Life sciences venture capital (VC) dealmaking continues to decelerate after record highs in 2021, while remaining active and resilient compared to many other fields. Total funding in 2023 exceeded several years before the COVID-19 pandemic. The digital health market could have promising opportunities for innovators. Dealmaking in Asia shows growth too, and two of the 10 largest deals in 2022 were made by Chinese companies.

Valuations grew for life sciences companies in most stages of the life cycle in 2023, while deal sizes have declined as companies reduce their budgets and investors have become more selective. There were fewer initial public offerings (IPO) in 2023, and private equity (PE) investors have also backed off after 2022’s high. Activity could resume as companies mature, but life sciences companies and their investors are still facing significant headwinds in the public markets and broader economic environment. Overall, deal values remain slow but steady, while exit activity remains more muted.

- Highlights

- Industry trends

- Spotlight: Digital health investment slows, but excitement remains

- Looking ahead

Explore additional reporting on market conditions and transaction trends in 2022 Life Sciences Venture Dealmaking in Difficult Market Conditions and 2021 Venture Capital Ecosystems.

Highlights

Notable trends cover the following areas.

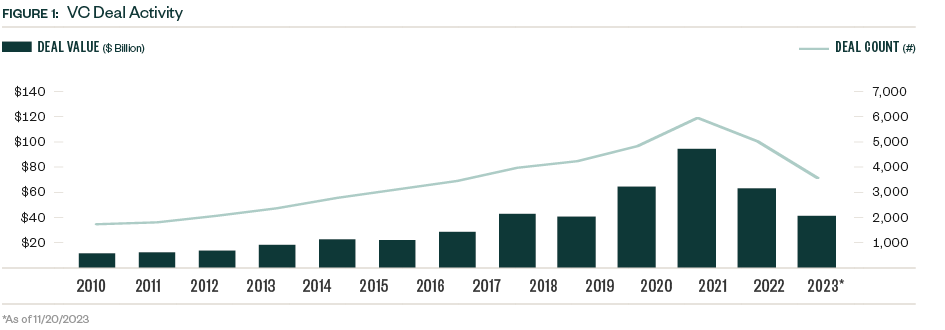

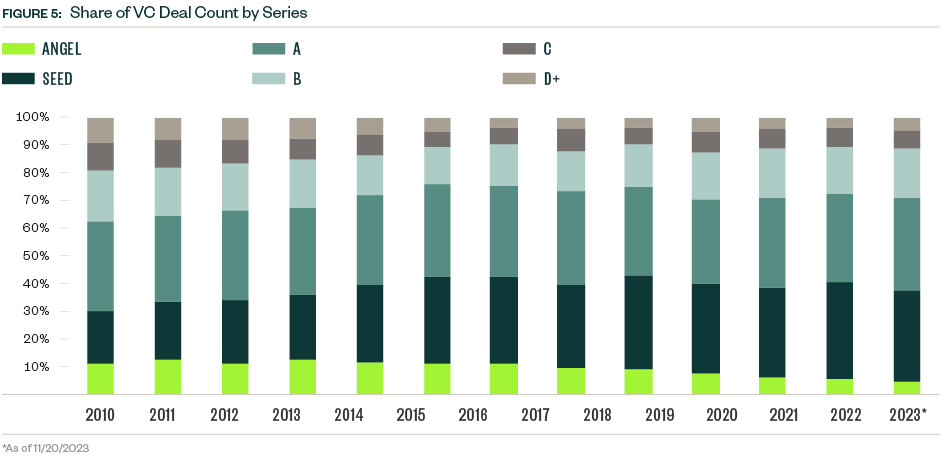

- Deal values are slow but steady. Year to date (YTD) through November 20, 2023, VC activity in life sciences reached $41.0 billion, representing two thirds of the value closed in 2022. Total deal value has slowed moderately since 2021, but deal flow was more resilient with over 1,000 deals completed each quarter between Q4 2019 and Q2 2023. Q3 2023 missed that threshold with 950 deals, indicating a delayed slowdown in deal volume.

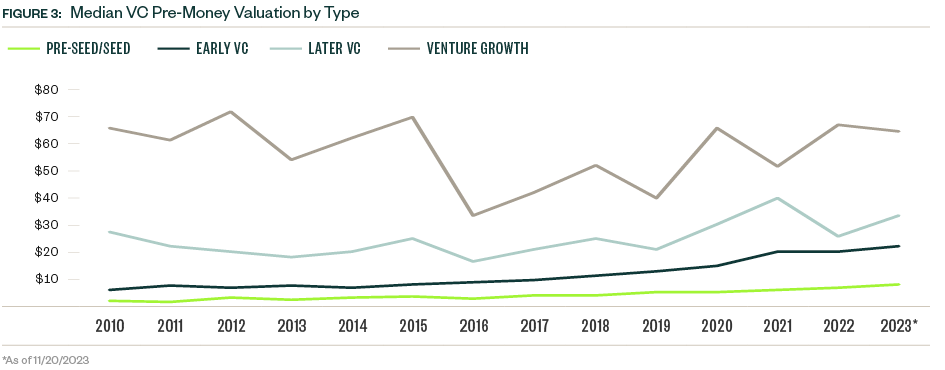

- Life sciences could rebound. A declining market in 2022 meant steep valuation cuts for many companies—especially technology companies—with effects that rippled through 2023 as macroeconomic challenges continued, and life sciences companies showed comparative resilience. However, median valuations have grown for most company stages in life sciences this year, including 30.1% growth for the late-stage VC category, partially making up for last year’s declines. Early-stage companies with extended timelines to commercialization were more insulated from market turbulence and avoided median valuation declines, while the latest venture growth stage experienced a slight decline of 3.6%.

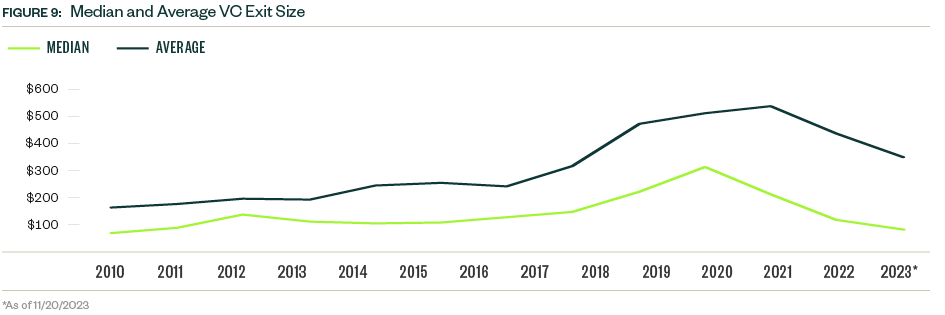

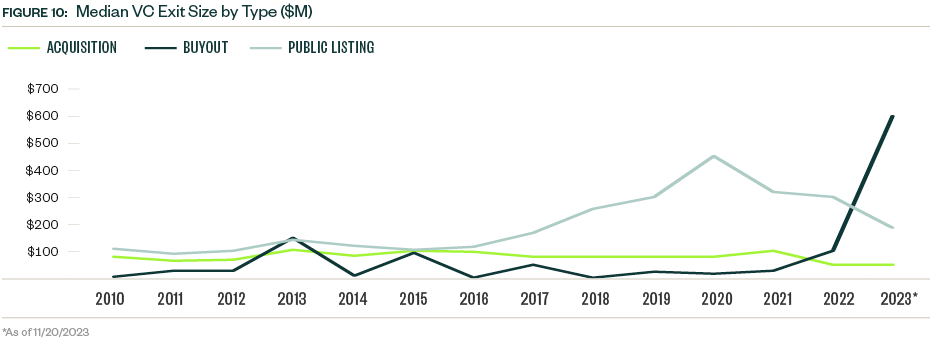

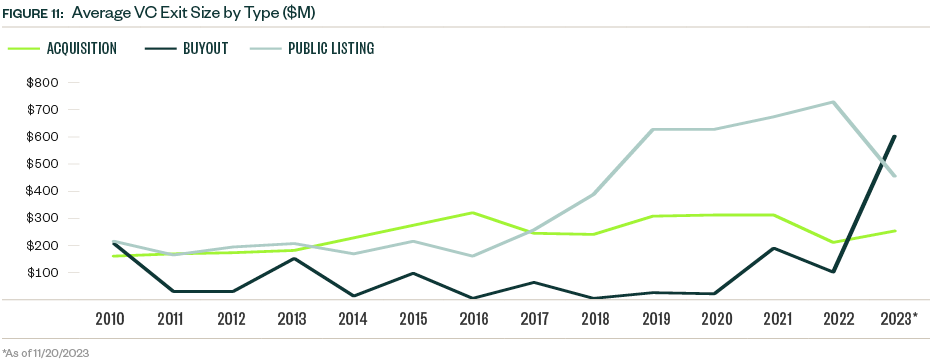

- Exit activity is slow but sure. Exit activity remains muted after holding steady throughout 2023 when compared with 2022. Total exit value reached $27.4 billion YTD, representing just under half of the total closed in 2022. Acquisitions have become a more popular exit route and are likely continue as public market debuts have yet to impress.

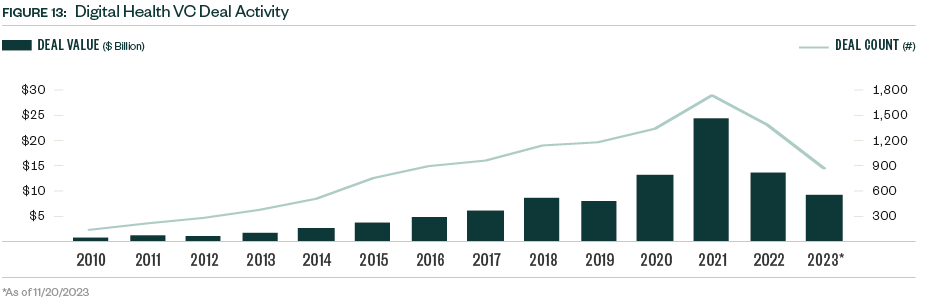

- Opportunities abound in the digital health market. The digital health market offers promising opportunities for innovators with annual VC deal count exceeding 1,000 deals each year between 2018 and 2022. Interest in artificial intelligence (AI) and machine learning (ML) rose rapidly in 2023, and digital health platforms are well positioned to integrate these technologies into their platforms. YTD VC deal value in the space reached $9.1 billion across 862 deals.

Industry Trends

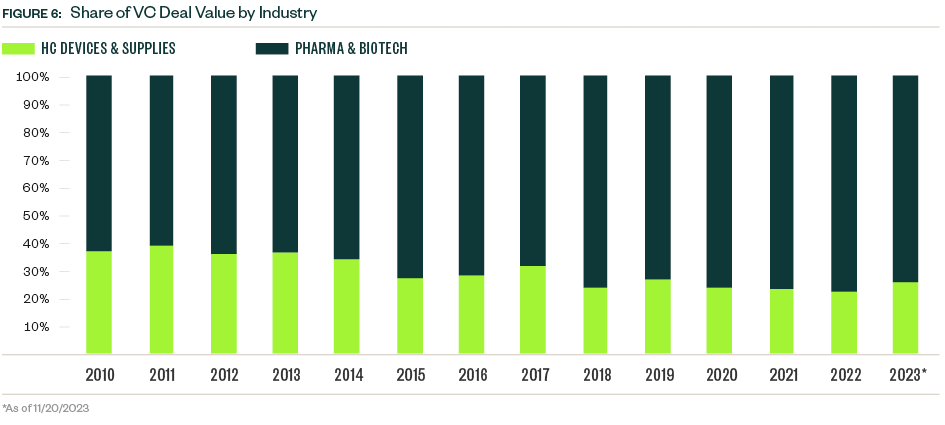

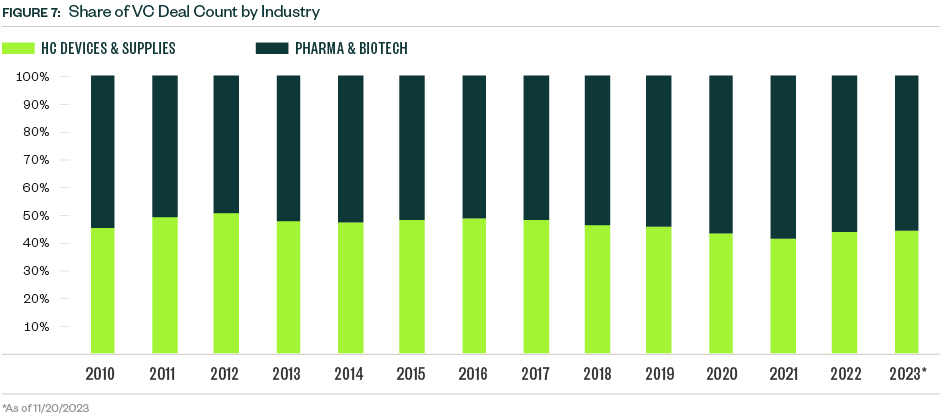

The life sciences industry experienced windfall investment in response to the COVID-19 pandemic, further bolstered by a record year for VC activity across the board in 2021. Momentum slowed in 2022, but VCs still managed to close near-record deal value by year’s end. 2023 presented additional challenges for investors, including a prolonged high interest-rate environment, resulting in a further slowdown in dealmaking.

YTD VC activity in life sciences reached $41.0 billion, representing two thirds of the value closed in 2022. Deal volume held steadier than deal value with more than 1,000 deals closed each quarter since Q4 2019, but Q3 2023 narrowly missed that threshold with just 950 deals, ending a three-and-a-half year streak of elevated deal volume.

Start-ups

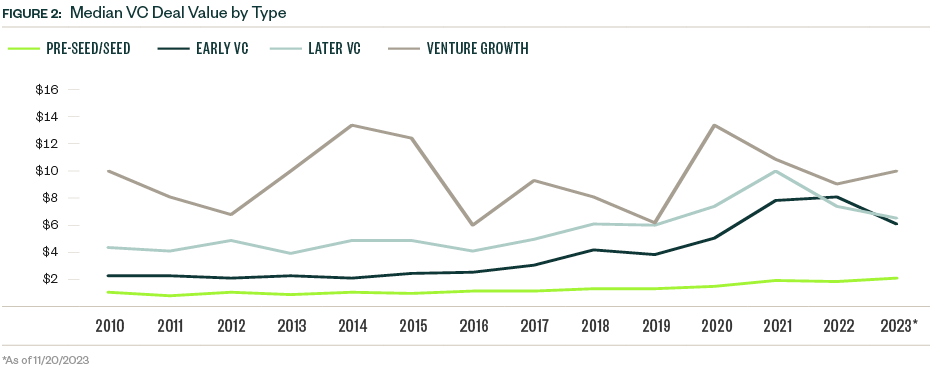

Many life sciences start-ups are adjusting budgets to smaller check sizes. The demand for lab real estate has declined, indicating a slower venture check-writing environment. Median deal sizes for the early- and late-stage buckets have declined 24.7% and 11.5%, respectively, since 2022.

Angel and Seed Companies

Median deal sizes for angel and seed companies continued to tick upward, reaching a record $2.0 million YTD. The venture-growth category, which represents the most mature and latest-stage companies, experienced the most volatility in deal sizes with these more mature companies on the front lines in a difficult exit market. The median valuation for the venture growth category has also declined slightly YTD. Valuations grew for all other company stages in 2023, including 30.1% growth in the median late-stage valuation, regaining some ground after declining by more than a quarter in 2022.

Global Trends

North America still drives the majority of total life sciences VC deal value, but activity in Asia has grown steadily in total deals over the past decade. Two of the 10 largest life sciences VC deals in 2022 were secured by Chinese companies, but YTD the 10 largest deals have all closed in the United States.

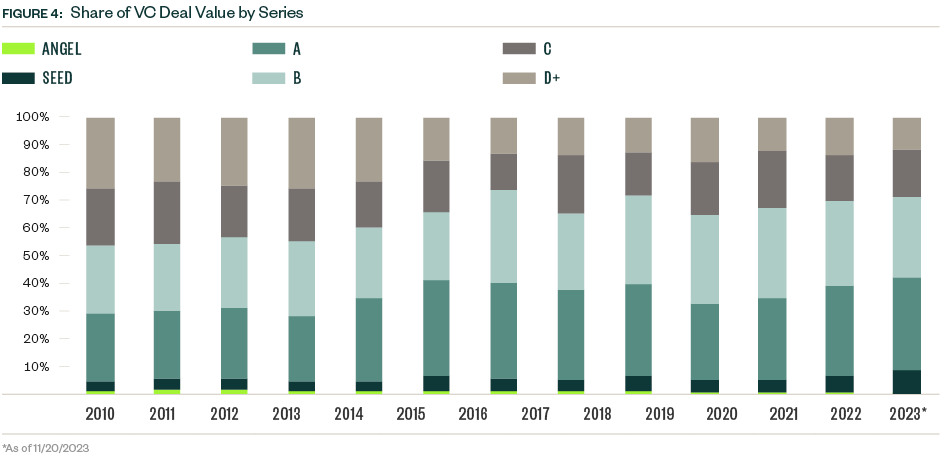

Capital deployment has become more measured following extended macroeconomic concerns. 60 megadeals, defined as $100 million or more, have closed globally YTD compared to 87 such deals in the same period of 2022, with large deals having occurred within the promising gene therapy space.

Exit activity remained muted but steadier on a quarterly basis in 2023 compared with 2022 as game plans mostly adjust to accommodate a shifting macro environment. Total exit value reached $27.4 billion YTD, representing less than half of the total value in 2022. Drug discovery companies continue to drive a significant portion of exit value in life sciences, with five exits exceeding $1 billion each YTD, including two initial public offerings (IPO) and several acquisitions.

M&A

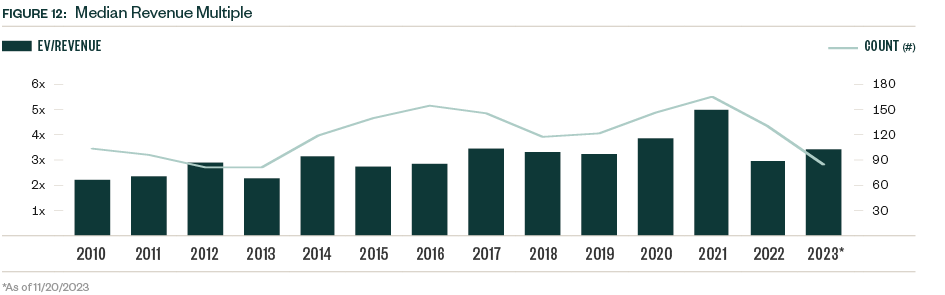

Median exit size declined 31.2% YTD, indicating continued caution. Acquisitions account for a greater share of total exit value compared with public listings, accelerating a trend seen in 2022.

More than 100 life sciences companies have gone public each year since 2018, but with just 51 companies listed through November 20, 2023, 2023 may have bucked this trend as market conditions lead companies toward additional financing rounds or M&A.

Spotlight: Digital Health Investment Slows, but Excitement Remains

Preference for real-time provider access and consolidated platforms grew during the pandemic, while AI and ML applications are expanding. The digital health space addresses both critical areas through hardware and software solutions to track health and facilitate communication between providers and patients. A plethora of mobile applications and telehealth services have emerged, raising concerns about fragmentation in the market.

VCs maintain interest in the space with more than 1,000 deals closed globally each year since 2018. Digital health investment mirrors trends in the broader life sciences industry, with its 2021 peak and subsequent decline, but the total deal value closed in 2022 narrowly notched the segment’s second-highest level on record, according to PitchBook data. The surge of VC funding into digital health has slowed YTD, with 862 deals representing just under two thirds of the 2022 count.

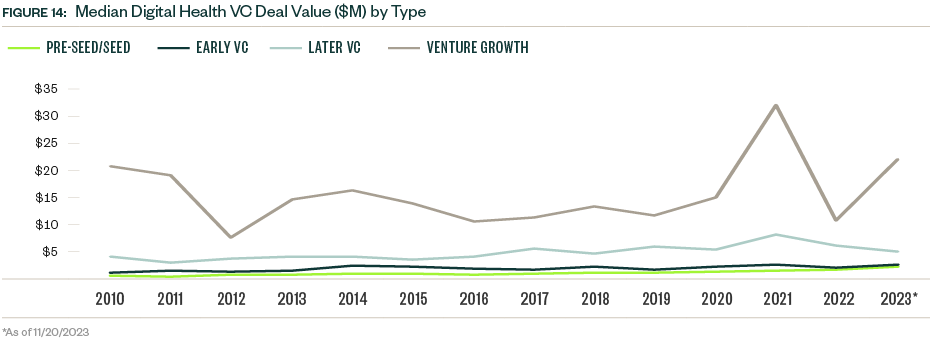

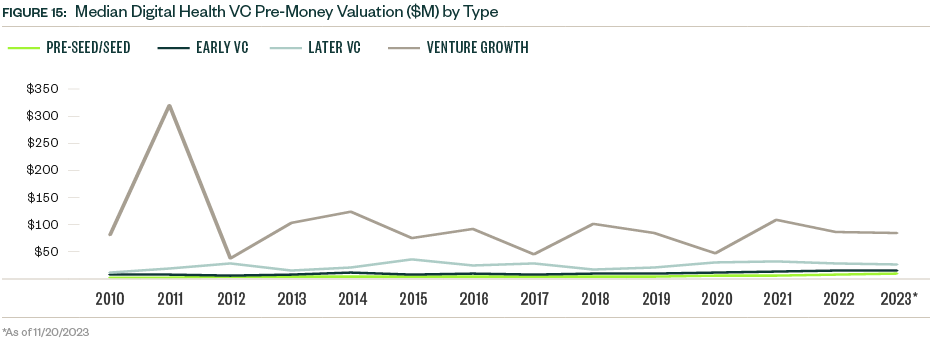

However, a healthy level of investment activity remains, with the YTD deal value of $9.1 billion exceeding annual levels closed each year prior to 2017. Eight deals greater than $100 million have closed YTD compared with 24 such deals in the same period of 2022, highlighting greater caution from checkwriters since last year. It’s worth noting that significant levels of capital are still being deployed for the best-positioned companies. Among the companies that successfully raised rounds, median deal sizes grew materially for all categories except for the late stage, which saw its median deal size decline moderately. Valuations are trending downward for most companies in the space, with the median pre-money valuation declining for all stages YTD except angel and seed.

Exit Activity

The fluctuating deal size trend exhibited by venture-growth companies mirrors volatility in public markets as these companies approach their exit windows. Deal size growth for angel and seed companies on the other hand has been slow and steady over the past five years.

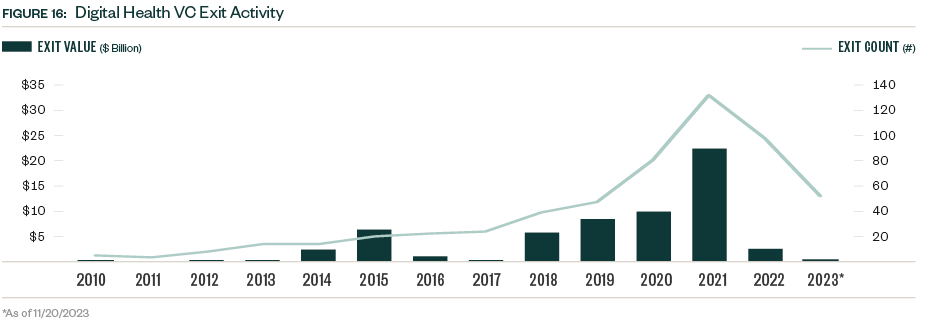

Exit activity in digital health has stalled with 52 exits totaling $554.9 million, compared with $2.6 billion closed in 2022. The rise of interest in digital health services in recent years created a high volume of new entrants, and the exit pipeline has been smaller compared to more mature verticals.

Private equity (PE) investors have largely stepped back from the digital health space this year with just $88.6 million closed across 18 deals YTD, following an uncharacteristically high level of deal value in 2022 amid discounted valuations and large capital reserves. A notable percentage of PE digital health deals are minority stake growth deals as firms cautiously approach a relatively nascent investment area. The maturation of digital health companies will likely bolster PE activity over the next several years.

Looking Ahead

Venture dealmaking in life sciences continues to decelerate from its record high in 2021, but the industry maintains a significant level of deal flow as a key area for scientific innovation. Fundraising is seeing increased exit hurdles, including higher lending costs and public market turbulence, which will likely have lingering downward effects on upcoming deal activity

It’s highly unlikely that the industry will experience another blockbuster year like 2021, which could bode well for companies with tempered valuation expectations and investors looking to avoid market froth to establish a strong portfolio. The digital health space will remain a key focus for life sciences investors as new applications are developed and centralized platforms for patient care become increasingly desirable from both a business to business (B2B) and business to consumer (B2C) perspective.

Excitement surrounding AI and ML will attract greater interest from strategic and corporate VC investors, bolstering integration with and investment into digital health capabilities. The broader slowdown in venture activity is more indicative of a return to normalcy rather than a cause for industry performance concern, and exciting scientific developments continue to make their way through research and trials.

Methodology

The scope of life sciences was defined using PitchBook’s primary industry codes for Pharmaceuticals & Biotechnology and Healthcare Devices & Supplies. The scope of digital health was defined using PitchBook’s dedicated digital health vertical. M&A values don’t reflect extrapolation. Otherwise, PitchBook’s standard methodologies for report datasets were used. Full details can be found here.

We’re Here to Help

For more information about trends in the life sciences industry, please contact your Moss Adams professional.