Washington will implement a new exemption on the state portion of personal property tax for qualifying renewable energy facilities starting January 1, 2025, per Revenue Code Washington (RCW) 84.36.680. Facilities generating and storing energy must apply for and be granted the new exemption.

The exemption includes a per-month per nameplate megawatt (MW) excise tax which varies depending on the length of the exemption applied for and the energy generating method.

Who Is Affected by the Personal Property Tax Exemption?

This exemption applies to all solar and wind generation and storage facilities with a nameplate capacity of at least 10 megawatts.

To receive the state property tax exemption, apply with Form 64 0119 and submit it to the Department of Revenue (DOR) by March 31 of the year before the personal property tax exemption will take effect. All construction must begin on or after July 1, 2023, to be eligible.

To receive the exemption in 2025, an application must be submitted by March 31, 2024.

Background on Washington Property Taxation

The personal property tax exemption only applies to the state tax levy, which represents approximately 30% of a county’s annual property tax rate. Local property taxes will not be exempt and will still be billed and collected by the county treasurer.

The percentage of state tax levy that will be exempt can vary by jurisdiction. The exact percentage can be requested by calling the county that assesses the project.

The exemption does not apply to real property.

Monthly Excise Tax Payments for Exempt Renewable Energy Facilities

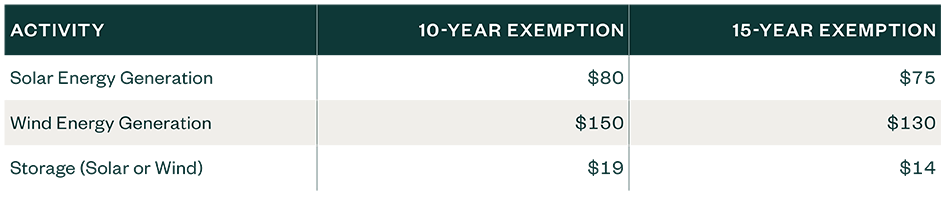

During the application process, a 10-year or 15-year property tax exemption can be requested. Based on the renewable energy system and the length, the monthly excise tax payments will be as follows:

The taxes are based on the nameplate megawattage of a renewable energy facility and must be reported on a combined excise tax return to the DOR.

Exemption Timing and Filing Requirements

The DOR will review each project and determine if the personal property qualifies as operating property of a public utility. Projects located in multiple counties will be assessed by the DOR and projects located in a single county will be assessed by the local county assessor.

If the property doesn’t qualify as operating property, the annual personal property tax filing must be submitted to the county assessor and is due April 30 of the relevant year.

If the property does qualify as operating property, then the annual personal property tax filing must be submitted to the DOR and is due March 15 of the relevant year.

We’re Here to Help

If you have questions about this exemption, please contact your Moss Adams professional.

Additional Resources

Special thanks to David Wolfe, Tax Senior, for his contributions to this article.