The final quarter of 2023 brought a welcome rally in both stocks and bonds as economic data continued to support the soft landing and disinflation narrative.

A turning point for the markets came following the Federal Reserve’s (Fed) December policy meeting where it indicated a potential pivot in interest rate policy with expected rate cuts in 2024.

View the latest insights on markets and economic trends to help inform your investment strategy:

Moss Adams Wealth Advisors Market View

Here are top themes we see in the market:

- Barring a significant uptick in inflation, the Fed is done with rate hikes.

- Inflation will likely continue to decline, and in our view, the next Fed move will be a rate cut.

- Economic strength and labor market trends support the softer landing scenario for the US economy and that is our base case.

- The resilience in jobs has been in the labor-intensive services sector of the economy which we expect to continue in the first half of 2024. Higher frequency indicators do show signs of slowing, including slower payroll additions, lower quit rates, and hours worked, however we believe this will further support the Fed’s decision to cut rates in 2024.

- Over the mid- to longer-term, we’re constructive on both stocks and bonds as the economy normalizes and deflationary tailwinds continue.

- Key risks to equities include a Fed policy error or overtightening, a reversal upward in long-term yields or escalation of global macro stresses, including tensions with China, the ongoing Russia-Ukraine war, and conflict in the Middle East.

- Labor market resiliency is key to our soft-landing narrative.

Markets

After an unsteady start, both stocks and bonds surged in the fourth quarter as declining inflation opened the door for potential rate cuts in 2024.

Unlike earlier in the year when equity gains were narrowly led by a handful of large cap technology names, 2023’s fourth quarter rally broadened with outperformance by more interest rate sensitive sectors, cyclicals, and small caps.

The S&P 500 gained 11.7% in Q4, while small cap stocks surged 14% with 12.2% of that coming in December alone. Small caps, which lagged for the first nine months, typically benefit from an easier Fed.

Fourth Quarter Review

The fourth quarter began with low expectations as rising long-term interest rates extended the late summer decline for stocks. On October 19, the yield on the benchmark 10-year US Treasury climbed as high as 5%, the highest since 2007. Rising long-term rates are a headwind for stocks, and the S&P 500 fell over 9% from July to October.

The market began to turn in late October with the release of positive third quarter economic data and business activity reports, coupled with better than feared anticipated corporate earnings results.

In addition, resilience in the job market supported better than expected consumer spending at the same time inflation softened. By December, the same 10-year Treasury fell below 4% in yield.

The Fed Pivot

The real tailwind for the rally came after the Fed’s December policy meeting. The Fed kept rates steady as expected, but the market’s focus turned quickly to the Summary of Economic Projections, which showed median policymaker projections for 75 basis points (bps) of easing in 2024.

Additionally Fed Chairman Jerome Powell indicated in the post-meeting Q&A that the Fed is willing to cut rates even if the US economy doesn’t dip into a recession in 2024. “It could just be a sign that the economy is normalizing and doesn’t need the tight policy,” he said.

The markets responded to the change in tone with a powerful rally in equities. In the bond market, after causing much pain for investors in the first 10 months of the year, the core bond index surged 6.8% for the quarter, erasing the prior three quarters of losses and bringing the 2023 return to 5.3%.

Inflation

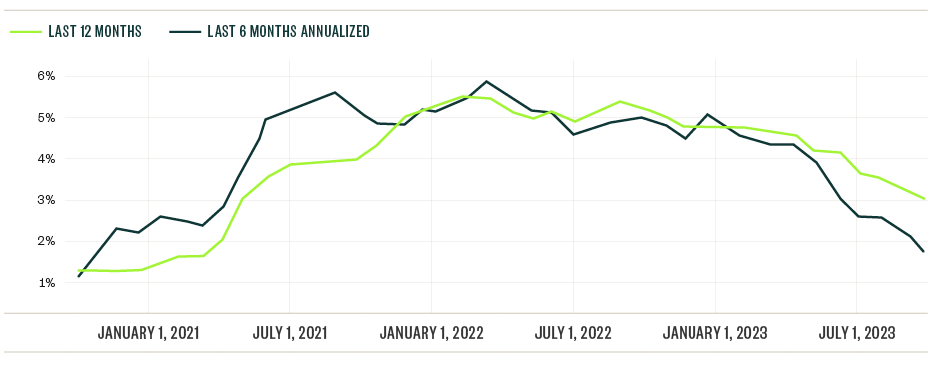

Inflation has been declining all year, but the fourth quarter saw an important milestone. The Core Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation measure, rose by 1.9%. This is the first time this measure has been below the Fed’s target of 2% since 2020.

Core PCE Inflation Continues to Subside

Source: Bureau of Economic Analysis

This is important because the Fed would like inflation around 2% but not lower; they don’t want disinflation to overshoot.

We believe this is a primary driver for the more dovish stance taken at the December meeting. The market is on board and the Fed fund futures are pricing in six rate cuts in 2024.

Rate Cuts: Does it matter how many?

Heading into 2023, many feared the economy would slow or go into recession, but with inflation high, the Fed wouldn’t be able to react by cutting rates to stimulate growth. Now, with inflation nearing the Fed’s target, they have significant ability to respond to any stalling in the economy.

This isn’t without precedent. The Fed either cut or stopped hiking rates in 1995, 1998, 2016, and 2019 in response to threats of an economic slowdown. In each case a recession was avoided. In our view, the number of rate cuts doesn’t matter, just the Fed’s ability to do so if need be.

In addition to supporting corporate earnings growth, lower rates are a tailwind for economically sensitive areas of the market, or highly leveraged companies. This is why the stock market’s rally broadened out to other sectors beyond tech, like cyclicals and small cap stocks.

Stock Market: Earnings Recession Ends

While the Fed received a lot of media attention in Q4, another driver of stock market returns was fundamentals. In fact, 82% of companies in the S&P 500 had earnings that beat analyst expectations in Q4. That’s significantly better than the 67% long-term average.

Consumer Activity: 2023’s Economic Stalwart

In the United States, 70% of Gross Domestic Product (GDP) is derived from consumption and the consumer has been surprisingly resilient. This is due in part to a resilient labor market with strong wage growth. The unemployment rate has surprised economist remaining below the 4% level putting wage growth above the rate of inflation—finally.

The pace of increase in consumer prices, as measured by the CPI, has fallen from 9% annually in the summer of 2022 to 3.1% at the end of December 2023. Meanwhile, wage growth is running above inflation at 4.3%, according to recent labor market data.

Consumer confidence is on the upswing. The US Conference Board’s consumer confidence index rose in December by the most since early 2021 as Americans grew more upbeat about the labor market and inflation outlook.

The index, which is a measure of expectations, captures a six-month outlook. The advance came as consumers saw better business conditions, incomes, and labor market prospects. More Americans reported plans for spending on vacations, cars, and appliances.

The results point to an economy holding up well going into 2024. Inflation expectations by consumers a year ahead fell to the lowest level since late 2020.