Washington State offers several tax incentives for the aerospace industry, including rate reductions and credits on business and occupation (B&O) tax as well as exemptions for certain sales and use tax.

Washington State offers several tax incentives for the aerospace industry, including rate reductions and credits on business and occupation (B&O) tax as well as exemptions for certain sales and use tax.

Here’s an overview of how to document and file for the incentives.

Eligibility

The credits and incentives listed in this article are all available through July, 2040, except for the sales and use tax exemption for aircraft repair operators, which expires on January 1, 2027.

The following business types operating in Washington State are eligible.

Commercial Airplane and Parts Manufacturers

These include manufacturers of airplanes—or parts of airplanes—certified by the Federal Aviation Administration (FAA) for transporting people or property as well as any military derivative of the airplane.

Aerospace Tooling Manufacturers

This refers to companies producing tangible property used in aerospace manufacture, repair, overhaul, or replacement processes. Property can include dies, die blocks, fixtures, gauges, molds, patterns, templates, and other manufacturing and inspection aids.

Nonmanufacturers Conducting Aerospace Product Development

Companies in this category include those developing, designing, or engineering aerospace products, such as:

- Commercial airplanes and their components

- Machinery and equipment designed and used primarily for the maintenance, repair, overhaul, or refurbishing of commercial airplanes or their components by Federal Aviation Regulation (FAR) Part 145 certified repair stations

- Tooling specifically designed for use in manufacturing commercial airplanes or their components

Certified FAR Part 145 Repair Stations

These include companies that provide services of maintenance, repair, overhaul, or refurbishing of commercial airplanes or their components.

B&O Tax Opportunities

There are three B&O tax incentives available.

Rate Reductions

Rate reductions are available for aerospace manufacturing activity and the subsequent sale of manufactured products.

Who Qualifies

- Manufacturers

- FAR Part 145 repair stations

- Tooling manufacturers

Rates

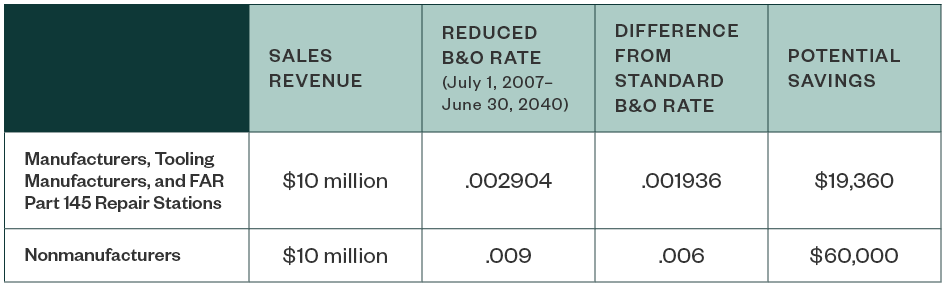

For manufacturers, including tooling manufacturers, and FAR Part 145 repair stations, the current reduced rate is 0.2904%; it’ll increase to 0.4840% when the standard rate resumes in 2040. For nonmanufacturers the current rate is 0.9%—this will increase to 1.5% in 2040.

Potential Savings

Filing

Companies must file all excise tax returns electronically.

Credit for Qualified Aerospace Product Development Expenditures

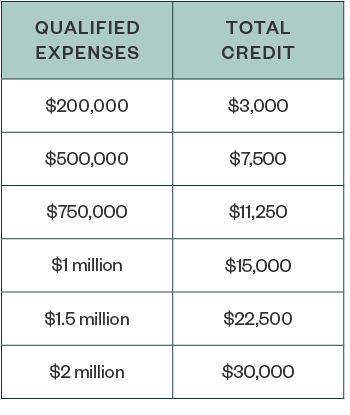

A B&O tax credit is available in the amount equal to 1.5% of qualified aerospace product development expenditures used in manufacturing commercial airplanes or their component parts.

Who Qualifies

- Manufacturers

- FAR Part 145 repair stations

- Tooling manufacturers

Qualifying Expenses

Expenses might qualify if they’re related to the design and engineering activities performed in developing an aerospace product, product line, model, or model derivative. Activities can include prototype development, testing, certification as well as tool design, and the operating expenses must be incurred by the person claiming the credit.

Examples:

- Wages

- Benefits

- Supplies

- Computer expenses

Excluded expenses:

- Manufacturing and production expenditures

- Surveys and studies

- Social science and humanities research

- Market research

- Quality control costs

- Sales and promotion

- Computer software developed for internal use

- Research in areas such as improved style, taste, and seasonal design

- Capital costs and overhead, such as expenses for land, structures, or depreciable property

- Amounts paid to a person to conduct qualified aerospace product development or to the state and any of its departments and institutions, other than a public educational or research institution

Potential Savings

Filing

Companies must file all excise tax returns electronically and can’t carry over credits beyond the calendar year in which they were accrued. The credit should be reported under the credits section of the excise tax return and can’t exceed the B&O tax due.

An Aerospace Credit Affidavit must be filed each time a company claims the B&O credit for qualified aerospace product development expenditures on a tax return. This affidavit is available in the Department of Revenue (DOR) electronic filing system located on the Credits page.

Tax Credit for Property or Leasehold Excise Taxes Paid on Property

A B&O tax credit may be taken that's equal to the property or leasehold excise taxes paid on new buildings, land for new buildings, the increased value of renovated buildings, and tangible personal property eligible for the manufacturing machinery and equipment exemption (M&E) when the buildings, renovations, and personal property are used in manufacturing commercial airplanes or components.

Who Qualifies

- Manufacturers

- FAR Part 145 repair stations

- Tooling manufacturers

- Nonmanufacturers

Considerations

The credit can’t be claimed until the property taxes associated with the qualifying land, buildings, or machinery and equipment have been paid. If the credit exceeds B&O tax due, it may be carried forward one year. Refunds aren’t granted.

Nonmanufacturers also may receive credit for property taxes paid on computer hardware, peripherals, and software used in the development, design, and engineering of aerospace products or in providing aerospace services.

Filing

Companies must file all excise tax returns electronically.

Sales and Use Tax Opportunities

There are two sales and use tax incentives available.

Exemption for Computers

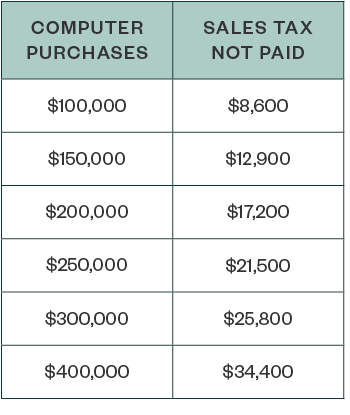

The retail sales and use tax exemption applies to computer equipment that isn’t otherwise eligible for the manufacturing machinery and equipment exemption.

Who Qualifies

- Manufacturers

- FAR Part 145 repair stations

- Tooling manufacturers

- Nonmanufacturers

Qualifying Expenses

Qualifying expenses include computer hardware, software, and computer peripherals used primarily in the design, development, and engineering of commercial airplanes or their component parts. Also included are charges for labor and services related to the installation of qualifying computer hardware, software, and peripherals.

Examples of some peripherals:

- Keyboards

- Monitors

- Mouse devices

- Accessories that operate outside the computer

Cables, conduit, wiring, and other similar devices are excluded.

Potential Savings*

* Assumed rate is the current Seattle rate, however, city and county rates vary throughout Washington.

Filing

Buyers must provide their retail sales tax exemption certificate to vendors. Box 6(i) of the certificate should be checked to indicate the appropriate exemption.

Exemption for Aircraft Maintenance Repair Operators

A sales and use tax exemption is also available for eligible aircraft maintenance repair operators on the construction of new buildings. This exemption extends to sales of tangible personal property incorporated as a component of such buildings as well as labor and services performed in respect to the installation of any fixtures.

Who Qualifies

To qualify as an eligible maintenance repair operator, a maintenance facility must have a certificate issued by the FAA under Part 145 of the Code of Federal Regulations and must be engaged in the maintenance, inspection, and alteration of aircraft and aircraft products.

Such operators must also be located in an international airport owned by a county with a population greater than 1.5 million. This limits the statute’s application to maintenance repair operator facilities at Sea-Tac Airport and Boeing Field.

Port districts, political subdivisions, and municipal corporations who construct new buildings for lease to eligible maintenance repair operators are also eligible for the exemption.

Annual Tax Performance Reports

Each year, companies reporting taxes under one of the preferential B&O tax rates or claiming a tax credit or exemption under an incentive program must submit an electronic report to the Department of Revenue that details employment, wages, and benefits for employment positions.

Effective January 1, 2018, House Bill 1296 modified the annual reporting requirements and consolidated the Annual Report and Annual Survey—which were both previously required—into one Annual Tax Performance Report.

Important Deadlines

The due date for filing the Annual Tax Performance Report is May 31 for the prior year’s activities. The reporting change affects tax incentives claimed in calendar year 2018 and reported on the 2018 report.

Consequences for Late Filing

If a taxpayer claims a tax preference that requires an annual report but fails to submit a complete report by the due date, the department will declare:

- 35% of the amount of tax preference claimed for the previous calendar year to be immediately due and payable

- An additional 15% of the amount of the tax preference claimed for the previous calendar year to be immediately due and payable if the taxpayer has previously been assessed for failure to submit a report for the same tax preference

We’re Here to Help

To learn more about these savings opportunities and your potential savings, contact your Moss Adams professional.