Special thanks to William Barcellona, Executive Vice President of Governmental Affairs, America’s Physician Groups; Eric Klein, Partner and Team Leader, National Healthcare Practice, Sheppard Mullin; John Carroll, Partner, Antitrust & Competition Practice, Sheppard Mullin; and Jordan Grushkin, Associate, Corporate Practice Group, Sheppard Mullin, all of whom contributed to this article.

Mergers and acquisitions have influenced the health care sector for years, creating everything from megasystem consolidations to small and midscale provider partnerships. But is that about to change—or at least significantly slow down?

Experts say it might, thanks to what they’re calling a perfect storm of federal and state regulations.

Impacts of New Health Care Regulations

- An overhaul in how the FTC and DOJ review and approve transactions now coexists with a new era of growing health care state regulations and filing requirements, already in place in 13 states.

- As a new wave of transaction scrutiny from both federal and state agencies impacts providers, without meaningful exemptions and expedited review processes for distressed entities, those organizations’ last-ditch efforts to survive might fail.

- Leaders need to be aware and prepare for the perfect storm of deal scrutiny, balancing the regulatory forces that can chill deals with the market demands that drive the need for them, including shifting to value-based care (VBC) reimbursement to meet CMS’s guidelines of achieving 100% VBC reimbursement by 2030.

An Antitrust Revolution from the FTC and DOJ

An overhaul in how the Federal Trade Commission (FTC) and Department of Justice (DOJ) review and approve agreements now coexists with a new era of state regulations and filing requirements, such as those in 13 states including New York, California, and Illinois.

These factors could affect which types of transactions get approved, increase review times, and substantially slow or kill the kinds of deals that would have passed muster years ago. As those agreements encounter more barriers, it’s raising new questions about how antitrust activity affects providers’ concomitant business considerations, such as reimbursement models.

Deal scrutiny is anticipated in 2024 like never before from both the federal and state levels.

Health care accounts for roughly a sixth of the gross domestic product, but health care deals have represented more than half of antitrust enforcements, according to John Carroll, partner in the antitrust and competition practice group at Sheppard Mullin.

“The FTC has lost a lot of cases, but one area where they’ve been extraordinarily successful is in hospital merger enforcement,” Carroll said at the November 2023 Moss Adams Annual Health Care Conference. “[In that area], they’ve lost very few cases in the last 20 years. If you’re talking about an in-market strategic transaction between hospitals, that’s the FTC’s bread and butter, and it’s one of the crown jewels of their enforcement.”

FTC and DOJ Final Merger Guidelines

In December 2023, the FTC and DOJ jointly issued their new Final Merger Guidelines—which describe how the FTC and DOJ examine mergers in all industries—following a public comment period on the Proposed Merger Guidelines first issued in July 2023. Those guidelines updated and replaced the 2010 Horizontal Merger Guidelines and the rescinded 2020 Vertical Merger Guidelines.

Now, the Final Merger Guidelines presume a deal to be unlawful based on substantially lower combined market share—just 30%—than in prior iterations of the guidelines and contain a number of other changes.

Many experts say that a 30% market share isn’t dominant and instituting that standard is likely to kill deals that pose no real monopolizing threat.

Does that mean providers should only consider agreements that would consume up to 29.99% of the market? Not hardly, explained John Carroll, a partner in the Antitrust & Competition Practice Group of Sheppard Mullin, at the 2023 conference. For one thing, market shares can be challenging to quantify. But second, it’s just one of many factors.

“If you’re evaluating potential bidders and a bidder would be considered dominant in a market by these standards, that gets factored into the scope of review,” Carroll said. “It’s about evaluating the overall competitive presence and factoring antitrust into all the other things involved in a transaction. Also keep in mind that the Final Merger Guidelines will be subject to challenges in court, though that would require merging parties to have the appetite for litigating against the FTC or DOJ.”

Changes to Hart-Scott-Rodino Regulations

In July 2023, the FTC and DOJ proposed drastic changes to the Hart-Scott-Rodino (HSR) regulations which require that parties in a transaction provide certain information to the FTC and DOJ in their HSR forms, potentially mandating that parties in a transaction provide information regarding investors and other information that is not currently required.

These changes haven’t been finalized but raise concerns about deal structuring, costs, and timelines. For example, every new draft of substantive merger agreements must be filed with the FTC and DOJ, indicating a need to plan for a bumpy and potentially extended and expensive pathway toward deal approval.

Decades of Federal Health Care Merger Guidance Withdrawn

Further, the FTC and DOJ each withdrew decades of health care guidance and stated they don’t intend to replace them. These guidelines represented a cornerstone of federal antitrust enforcement and have provided US health care industry providers, payors, employers, and others with hundreds of pages of detailed guidance regarding the application of US federal antitrust laws to the health care industry and provided certain safe harbors for rural hospital transactions and information exchanges.

Additionally, a recent FTC press release announced a partnership between the DOJ, FTC, and Department of Health and Human Services (HHS) to—among other things—exchange data to identify high-risk deals that would have otherwise not been flagged. A deal may be considered high-risk if it hinders competition or access to care.

On January 8, 2024, HHS named Stacy Sanders its first chief competition officer. The new role is intended to boost competition in health care to mitigate rising costs. Sanders will work with the FTC and the DOJ to focus on consolidation in the industry by “sharing data, creating reciprocal training programs, and developing new competition policy initiatives.”

New Developments in State Regulation and Review

By the end of 2023, 13 states had passed regulations requiring M&A transactional reviews by state regulatory bodies:

- California

- Colorado

- Connecticut

- Hawaii

- Illinois

- Massachusetts

- Minnesota

- Nevada

- New York

- Oregon

- Rhode Island

- Vermont

- Washington

These laws are modeled after HSR, which requires parties to a proposed transaction first provide information to the FTC and DOJ.

These laws, often referred to as so-called mini HSRs or baby HSRs, require entities to get state approval at lower threshold requirements. Similar to the scrutiny seen federally, many states define the lower transaction thresholds not by market share, but rather by transaction value, similar to federal requirements.

For example, under California’s SB 184 and its new regulations, health care entities, which include payors and many categories of providers, will be required to notify the Office of Health Care Affordability (OHCA) of certain transactions, including those valued at $25 million or more.

Similarly, New York now requires heath care entities, including physician practices and management services organizations (MSO), to submit written notice to the State Department of Health prior to consummating certain material transactions, but exempting transactions that won’t increase a party’s in-state revenue by at least $25 million.

These state-based requirements could exacerbate the pressures from national antitrust activities, making already burdened deals even harder to pass through. But unlike federal regulations and enforcements channeled through the FTC and DOJ, state requirements are more nuanced, complex, and dispersed across different agencies, sometimes with overlapping scopes of review.

Case in Point: California

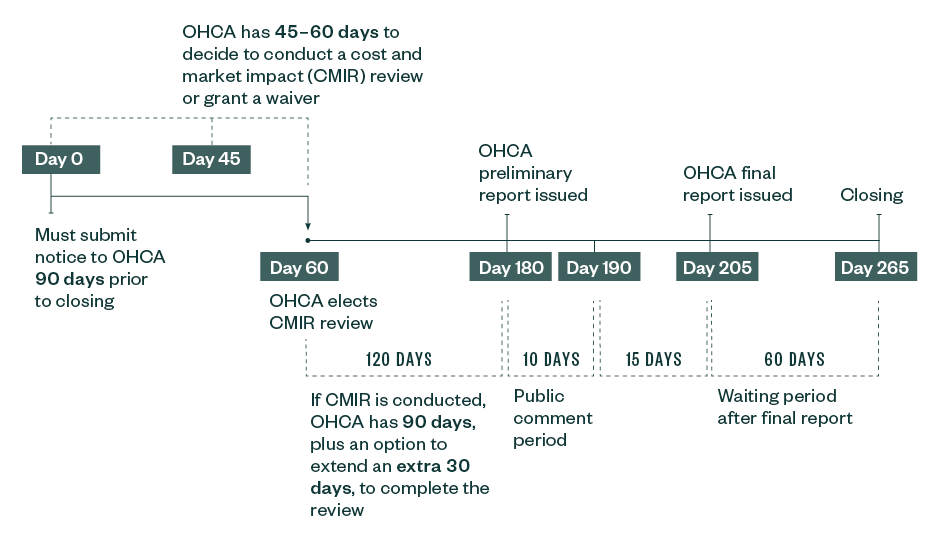

California’s new regulations demonstrate the level of nuance and complexity the health care industry must contend with, in addition to the federal requirements. As previously noted, California’s SB 184 requires health care entities including payors to notify OHCA of certain transactions.

Under the OHCA cost and market impact reporting (CMIR) requirements, the California Department of Managed Care (DHMC) and the Department of Insurance will retain primary authority to review transactions involving Knox-Keene health care service plans and licensed insurers, respectively, and the attorney general will retain primary authority to review transactions involving not-for-profit corporations, notwithstanding the fact that such entities may be considered health care entities under SB 184.

That said, such state agencies have the ability and discretion to refer such transactions to OHCA for a separate CMIR, potentially adding significant reporting and disclosure obligations, costs, and delays to deals beyond what may be normally expected under the initial agency review.

Interference with Market Dynamics

These and related California-based requirements can clash with other market dynamics, such as one that Bill Barcellona, the executive vice president of government affairs of America’s Physician Groups, says is particularly concerning—a recommended 3% cost growth cap over the next seven years that OHCA contemplated in connection with its cost-target setting authority under SB 184, in addition to OHCA’s CMIR authority discussed above.

Confidentiality

Besides understanding what to file, when, and where, there’s also the concern that confidentiality is not automatically assumed when filing in California and other state agencies, unlike in federal processes. Under the recently released OHCA CMIR regulations, much of the filing materials and information is treated as a public record unless OHCA accepts a submitter's confidentiality designation.