In times of financial disruption, loan restructuring and forgiveness can provide vital opportunities for borrowers to avoid bankruptcy or defaulting on their loans. This is especially true for real estate and private equity investors with large portfolios with tenants that aren’t paying rent as anticipated.

In times of financial disruption, loan restructuring and forgiveness can provide vital opportunities for borrowers to avoid bankruptcy or defaulting on their loans. This is especially true for real estate and private equity investors with large portfolios with tenants that aren’t paying rent as anticipated.

However, while loan reductions and forgiveness can provide companies with financial relief, they’re often accompanied by significant tax consequences that can have long-term financial effects if borrowers don’t adequately prepare for them.

Following is an overview of loan forgiveness and restructuring opportunities, potential benefits, and tax consequences companies should know.

Background

Following the Great Recession of 2008–2010, loan modifications and foreclosures were widespread—and many borrowers learned about the tax consequences of these transactions the hard way.

When a borrower is unable or unwilling to make principal and interest payments, a debt settlement, foreclosure, or workout arrangement normally ensues. Each method has substantial and differing tax consequences for the borrower.

If a lender agrees to a haircut on a loan amount—which is the difference between an asset’s current market value and the value assigned to that asset when determining regulatory capital or loan collateral—the tax consequences for the borrower depend on whether or not:

- The borrower is solvent at the time of the modification

- The loan is recourse or nonrecourse

- The borrower retains ownership of the asset

If the borrower is solvent, a discounted debt settlement can result in taxable discharge of indebtedness income. If the borrower is insolvent, discharge of indebtedness income on settlement of the debt at a discount can be avoided if the loan modification leaves the borrower insolvent. Whether or not the borrower is solvent or insolvent depends on the classification of the borrower as an individual, a partnership, or a corporation for tax purposes.

Debt Instruments Modifications and Insolvency

If an entity experiences financial hardship and is unable to make its scheduled debt or mortgage payments, there are a variety of loan and debt restructuring options. These opportunities typically occur through lenders or creditors altering the debt agreement in one of the following ways:

- Reducing interest rates on loans

- Forgiving a percentage or amount of the loan

- Extending the dates when a company’s liabilities are due

- Creating a forbearance agreement that allows borrowers to delay their debt-service payments for a period of time

Discharge of Indebtedness Income

It may seem logical that modification of a note payable—such as a change in interest rate or payment schedule—wouldn’t result in discharge of indebtedness (DOI) income. However, some alterations are considered modifications and are treated as an exchange of one debt instrument for another. DOI income can result from these alternations, similar to an outright reduction in the amount to be repaid.

Insolvency

There are multiple exceptions to DOI income recognition, one of which concerns an insolvent borrower. Insolvency occurs when an entity’s liabilities exceed its assets. All entities can become insolvent during challenging times, but measuring insolvency—and thus determining the consequences of debt restructurings—depends on an entity’s classification for tax purposes.

- Corporation. Insolvency is measured at the corporate level. That means the corporation’s liabilities must exceed its assets at the corporate level.

- Partnership. Insolvency is measured at the partner level instead of the partnership level. The insolvency exclusion will only be available if the partners are insolvent at their level, as opposed to the borrowing-partnership level.

Example

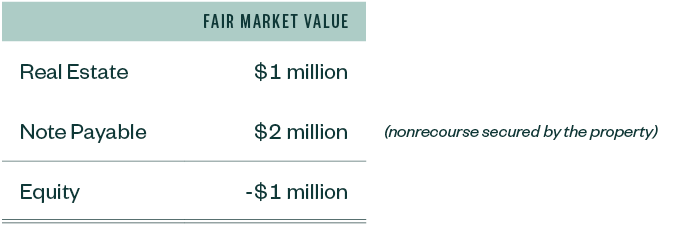

Real Estate Partnership and Real Estate S Corporation are both owned equally by two individuals. Both entities have identical balance sheets—on a fair-market-value (FMV) basis as opposed to tax basis. The lender agrees to write down their loan balances from $2 million to $1 million, resulting in both entities having loan balances of $1 million. Both of their balance sheets look like this:

In the case of Real Estate S Corporation, its liabilities exceed its assets by $1 million, which means the $1 million of loan reduction can be excluded from Real Estate S Corporation’s income under the insolvency exclusion.

In the case of Real Estate Partnership, the insolvency exclusion is measured at the individual partner level. This requires an analysis of all individual-level assets and liabilities—including personal-residence home equity, automobile equity, and retirement accounts—to determine the amount of insolvency. Additionally, partnership-level nonrecourse liabilities are only included in the partner’s insolvency computation if:

- The loan balance exceeds the FMV of the property that secures the debt

- The debt is discharged

In this case, assuming the only asset the partners own is their partnership interest, each of the partners would be eligible to exclude their respective $500,000 share of the debt because:

- The nonrecourse debt exceeds the FMV of the property by $1 million

- Each of the partners is insolvent by $500,000, when counting only their share of the partnership-level debt discharged

Real Estate Loans and Seller Carry Notes

For owners of leveraged real estate, there’s an important exception to the discharge of indebtedness rules: A solvent borrower may avoid DOI income if certain requirements are met and if they elect to reduce the basis of property.

Requirements

This exception is available to those borrowers that have qualified real property business indebtedness (QRBI), but the following three requirements must be met:

- The indebtedness must have been incurred or assumed by the borrower in connection with real property used in a trade or business and must be secured by the real property.

- The indebtedness must have been incurred or assumed prior to January 1, 1993, or be qualified acquisition indebtedness.

- The borrower, who is also the taxpayer, must elect to have this provision apply to the indebtedness.

Excludable Amounts

The amount of DOI income that can be excluded under the QRBI rules can’t exceed the lesser of:

- The excess of the total outstanding debt immediately before the discharge over the FMV of the real property securing the debt, which is referred to as the FMV limitation

- The aggregate adjusted bases of all depreciable real property held by the taxpayer, determined as of the first day of the tax year following the discharge—or, if earlier, the property's disposal date

Seller-Financed Debt

The balance of a loan may be reduced by a seller of property to a purchaser. The purchaser can then treat the transaction as a purchase price reduction if the following points apply:

- The loan holder is the original seller of the property

- The debt attached to the loan note originated from the sale of property

- The purchaser isn’t bankrupt or insolvent

If a seller-carried note balance is reduced and the above conditions are met, no DOI income is transferred to the purchaser, who is required to reduce the tax basis of the property by the amount of the principal reduction. This tax treatment isn’t elective.

Foreclosures, Deeds in Lieu, and Short Sales

Some conveyances can result in DOI income to the borrower, such as:

- If a lender forecloses on a property

- If a borrower transfers property to a lender by a deed in lieu of a short-sale transaction

The primary question surrounding these transactions is whether or not the debt is recourse or nonrecourse.

Recourse Debt

Recourse debt is backed by collateral from the borrower. If a loan is recourse to a borrower, the transaction is viewed as a bifurcated transaction with the first part of the transaction considered to be a sale of the property at its FMV with gain or loss based on the tax basis of the transferred property. If the balance of a recourse loan exceeds the fair market value of the transferred property, the excess is DOI income to the borrower.

Nonrecourse Debt

Nonrecourse debt implies that the sole security for the loan is the underlying collateralized real estate. If a loan is nonrecourse to the borrower, the borrower reports only gain or loss based on the difference between the loan balance and the tax basis of the property. The loan balance is viewed as the total sales proceeds in a nonrecourse foreclosure and, accordingly, no DOI income results to the borrower.

It’s imperative that a tax advisor carefully review the loan documents to determine whether the loan is recourse or nonrecourse to the borrower in a foreclosure or similar transaction.

Paycheck Protection Program Loan Forgiveness

The Small Business Administration’s (SBA) Paycheck Protection Program (PPP) is an incentive program designed to provide financial relief to small businesses that keep their employees on payroll during the current COVID-19 pandemic.

Under this program, the SBA will forgive part or all of a loan if:

- A company keeps all employees on its payroll for eight weeks after receiving proceeds

- The requisite amount of loan proceeds is used for payroll, rent, mortgage interest, or utilities

According to the IRS, any expenditures paid with PPP loan proceeds aren’t deductible for federal income tax purposes. However, several senators have introduced legislation that may allow PPP loan proceeds to be used to pay the requisite expenses. Entities should maintain detailed records of PPP loan proceeds disbursements to support any eligible loan forgiveness.

Learn how to determine if you’re eligible for loan forgiveness in our article.

Summary

The consequences surrounding debt modifications are complex, and there are many available options and elections that need to be carefully analyzed by borrowers based on their facts and circumstances. It’s important to speak with an experienced tax professional prior to entering into any loan modification agreements with a lender—especially in times of financial uncertainty.

We’re Here to Help

To learn more about loan restructuring opportunities and steps your company can take to get started, contact your Moss Adams professional.