When it comes to Medicare provider reimbursement, Worksheet S-10 has captured the provider reimbursement community’s attention. But it’s important not to lose sight of the Medicare Disproportionate Share Hospital (DSH) program.

When it comes to Medicare provider reimbursement, Worksheet S-10 has captured the provider reimbursement community’s attention. But it’s important not to lose sight of the Medicare Disproportionate Share Hospital (DSH) program.

Medicare DSH is a $4 billion-plus program in federal fiscal year (FFY) 2020, which makes it a significant and important revenue stream for many hospitals.

Qualification for Medicare DSH is a factor in other reimbursement programs as well. Medicare DSH qualification drives participation in the $8.35 billion Federal Uncompensated Care (UC) pool as well as the 340B Drug Discount Program.

And unlike the UC pool payment, hospitals, in essence, have a greater ability to control their DSH reimbursement; in fact, they have permission to revise it.

It’s common to hear about how overall hospital reimbursement is declining, but Medicare DSH is growing, and hospitals have opportunities to optimize theirs based on how well they report their DSH data.

Following is an overview to help hospitals determine Medicare DSH eligibility and evaluate their Medicare DSH reporting.

What’s the Medicare DSH adjustment?

The original intent of the Medicare DSH payment was to supplement providers who treated higher percentages of low-income Medicare patients because the costs to treat those patients were more expensive.

According to the CMS website, “the Medicare DSH adjustment was enacted by Section 9105 of the Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985. This program became effective for discharges occurring on or after May 1, 1986.”

What are DSH qualification methods?

According to the section of the Act mentioned above and the CMS website, “there are two methods for a hospital to qualify for the Medicare DSH adjustment.

1. The primary method for a hospital to qualify for the Medicare DSH adjustment is based on a statutory formula that results in the DSH patient percentage.” That formula is reviewed below.

2. “The alternate, special exception method is for large urban hospitals that can demonstrate that more than 30 percent of their total net inpatient care revenues come from State and local governments for indigent care (other than Medicare or Medicaid).” This is referred to as the Pickle Method, and there are very few Pickle hospitals remaining.

Formula

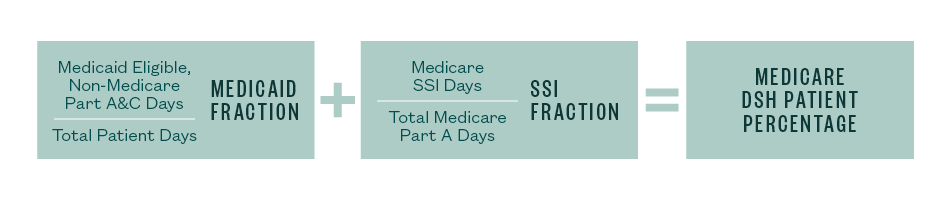

The DSH patient percentage is the sum of two fractions meant to represent two at-risk populations: the under-served and the elderly and disabled.

The Medicaid fraction consists of Medicaid eligible patient days that aren’t entitled to Medicare Part A and C divided by all total inpatient days.

The SSI fraction, meanwhile, consists of Medicare Part A and C days where patients also have federal SSI benefits divided by the total hospital Medicare Part A and C patient days.

Medicare DSH patient percentage

These two fractions are added to formulate the hospital’s disproportionate patient percentage (DPP) that’s then applied to a statutory formula to establish a hospital’s DSH percentage based on hospital type. Note that there are slightly different formulas for urban and rural hospitals.

To qualify for Medicare DSH payments, hospitals must reach a 15% DSH threshold when these two fractions are summed.

Ineligible Hospitals

There are certain types of hospitals that aren’t eligible for Medicare DSH:

- Critical access hospitals (CAH)

- Sole community hospitals (SCH), whose hospital-specific payment is greater than their federal specific payment

- Children’s hospitals

How do you report Medicare DSH?

The Medicare DSH amount is typically reported annually on Worksheet E Part A of the Medicare cost report. Final eligibility is determined and could potentially be adjusted at cost report settlement by a provider’s Medicare administrative contractor, which is known as MAC.

The fiscal year 2019 IPPS Final Rule stated that for cost reporting periods beginning on or after October 1, 2018, each DSH-qualifying hospital must now include, as part of the cost report filing, a detailed listing of its Medicaid eligible days that corresponds to the Medicaid eligible days claimed in the cost report (and supports the DPP shown above) as supporting documentation.

This requirement affects the acceptability of the cost report. Again, without a detailed listing, a cost report will be deemed unacceptable and your report will be rejected.

We’re Here to Help

For more information about whether or not you qualify or how to report Medicare DSH, contact your Moss Adams professional.