What to Know When Picking an ERP for a Multicompany Organization

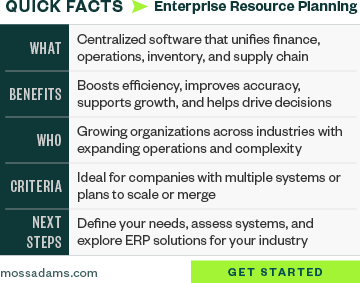

As your multicompany organization outgrows entry level accounting due to the scale and complexity of your company structure, you’re faced with the challenge of selecting an enterprise resource planning (ERP) system that will enable the next phase of growth.

Among the many requirements to consider, navigating the various features needed to support multiple legal entities and the approach that potential systems allow is essential to understand.

Selecting the appropriate system and implementing it effectively will require upfront diligence of the current operations and a strategic plan for future operations. The sections that follow focus on multicompany considerations.

Understand the Purpose and Operations for Each Legal Entity

The first step is an inward look at each legal entity’s purpose and operations. Consider it an inventory of legal entities. Ask the following questions to gain further clarification.

Is the Entity Financial in Nature and Without an Operational Function?

An example would be a real estate holding company that leases space to other entities in the organization.

Does the Entity Have an Operations Component?

This would be manufacturing, distribution, or service delivery.

Does the Location and Service Area for the Entity Necessitate International Requirements?

These requirements may include localization, statutory books, multicurrency, and exchange rates.

Do Multiple Entities Operate in the Same Manner?

A great example here would be retail outlets in various locations, each operating under its own legal entity but essentially operating in the same fashion.

Do Any of the Entities Transact with Each Other?

This could be several scenarios including a manufacturing entity providing product to a distribution or retail sales entity, or an entity providing centralized administrative services to several other entities.

Centralized Versus Decentralized Operational Needs

Based on the purpose of the legal entities involved, determine whether you need a centralized approach that can manage all companies following similar processes or if a decentralized approach is needed to address specific needs for each entity.

There are certain factors that will help inform this decision:

- Does the organization require best-of-breed applications for the core business operations of the entities? This could be health care encounter and claims billing, retail point of sale, hospitality management, telecommunications operations and business support (BSS/OSS), and others.

- If best-of-breed applications are involved, does the proposed ERP system support the controlled integration of data streams for revenue and expense information that map to the general ledger accounts and reporting dimensions? This is the case for many industry-specific applications that have strategic alliances with ERP system providers.

- Are there any components, like purchasing, that can be delivered using a centralized approach in conjunction with the best of breed systems? Common examples are purchasing, inventory control, and record to report.

Intercompany Transactions and Eliminations

Intercompany transactions are common between legal entities including supply chain relationships, centralized services entities, and real estate holding companies. If intercompany transactions are part of the organizations processes, ensure the ERP can handle intercompany transactions seamlessly.

It’s also beneficial to understand the nature of the transactions and how the proposed system will support them. Scenarios range from the sale and purchase of goods between entities, rental agreements, service agreements, or complex financial relationships between entities that may be compliance driven.

There are specific functions to consider:

- Customer and vendor representation for legal entities: These allow for normal order to cash and procure to pay processes while tracking intercompany transactions that will need to be eliminated. This support should allow for flexible order to cash and procure to pay transactions, including order modifications with proper approval workflow for the linked transactions.

- Due-to and due-from accounts support when more complex business agreements between entities are involved.

- Intercompany journal entry integration and import which also support more complex business arrangements where funds flow may be determined outside of the ERP system.

Financial Consolidation and Reporting

Consolidation and reporting are tables stakes functionality for multiple entity organizations. This includes automated consolidation of financial statements from all subsidiaries, including balance sheets, income statements, and cash flow statements, the goal being accuracy in financial reporting and a streamlined process of generating consolidated financial overviews for stakeholders.

While several ERP solutions provide for this functionality, they employ varying approaches. The best approach for you will be driven by the section above, particularly the diligence on the entity’s purpose and operation. It’s essential to understand which approach the proposed ERP provider supports.

Unified or Global Ledger

This approach involves a unified ledger that incorporates an entity or company dimension that differs from other reporting dimensions due to security requirements.

In addition to facilitating reporting, the system must allow for security of the entity’s transactions to the users who are assigned access. This would be in addition to the standard security for module- or process-based security. This approach is advantageous for real-time reporting for companies that can operate within a centralized record to report process.

Consolidation Parent Database or Partition

Systems using this approach configure a consolidation database or partition and leverage automation to import and consolidate relevant transactions from each of the databases or partitions for the legal entities in the organization.

This approach is effective for consolidation but may hinder real time reporting at the enterprise level. It does allow for systems to accommodate multiple entities wherein the original system design didn’t consider that functionality. Corrections to entries tend to be tedious in this approach.

Third Party Consolidation Tools

Third party consolidation tools are typically seen in larger, global organizations with disparate systems wherein the autonomy or each entity is prioritized.

This approach typically involves considerable effort for implementation and operational overhead typically owned by the shared services group of the parent organization.

Compliance and Security Considerations

In addition to the multicompany considerations, keep in mind the compliance and security requirements for any ERP to be considered, including the following.

ERP Provider Compliance

Is the potential system provider System and Organization Controls (SOC) compliant and will they provide the relevant SOC 1® or SOC 2® audit reports? What’s the provider’s business continuity plan?

Audit Trails

Implement comprehensive audit trails to document all financial transactions and changes within the system, supporting transparency and compliance with regulatory requirements.

Configurable Compliance Controls

The system should include configurable settings to comply with local and international accounting standards and tax regulations for each entity. Will the proposed system support segregation of duties for all entities in the organization?

Role-Based Access Control (RBAC)

Implement RBAC to define user roles and permissions, ensuring users have access only to the appropriate data and functionalities based on their role within the organization.

Data Security

Employ robust security measures, including encryption and secure data storage, to protect sensitive financial data against unauthorized access and breaches.

Next Steps

There are several considerations related to multicompany functionality as you’re searching for an effective ERP for your organization. Starting with an internal review of your legal entities and operations is an effective way to orient yourself to priorities that will inform your decision.

In addition to multicompany considerations detailed here, there are a wide range of functional requirements and provider and system integrator topics to consider.

The functional requirements should be driven by the business processes—lead to cash, procure to pay—while the provider specific topics include company history and reputation, implementation capabilities, training or enablement approach, one-time or recurring costs, and system deployment options.

As with any impactful decision, following a structured process for internal diligence, requirements gathering, provider evaluation, and provider engagement can help reduce the risk of misalignment for the system and implementation partner you choose.

We’re Here to Help

For more information on effective assessment and system selection approaches for your organization, contact your Moss Adams professional.