Has Your Business Outgrown QuickBooks?

You may have been using QuickBooks to manage business finances for a while, but how well is it serving you today?

It’s a great tool for keeping track of income and expenses, generating invoices, and running basic financial reports. However, as a business grows and becomes more complex, so do its accounting needs, and QuickBooks may no longer be sufficient to meet them.

While upgrading to a more robust accounting solution requires an investment of time and money, the benefits of improved efficiency, accuracy, controls, and scalability can make it well worth taking your financial management to the next level.

A consultant can help organizations implement technological transformation and the supporting processes needed to increase efficiency. Whether the best solution for a business is in-house or outsourced, continuous operational support can help with the move. This usually includes the realignment or training of existing personnel, or it could lead to outsourcing many of those functions.

Is QuickBooks Holding You Back?

If QuickBooks is holding you back in the following ways, it may be time to consider upgrading your system:

- Your accounting team spends too much time managing subledger spreadsheets and you’d like to automate.

- Your manual processes create errors that impact data accuracy.

- Your ability to make informed and timely decisions is hamstrung by slow reporting.

- Your business is growing by acquiring or creating new companies.

- Your accounting team is growing, and you need more effective workflows.

- You can’t view activity across your organization in real time.

- Your cash flow is affected by lack of efficient billing processes.

- Your financial data is impossible to analyze.

- Your audits pose concerns.

Check out more details in our Eight Signs You’re Ready to Switch to NetSuite ERP Insight.

What Are the Benefits of Making a Switch?

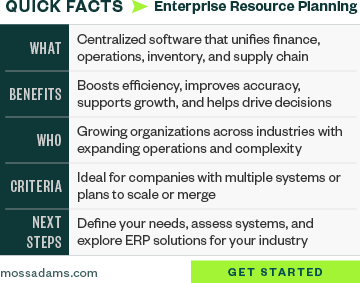

An updated Enterprise Resource Planning (ERP) accounting system can be a tool for assessing key considerations about your organization and help you in the following ways:

- Deliver enhanced visibility through pre-built and customizable dashboards.

- Reduce human errors and give employees more time to focus on results and financial analysis by cutting time spent in Excel Spreadsheets and multiple systems.

- Increase security and controls to meet compliance standards.

- Eliminate outdated technology that prevents ability to scale or integrate with other programs.

- Enable timely reporting on all processes in one place and enable better decision-making.

- Provide access to real-time financial data and insight for key performance indicators (KPIs).

- Enhance automation and workforce management.

- Establish granular budgeting and financial planning through relevant reporting dimensions.

- Save money and resources.

- Enable automated allocations in the ERP system based on static and dynamic allocation rules.

- Streamline intercompany transaction recording, eliminations, and consolidated reporting.

Check out our Checklist for Determining When It’s Time for a New ERP Solution.

How to Overcome Common Hurdles of Switching

Switching from QuickBooks to another ERP system can be an intimidating task that can lead to a potential business disruption if it’s undertaken without appropriate planning. Here are six key activities that can help you make a smooth transition to new accounting software.

Develop a Team

Consider the transformational benefits from the start of the project and establish a team to drive the project charter, needs analysis, provider vetting, and provider engagement. Executive sponsorship and communication with stakeholders are essential.

Prepare for Delays

During the transition period, there may be a temporary slowdown in business operations as employees adjust to the new system. Anticipate this to help reduce the impact on cash flow and customer satisfaction if delays occur processing orders, invoicing, and other financial tasks.

Communicate the Change

To minimize disruption, it’s important to plan the transition carefully and communicate with employees, customers, vendors, and other partners and stakeholders about any potential delays or changes in processes. It may also be helpful to have a dedicated team or consultant to manage the transition and provide support to employees during the learning process.

Provide Training

One of the biggest hurdles is the learning curve associated with a new system. Employees will need to be trained on the new software, which can take time and resources away from other tasks. Additionally, the new system may have different features and functionality than QuickBooks, which can require changes to existing business processes.

Data Transfer Management

Transferring your financial data from QuickBooks to the new system can be a complex and time-consuming process. It’s important to ensure that all data is transferred accurately and completely to avoid any discrepancies or errors in financial reporting.

Consider the Timing

Timing this transition is vital. If you are performing the transition mid-year, you’ll need to consider the transaction details that will need to be transferred to allow for year-end reporting, audit requirements, and tax return filings.

Common Upgraded ERPs Businesses Choose

Two common ERP platforms companies upgrade to when they leave QuickBooks are Sage Intacct or NetSuite.

Both of these systems are common with customers looking to move to a more robust system than QuickBooks or need a full ERP system. Each of these solutions has its strengths and industries that it better serves. You should take the time to evaluate the alignment with your firm for each solution based on your requirements, growth plans, and other factors.

Features to consider in selecting an upgraded solution for your business include:

- Provides more flexible segmentation for financial reporting than QuickBooks.

- Provides real-time entry with immediate ledger impact for approved transactions, providing real-time reporting and visualization of performance.

- Scales easily as your business grows, accommodating increased transaction volumes and additional users without significant changes to the system.

- Includes a unified ledger with unlimited reporting dimensions for automated elimination and consolidation capabilities to multicompany organizations.

- Supports international operations with financial exchange rates and localization.

- Automates routine accounting tasks, such as invoicing and reconciliations, reducing manual entry and the risk of errors.

- Offers industry-tailored solutions built on the same extensible platform and personalization tools used to design the core application.

- Offers advanced modules including advanced revenue management, advanced inventory, and manufacturing.

- Uses artificial intelligence (AI) for cash flow forecasting.

- Supports customizable dashboards and KPI tracking based on financial and operational data.

- Integrates with third-party systems through mature and open APIs, eliminating duplicate entry and increasing operational efficiency.

Choosing a new ERP system can be daunting, as there are many options, and the decision can have a significant impact on your business's operations and bottom line. Working with an IT consultant or outsourced accounting provider to evaluate new systems can make this a smoother process.

We’re Here to Help

To learn more about moving to new financial management software, contact your Moss Adams professional.