A version of this article was published in the December 2017 issue of California CPA Magazine.

With the rapid changes taking place in the economy and regulatory world, there’s much to know when it comes to filing for your 2017 California state taxes. Here are some of the most important changes:

With the rapid changes taking place in the economy and regulatory world, there’s much to know when it comes to filing for your 2017 California state taxes. Here are some of the most important changes:

Key Changes

Extensions for Partnership and LLC Returns (AB 119) | Businesses

AB 119 changes the automatic extension for filing partnership and LLC returns from six months to seven months, effective for 2017 tax year returns and thereafter (R&TC Section 18567). For calendar-year partnerships and LLCs taxed as partnerships, the extended due date will return to October 15.

AB 119 directs the Franchise Tax Board (FTB) to presume reasonable cause and not willful neglect for the late-filing penalty (R&TC Section 19131) and the per-partner or member penalty (R&TC Section 19172) for 2016 returns filed after the September 15, 2017 due date if the partnership or LLC both:

- Files a return by October 16, 2017 (or by the 15th day of the 10th month for non-calendar year entities)

- Requests relief “in a form and manner specified by FTB”

At this time, the FTB hasn’t specified how they’re going to implement this provision.

AB 119 didn’t change the extended due date for any other entity returns.

FTB to Revise Income Tax Forms and Instructions for Use Tax Reporting Requirements (AB 1593) | Individuals and Businesses

For the returns required to be filed for taxable years beginning on January 1, 2017, and thereafter, AB 1593 requires the FTB to revise the personal income tax return related to use tax reporting.

AB 1593 requires:

- Taxpayers to enter a number on the use tax line of personal income tax returns

- If zero is entered on the use tax line, taxpayers will need to check one of two boxes to validate that they:

- Remitted the use tax due for the taxable year to the California Department of Tax and Fee Administration (CAFTA)

- Don’t owe use tax

E-filed returns will be rejected if the use tax lines are left blank.

FTB Income Tax Forms for Use Tax Reporting and Payment; Acceptable Tax Return Means Original Return (AB 1717) | Individual and Businesses

AB 1717 made the following changes:

- Removes the phrase timely filed from the definition of an acceptable return for the purposes of remitting use tax on the income tax returns

- Defines an acceptable tax return to mean an original return, clarifying that use tax can be reported on an original return regardless of the date the original return is filed.

AB 1717 changed the original return definition to avoid the California Department of Tax and Fee Administration from asserting late payment penalties where the FTB transferred the use tax payment to cover any shortfall in the income tax liability.

CA Earned Income Tax Credit (SB 106) | Individuals

For taxable years beginning on or after January 1, 2017, California conforms to federal law and allows the credit to be calculated on self-employment income. SB 106 increases the maximum adjusted gross income (AGI) phase-out amounts for the California Earned Income Tax Credit (EITC) by substituting new tables for the credit and phase-out percentages and the earned income amount.

For taxable years beginning on or after January 1, 2018, the phase-out amounts will be annually adjusted in the same manner as the income tax brackets.

Minimum Voluntary Contribution Amount (AB 111) | Individuals

AB 111 reduces the minimum contribution amount requirement to zero for any voluntary contribution fund that has a minimum contribution requirement for 2017.

New Check-Off Designated Charitable Funds | Individuals

The following bills would allow a taxpayer to make a voluntary contribution to one of the funds listed below on their state personal income tax return:

- Habitat for Humanity Tax Contribution Fund (AB 149)

- Rape Backlog Kit Voluntary Tax Contribution Fund (AB 280)

- California Senior Citizen Advocacy Fund (AB 519)

- YMCA Youth & Government Voluntary Tax Contributions Fund (AB 846)

- Emergency Food for Families Voluntary Tax Contribution Fund (SB 61)

- California Breast Cancer Research & California Cancer Research Voluntary Tax Contribution Funds (SB 440)

- Keep Arts in School Voluntary Tax Contribution Fund and Protect Our Coast and Oceans Voluntary Tax Contribution Fund—Extends Repeal Date to January 1, 2025 (SB 503)

Other Legislative Changes

Voluntary Disclosure Program Expansion (SB 813) |Individuals and Businesses

For voluntary disclosure agreements (VDAs) entered into on or after January 1, 2018, SB 813 modifies the VDA Program’s provisions to allow the following to participate:

- Out-of-state partnerships with nonresident partners of general partnerships (GPs), limited partnerships (LPs) or limited liability or limited liability partnerships (LLPs) LPs, or LLPs

- Out-of-state trusts with California resident beneficiaries

SB 813 also updates the list of penalties the FTB won’t assess for the taxable years covered by the VDA entered into on or after January 1, 2017, to include the failure to file a timely return for:

- S corporations (R&TC Section 19172)

- LLCs classified as a partnership (R&TC Sections 18633 and 18633.5)

Electronic Communication with FTB—Extended (AB 1720)

AB 1720 extended the date for alternative electronic communications, MyFTB, between taxpayers and the FTB, from January 1, 2018, to January 1, 2025.

Other FTB Changes

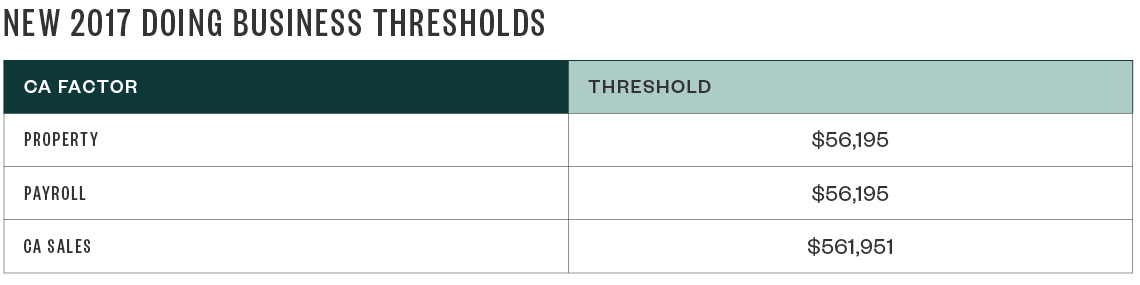

Economic Nexus Thresholds Indexed for Inflation | Businesses

The threshold amounts are indexed for inflation and revised annually.

Interest on Corporate Refunds and Interest Rates for January 1, 2018 | Individuals and Businesses

The FTB began paying 1% interest on corporation refunds beginning July 1, 2017. Prior to July 1, 2017, the FTB paid 0% interest on corporate refunds. The corporation overpayment rate will remain 1% through June 30, 2018.

The current interest rate on personal income tax underpayments and overpayments, corporation underpayments, and estimate penalties will remain the same at 4% through June 30, 2018. For certain corporate underpayments subject to the additional 2% interest—hot interest—the combined interest rate increases from 5% to 6%.

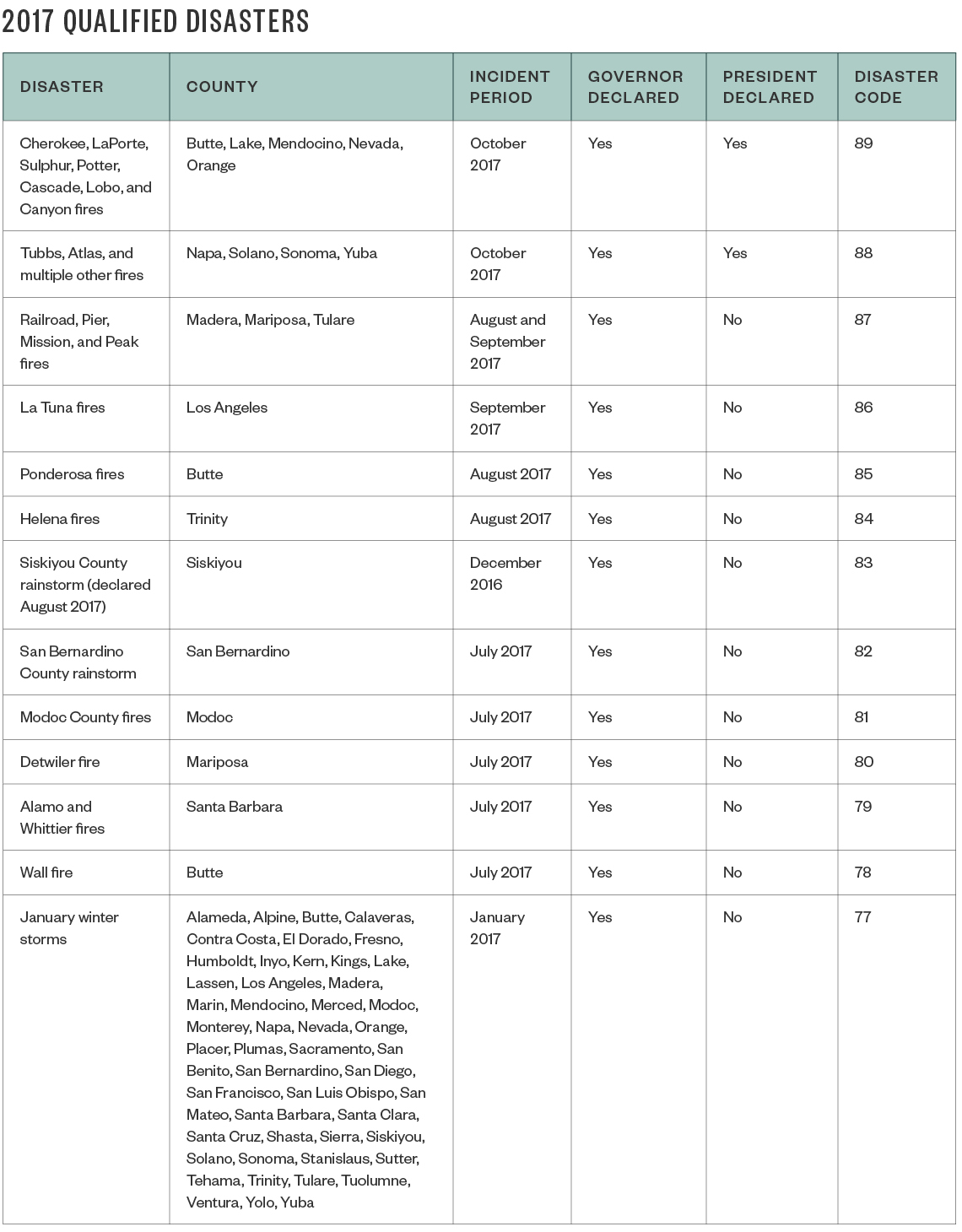

2017 Disaster Losses | Individuals and Businesses

October California Wildfires

The FTB announced special tax relief for California taxpayers impacted by wildfires. Affected taxpayers are granted an extension to file 2016 California tax returns and make payments until January 31, 2018.

The IRS granted an extension to file certain individual and business tax returns and make certain tax payments to January 31, 2018. This relief applies to taxpayers in nine counties: Butte, Lake, Mendocino, Napa, Nevada, Orange, Solano, Sonoma, and Yuba. In addition, firefighters and relief workers who provided relief services, but live elsewhere, also qualify for the extension. This relief applied to various tax filing and payment deadlines that occurred starting on October 8, 2017. This includes:

- Individual filers whose tax-filing extension ran out on October 16, 2017. Because tax payments related to 2016 tax returns were originally due on April 18, 2017, any payments associated with these filings aren’t eligible for this relief.

- Quarterly estimated tax payments due January 16, 2018.

- Quarterly payroll and excise tax returns that were due October 31, 2017.

- Calendar-year tax-exempt organizations whose 2016 extensions ran out on November 15, 2017.

A variety of other returns, payments, and tax-related actions also qualify for additional time. See the IRS’s disaster relief page for details on these and other relief the IRS has offered since the wildfires began, October 8, 2017.

The FTB automatically follows federal postponement periods for any presidentially declared disasters.

Hurricanes Harvey, Irma, and Maria

The FTB automatically follows the announced federal postponement periods for hurricanes Harvey, Irma, and Maria. Affected taxpayers were granted an extension to file tax returns and make payments until January 31, 2018. For instance, if Hurricane Harvey impacted a taxpayer who earns income in California, that taxpayer has extra time to file a California tax return.

On September 26, 2017, the IRS issued a recap of special relief for taxpayers affected by the three hurricanes. A variety of other returns, payments, and tax-related actions also qualify for additional time. See the IRS’s disaster relief page for details on these and other relief the IRS has offered since these hurricanes began hitting in August.

The FTB will also follow these extended dates and will cancel interest and any late filing or late payment penalties that would otherwise apply.

Other 2017 California Disasters

Taxpayers may deduct a disaster loss for any loss sustained in any city or county in California that’s proclaimed by the governor to be in a state of emergency.

Claiming a Disaster Loss on the California Return

If you e-file, use the disaster code provided in the following chart. If you file a paper return, print the following information in red ink across the top:

- Disaster

- Name of disaster in governor’s state of emergency proclamation

- The year the loss occurred, according to the Governor’s state of emergency proclamation

For more information regarding California disaster losses, refer to Publication 1034, Disaster Loss How to Claim a State Deduction, on the FTB website