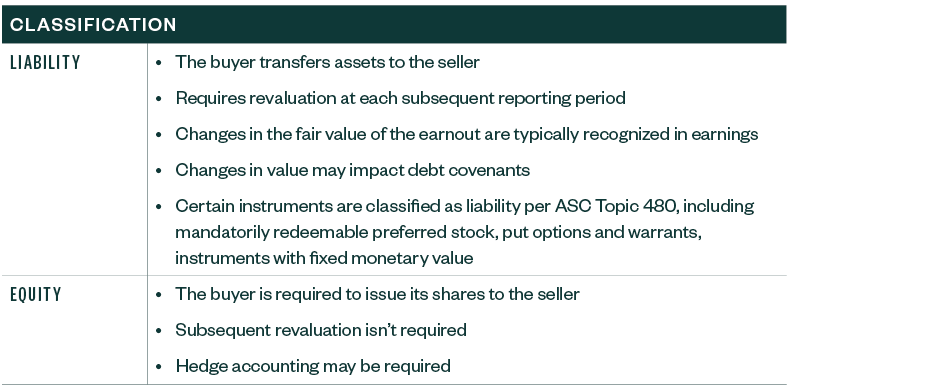

For that reason, parties should engage early with a specialist to determine the appropriate accounting treatment. Financial Accounting Standards Board Accounting Standards Codification® Topic 805 requires the buyer to classify the earnout. Commonly seen classifications are listed in the table below.

In addition to the above classifications, earnouts are classified as compensation if they’re tied to the continued employment of certain individuals or even as a contingent asset if there’s a clawback, or potential payment back to the buyer, if certain targets or conditions aren’t met. There has been an increase in contingent asset-based earnouts because buyers are negotiating terms to mitigate risk in the event the asset or entity acquired underperforms.

An EBITDA guaranty negotiated by a buyer where the seller is on the hook to pay the difference if the EBITDA underperforms would be an example of a contingent asset. Typically, earnouts are an addition to the purchase price. However, if the earnout is a contingent asset, it would be subtracted from the purchase consideration as it is payable by the seller to the buyer.

Valuation Approach

In the oil and gas industry, the fair value of the earnout is typically derived using a Monte Carlo simulation (MCS) with mean reversion if the earnout is tied to a commodity price curve. An MCS is used to model the probability of different outcomes in a process that can’t easily be predicted due to the intervention of random variables. It’s a technique used to understand the impact of risk and uncertainty.

An MCS with a mean reversion process runs several random prices from specified probability distributions with the mean of the results tying to the respective commodity price curve. An MCS approach is commonly used in valuing earnouts and qualifies as a level-three measurement.

The use of a mean reversion equal to the futures strip prices is used to incorporate a market participant view of future prices. This approach is specific to the industry and consultation with an expert in this type of valuation is recommended.

Case Study

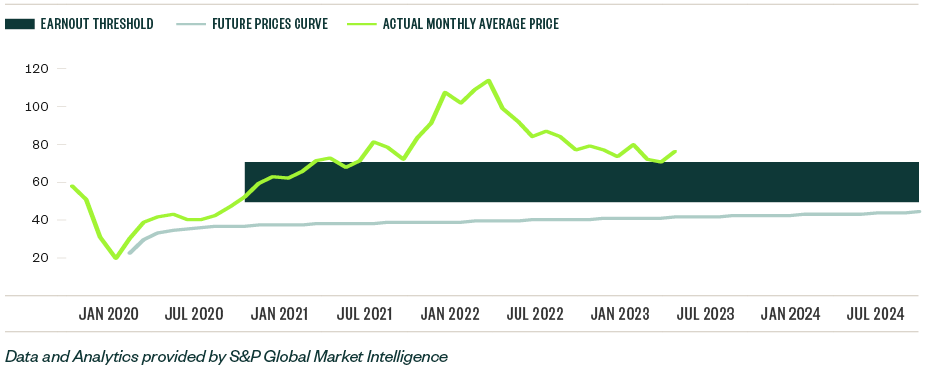

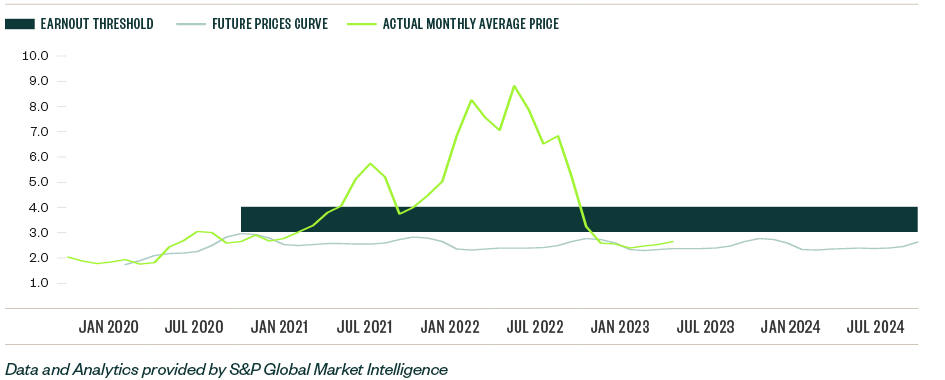

In 2020, an energy company sold its oil and gas assets to a natural gas producer. The purchase price included a commodity price earnout representing over 30% of the total consideration. The earnout has a term of four years starting in 2021, and thresholds are based on the daily prices of WTI crude oil and Henry Hub gas index. For illustration purposes we have included hypothetical numbers that capture the main components of the actual transaction.

At the time of the transaction, energy prices were at historic low levels. Earnout thresholds generally exceeded the price observed on a futures curve which indicated minimal value to the earnout at the time of transaction closing in 2020, however, actual prices surpassed the threshold amounts in 2021 and 2022 thus proving the unpredictable nature of the commodity price environment.

WTI Price

Henry Hub Price

As illustrated in the chart, because actual oil and gas prices surpassed the earnout thresholds for the first two years of the earnout term, the seller will receive the maximum earnout payment allocated in each year.

Earnouts can add complexity in financial planning and reporting as their fair value can have a material change between reporting periods.

In this example, we performed a MCS using a mean reversion process at the end of 2020 when the commodity prices were still below the threshold amounts, resulting in an immaterial earnout value. A year later, after the recovery in commodity prices in 2021, the same methodology with updated market pricing resulted in a fair value that was materially larger in comparison with the expectation that most of the earnout would become payable.

While there’s diversity in practice regarding the seller’s accounting for contingent consideration, one alternative may be that the seller reports the fair value of the earnout as part of the initial gain or loss recorded on the transaction, and any subsequent changes are reflected in the current period’s income statement. The seller should also consider whether discontinued operations presentation is appropriate.

We’re Here to Help

To learn more about how earnouts could impact your business, contact your Moss Adams professional.

Additional Resources

Special thanks to Adriana Sauceda, Senior, Valuation Services, for her contributions to this article.