When contending with the day-to-day demands of running a business, long-term planning and bigger picture strategy can often get pushed aside, but there are five strategies that could benefit from your attention.

While it can be hard to make time, assessing the direction of your company on high-level strategic matters, such as your company’s entity type or your exit strategy, can have significant benefits—regardless of the stage or size of your company.

Proactive planning could help you identify any missed opportunities due to frequent updates to the tax code. In addition, this approach could help you preserve and create longer-term wealth for you and your family.

Below are five key strategies that could help strengthen the position of your business and personal finances.

1. Understand the Value of Your Business

Even if you’re not actively looking for a buyer, you never know when one or another opportunity might come along so it’s useful to understand what your company is worth.

As an owner, your business might be the largest asset on your personal balance sheet, so it’s important to assess how it could be utilized for personal wealth as well.

Values likely change depending on what stage of the life cycle your business is in so there may be differing moments in your life when you must evaluate where you’ve allocated your financial resources.

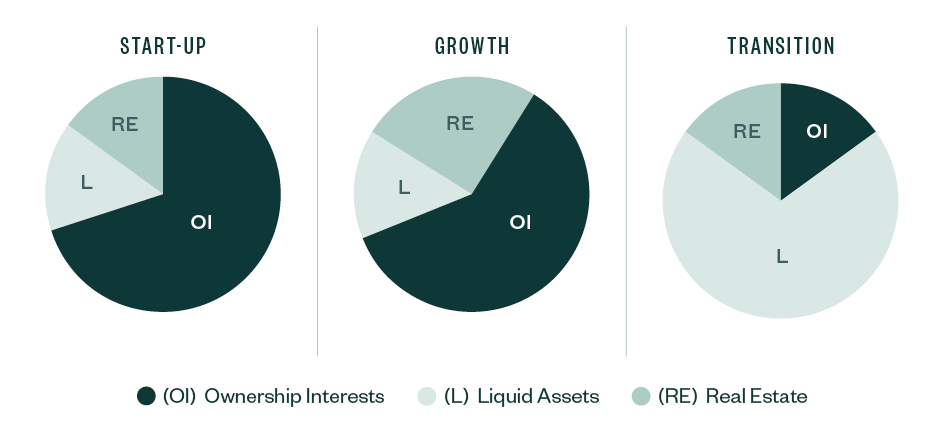

In the start-up stage, most of your assets likely take the form of your ownership interests in the company, with a smaller percentage devoted to personal liquid and real assets, such as real estate—personal as well as business—or business equipment.

As your business grows, you may need more real assets to accommodate expansion. As the business matures and you prepare your exit strategy or transition, you might find yourself with a greater proportion of liquid assets.

Assets by Life Cycle

Valuation Factors to Consider

- Owners’ personal financial plan, cash flow needs, and goals

- Preservation of the value of the business

- Low interest rates

- Family dynamics

- Income tax issues

- Estate Planning

Learn more about five estate planning factors to take into account during COVID-19—and four steps to get started.

2. Plan Your Exit Strategy

Even if you’re not actively looking to make an exit, it’s important to have a plan in place—both to increase your potential financial position and to secure a better future for you and your company.

There are many changes to consider when planning for an exit. Determine which structure makes the most sense for your business and what timeframe you’re working with to benefit from tax changes.

It can also be helpful to have a transaction preparedness evaluation done to assess your readiness before getting started.

Planning Opportunities: Proactively Assess Options

As a business owner, exit planning is a major, one-time opportunity that warrants long-term attention through your company’s life cycle. Understanding the strategic exit options can help extend the value of your business and its legacy, while preserving the wealth generated for your future.

It’s important to evaluate these options thoroughly and select the approach that provides you and your successors with the greatest chance for financial success.

Here are several options to keep in mind when planning your exit.

Keep It in the Family

You can transfer ownership of your business by gifting or selling your ownership interests to other family members.

Account for your future income needs, gift and estate taxes, and the impact of your decisions on family members who may or may not be involved as the next generation of owners.

This option can often involve potential personal conflicts or strife—for example there might be strife between siblings if they won’t inherit the business equally—which is why it’s crucial to take a proactive approach and outline expectations early

Many business owners avoid important succession issues because they touch on personally sensitive areas, such as family dynamics, retirement, and mortality.

Management Buyout

If your family members aren’t able or willing to take the reins, a management buyout might be a good option.

Benefits could include saving time and resources that would otherwise be spent finding an outside buyer and shorten the learning curve for new owners. This could help them maintain the pace of business, resulting in a smoother transition that ultimately funds your buyout.

Outside Sale

While you might not be planning to sell your business, you want to be prepared if opportunity knocks and the right buyer finds you. You may be able to sell your business at a premium.

Due diligence is critical, however, to make sure you get a fair value and one that allows you to meet your long-term objectives.

Ownership Transition

If you intend to exit or transition the business to new ownership, consider your planning options well in advance—not only because planning can be financially rewarding, but also because it can give you peace of mind.

Comprehensive Plan

A comprehensive plan should address business and personal financial planning, management succession, estate planning, and ownership transition together.

Advisor Insight

If you’re weighing the sale or transfer of a wholly owned subsidiary of your organization, determine with your advisor if the subsidiary chooses any tax elections that affect the taxability of the transfer.

This is particularly important in situations involving a subsidiary that’s either a single-member LLC or an S corporation.

3. Review Your Financial Plan

Taking your personal needs into consideration alongside your business is key as every business and owner is different.

You’ll want to continue to create sufficient personal liquidity and net worth to fund your lifestyle and tend to your family’s needs and interests.

Key Questions

Important questions to review each year include:

- When do you want to transition out of your ownership role?

- How can you derive the greatest value from your business?

- Who’s the best candidate to lead your company into the future?

- Do you have the right management team in place?

Plans and Insurance

It’s also important to reevaluate your financial plan and insurance to assess if you’re still meeting your needs and goals. Business planning around transitioning your ownership interests requires comparable diligence.

Maintaining a strong financial plan can help you sustain long-term business value—also known as transferable value—as well as improve profit and cash flow while providing fair compensation to the owners.

Like many owners of privately held companies, you may be a personal guarantor for your company’s debt, having worked hard to cultivate close relationships with your bank and other creditors.

For the viability of your company, you must transition these key business relationships to your successors. Business financial planning will also help you satisfy these key external stakeholders and set the stage for your release from personal credit guarantees.

Many lenders also look for a formal succession plan when determining the amount of credit to extend to a business, with concerns around:

- Whether your company can complete all pending and anticipated sales

- How it will secure future debt

- How you’re developing your future management team to take over on an interim or permanent basis

How you structure an ownership transition of your business can have a substantial impact on your personal financial plan. These key questions should all be considered prior to settling on a final transition structure:

- How will the buyout of your ownership interests be financed?

- Is the timing of the cash payments you’ll receive consistent with your future cash flow needs?

- Will your needs for life insurance change as a result of this transaction?

Tax and Investment Implications

You should also reevaluate your personal tax implications to make sure you’re reviewing all the potential issues that could impact you or your business.

Most business owners generally know how to manage their individual and business’ annual income tax obligations. Yet few integrate strong strategies for ownership transition when balancing the conflicting long-term income, gift, and estate tax ramifications.