Texas property owners can receive a temporary property tax exemption for qualified property damaged by Hurricane Nicholas, which hit the Texas Gulf Coast on September 13, 2021.

For a qualified property to receive the exemption, damages from the storm must reach or exceed 15% of current appraised property valuation.

Property owners must apply for the temporary exemption by December 27, 2021 to receive the benefit. Below, learn who’s eligible for the tax relief, how to apply, and more.

Qualified Property Eligible for Exemption

Under Section 11.35 of the Texas Property Tax Code, qualified property eligible for this exemption includes:

- Tangible business personal property used for the production of income

- Residential buildings

- Commercial buildings, such as office buildings and manufacturing plants

- Multifamily buildings

- Other real property, including certain manufactured homes

Eligibility for tangible business personal property requires that a 2021 personal property tax rendition or property statement was filed before April 15, 2021.

How to Determine Eligibility

Property owners may receive the temporary exemption given they meet the following two conditions:

- Chief appraiser grants damage assessment to the property

- Damage is at least 15% of the current appraised property valuation

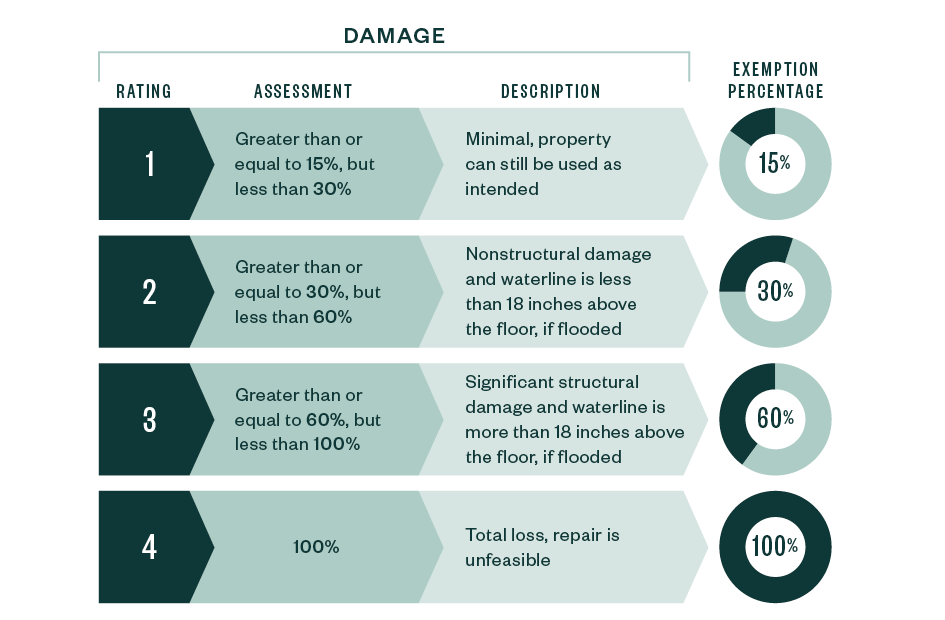

If the property qualifies for and receives the exemption, the county appraisal district will review all available information to assign a damage assessment rating.

Damage Assessment Ratings

How to Determine the Exemption Percentage

Determine the exemption percentage by multiplying the building or business personal property value by the exemption percentage based on the damage assessment level, as the above diagram illustrates.

Multiply that amount by the annual proration factor, as defined by the disaster declaration. The proration factor for this disaster is 0.3, which was determined by dividing 109 days by 365.

Sample Calculation

A home appraised at $200,000 received $40,000 in damage, but its minimal damage didn’t prevent intended use.

The damage assessment would exceed the 15% threshold—$40,000 damage divided by $200,000 appraised value, which equals 20%—and the home would be granted a damage rating level 1 and a 15% exemption.

The home’s appraised value of $200,000 would then be multiplied by the 15% exemption percentage, which equals $30,000. That amount would then be further multiplied by the proration factor of 0.3, equaling a $9,000 exemption that would reduce the taxable value of the property for the 2021 tax year.

Filing Deadline and Disaster Area Counties

Property owners must apply for the temporary exemption within 105 days of the governor’s declaration of a disaster area, with the deadline to file on December 27, 2021.

Governor Greg Abbott declared the following counties in the disaster area on September 13, 2021: Aransas, Brazoria, Calhoun, Chambers, Galveston, Harris, Jackson, Jasper, Jefferson, Liberty, Matagorda, Montgomery, Newton, Nueces, Orange, Refugio, San Patricio, Victoria, and Wharton.

We’re Here to Help

For more information about the tax relief available to Texas Gulf Coast property owners, contact your Moss Adams professional.