Making the most of your investments should be a top priority. But navigating investment strategies can be difficult, especially when going it alone.

Explore a few examples below to see how strategic advice around charitable giving could provide compounded value to your investment portfolio.

Boost Your Portfolio with Charitable Giving Strategies

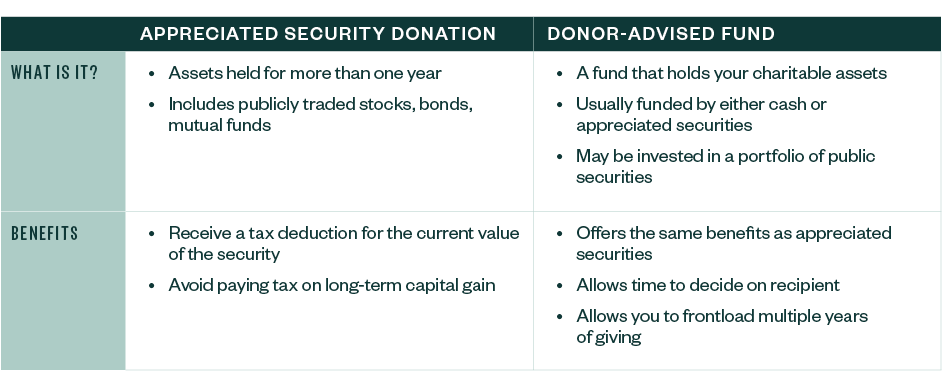

If you’re charitably inclined, tax-efficient investment strategies can help accomplish your giving, such as donating appreciated securities directly to a charity or donating to a donor-advised fund, also known as a DAF.

Quick Facts for Appreciated Securities and Donor-Advised Funds

Appreciated Securities

The most basic charitable giving strategy might be to donate appreciated securities instead of cash.

What Is an Appreciated Security?

An appreciated security is an asset held for more than one year and worth more than when it was acquired. Assets are often publicly traded stocks, closely held stock, bonds, or mutual fund shares.

Appreciated Securities as an Investment Strategy

By donating securities, you can claim a tax deduction for the current value of the security and avoid paying tax on the imbedded long-term capital gain.

Avoiding capital gain taxes could enable your portfolio to grow faster and ultimately put you in position to give more generously to charity or pass along more wealth to your family. If you’re donating from a concentrated position of stock, giving those shares to charity may also help you diversify.

Donor-Advised Fund

For those who give regularly, consider frontloading multiple years of giving to a donor-advised fund rather than taking smaller deductions annually.

What Is a Donor-Advised Fund?

A donor-advised fund lets you gift cash as well as other appreciated assets to a charitable organization. Over time, the fund grants the value of your gifts to the charitable organizations you designate.

Donor-advised funds can be useful if you’d like time to decide where the money will go but want to make a contribution and need a current-year tax deduction. You can make a gift now, and the donor-advised fund holds the assets until you’re ready to distribute to a charity. Since the fund itself is a tax-free vehicle, the income and annual growth of the investments inside the fund is not taxable, potentially allowing you to give more.

Donor-Advised Fund as an Investment Strategy

A donor-advised fund investment strategy works particularly well if you’re in a high tax bracket now—perhaps you went public with or sold a company—and you’ll be in lower brackets in future years.

If you use appreciated stock you’ve held for more than one year instead of giving cash, you won’t pay tax on imbedded gain and will still get a tax deduction for the current value. As mentioned above, this may also be a good way to diversify a concentrated stock position.

How a Donor-Advised Fund Impacts Your Portfolio

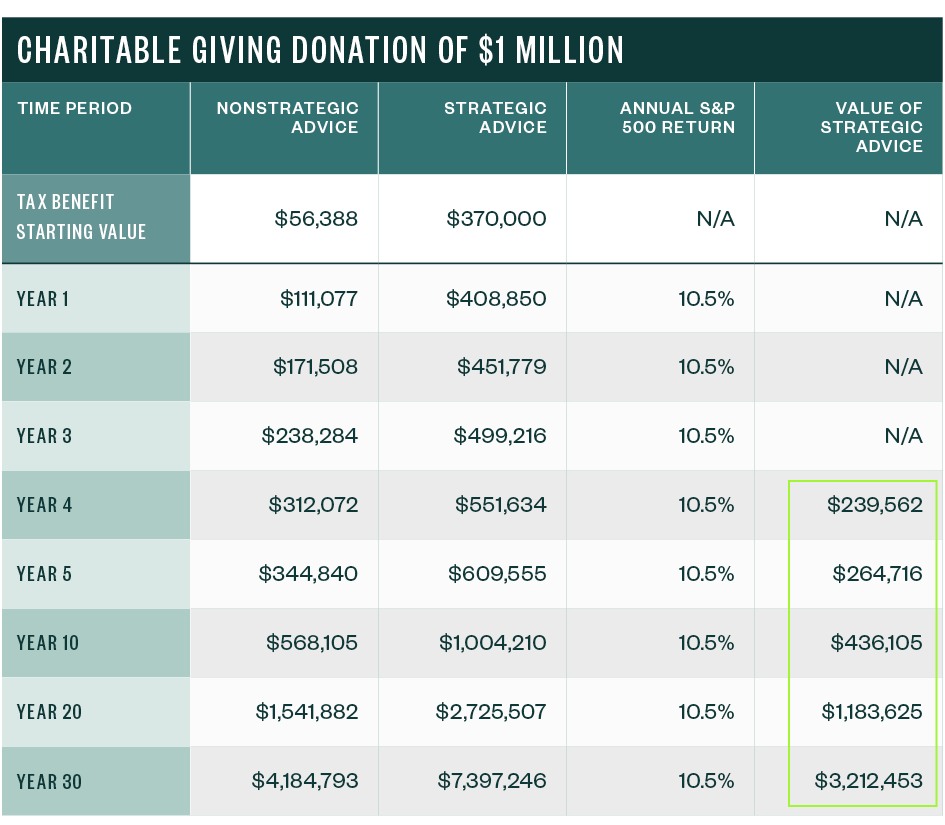

What impact can frontloading donations of appreciated securities, such as stock, have on your portfolio over time?

The example below assumes you donate $1 million of long-term stock with zero cost basis to a donor-advised fund in year one when your tax bracket is 37% versus selling $200,000 of the same stock, paying 23.8% combined long-term capital gains and net investment income tax, and then donating the cash each year for five years when your tax bracket starts at 37% then drops to 32% for the next four years.

Compounded Value of Charitable Giving Strategies

Boost Your Investment Strategy

The charitable giving strategies above demonstrate the value of professional personal financial planning advice. There are other strategies as well that could help increase the amount of capital available for investment in your portfolio.

These could include:

- State tax planning. Reduce state taxes to potentially boost your investment portfolio.

- Stock options. Know when and how to exercise your stock options.

- Qualified small business stock (QSBS). Careful planning around QSBS could drastically impact your tax liability.

Even if you only earn market-based returns, you can see how the value of professional advice compounding over time could have a dramatic impact on your portfolio.

We’re Here to Help

For more information about creating an integrated approach to strategic investments, taxes, and estate planning, contact your Moss Adams professional.

You can also visit our Private Clients Practice for additional insights.