The Corporate Transparency Act (CTA) went into effect January 1, 2024. The CTA includes requirements for reporting beneficial ownership information (BOI) for individuals who own 25% or more of a company or who exercise substantial control over the entity.

Companies subject to the requirements must file an initial report according to timelines outlined below and must report any changes to a previously filed report within 30 days of the change.

What Is the CTA and Why Was It Enacted?

Congress enacted the CTA in 2021 as part of the National Defense Authorization Act to provide transparency into business entity structures to try to combat money laundering, corruption, and other illicit activities that may be committed anonymously through corporate structures.

Who’s Subject to BOI Reporting Requirements?

Domestic and foreign entities that have filed formation or registration documents with a US state or Tribe are subject to the reporting requirements unless they meet one of the exceptions.

For a full list of exceptions, see the Financial Crimes Enforcement Network (FinCEN) BOI Reporting Frequently Asked Questions page, question C.2; there are 23 exemptions in all. Additional details are provided in the FinCEN’s Small Entity Compliance Guide.

Failure to comply with the BOI reporting requirements or missing filing deadlines can result in criminal or civil penalties. There’s a $500 per day penalty, up to $10,000, and up to two years of jail time for the failure to timely file initial or updated reports.

When Are Reports Due to FinCEN?

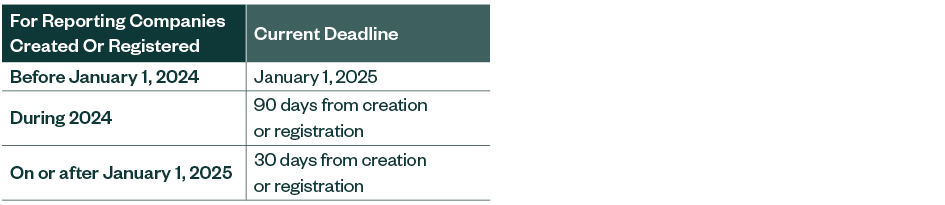

The due date for an initial report varies depending on when the reporting entity was created or registered.

On November 29, 2023, FinCEN extended the deadline for companies created or registered in 2024 to provide 90 days—instead of the original 30 days—from formation to file their initial report. This change is intended to allow entities additional time to understand the new reporting obligation and collect the necessary information to complete the filing.

Consequently, the current due dates for filing the initial reports are as follows:

Timeline for Reports Due

Once an initial report is filed, any changes to previously reported information must be filed within 30 days of the change.

Looking Forward

Reach out to your legal counsel if you have questions regarding the CTA or need help meeting your reporting obligations.