On August 21, 2019, the Financial Accounting Standards Board (FASB) issued a proposed Accounting Standards Update (ASU) to defer the effective date of the amendments in ASU 2018-12, Financial Services–Insurance (Topic 944), for all entities.

Background

On August 15, 2018, the FASB issued ASU 2018-12 to improve, simplify, and enhance the financial reporting requirements for long-duration contracts, such as life insurance and annuities, issued by insurance entities.

The FASB received a technical agenda request to defer the effective date of the amendments in ASU 2018-12 for public business entities (PBEs) by one year due to various implementation challenges faced by insurance entities.

After conducting outreach with a wide range of insurance entities that would be impacted, the FASB voted during the July 17, 2019 board meeting in favor of adding a project to the technical agenda to defer the amendment’s effective dates.

Additionally, the FASB voted in favor of applying the new two-bucket philosophy to stagger the effective date of ASU 2018-12 between larger public companies and other entities, including smaller reporting companies (SRCs), private companies, not-for-profit organizations, and employee benefit plans, by two years.

Proposed Effective Dates

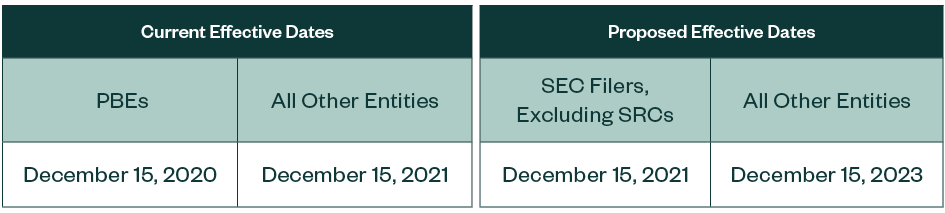

Consistent with the tentative board decisions from the July 17, 2019 board meeting, the proposed update seeks to amend the effective dates for the recently issued ASU related to Insurance to be for fiscal years beginning after the following dates:

Determining whether or not an entity is eligible to be classified as an SRC would be based on an entity’s most recent determination in accordance with SEC regulations when the final update is issued. Early application is permitted for all entities under this proposed update.

The proposed update is open to a 30-day comment period, with comments due by September 20, 2019.

We're Here to Help

Implementing a major standard can be a time-intensive process. For more information on how these proposed changes may affect your business and how you can prepare, contact your Moss Adams professional.