Below is a summary of the current status of relief opportunities related to certain California taxes due to COVID-19. We’ll continue to update you as more official guidance becomes available.

Franchise Tax Board (FTB)–Income Taxes

In light of the tremendous impact of COVID-19, often referred to as the coronavirus, California has provided a relief program for both returns and estimated tax payments for 2020.

FTB is now postponing the filing and payment deadlines until July 15 for all individuals and business entities. This includes:

- 2019 tax returns

- 2019 tax return payments

- 2020 Q1 and Q2 quarter estimate payments

- 2020 LLC taxes and fees

- 2020 Non-wage withholding payments

A return or payment coupon should contain COVID-19 STATE OF EMERGENCY or similar language at the top of the form to be treated as qualifying for this relief program. Note that with the latest update, this language isn’t required. It’s still good practice, however, to include this language for posterity.

Note that underpayment penalties will not be waived by this relief program. The estimate payments and tax payments must still meet the ordinary thresholds when payments are made by the new due dates.

This new extension to July is in response to IRS Notice 2020-17 released on March 18. FTB will continue to monitor changes at the federal level.

As of this alert, the IRS has only issued guidance regarding an extension of the upcoming payment deadline. The April 15th deadline to file either a federal income tax return or extension request has not changed. We’ll keep you updated as future updates become available.

For more information, please visit the FTB’s COVID-19 resource page.

California Department of Tax and Fee Administration (CDTFA)–Sales/Use Tax & Other Tax and Fee Programs

The CDTFA is responsible for the administration of over 30 different taxes and fees including sales and use tax and many excise taxes.

California is providing a relief program by granting extensions for filing returns, making payments, filing a claim for refund, and relief from interest and penalties. This relief program is currently available through May 11, 2020, to individuals and businesses impacted by complying with a state or local public health official’s imposition or recommendation of social distancing measures related to COVID-19. The CDTFA’s website has issued guidance on requesting relief under this program. Taxpayers must contact the CDTFA to request relief of interest, penalties, or the opportunity for an extension to file a return, or defer making tax payments by filing a request through the CDTFA’s online services.

Access to this relief is available by sending a written letter request or an email to the specified address for CDTFA. Specific information is available on the CDTFA’s website.

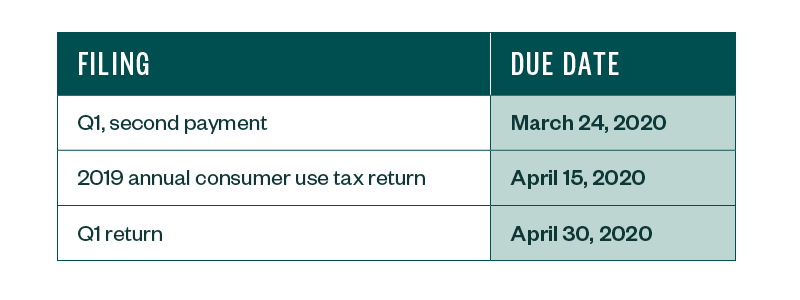

Due dates that may be affected include the following sales and use tax prepayments and returns.

For more information on filing, please visit the CDTFA’s dedicated page.

Note that this relief program may change as more information becomes available or if the Governor extends his declaration of emergency.

Employment Development Department (EDD)–Employment Taxes

The EDD has announced a relief program for employers experiencing a hardship related to COVID-19 consistent with the Governor’s executive order.

Employers experiencing hardship as a result of COVID-19 may request up to a 60-day extension of time from the EDD to file their state payroll reports. Employers may also request an extension to deposit state payroll taxes without penalty or interest. A written request for extension must be received within 60 days from the original due date of the payment or return.

For employers that may be looking at reduced hours for employees or potential layoffs, the EDD has provided additional resources to help. This includes an Unemployment Insurance Work Sharing Program, which allows employers to retain workers by reducing their hours and wages and offsetting the wage loss with unemployment insurance benefits. Additionally, they’re providing a Rapid Response team to support the needs of businesses potentially facing layoffs and closures.

For additional information please visit the EDD’s COVID-19 resource page.

We’re Here to Help

For more information about emergency relief in California, please contact your Moss Adams professional.