When creating a financial plan for your estate, there are several common concerns. How can you protect your wealth for future generations? How big of an impact will taxes have?

Whether you invest on your own or previously worked with a personal financial planning service, there are strategies that could help increase the amount of assets you put to work in your portfolio.

State Income Taxes Impact Your Portfolio

State income tax rates can range from 0% to over 13%, so your state residency can take a big bite out of your portfolio.

Let’s look at two examples of how strategic advice around state taxes could provide compounded value to your portfolio.

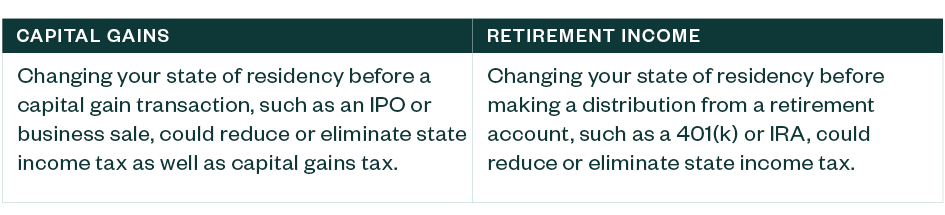

Overview of State Tax Planning Strategies

Capital Gains Taxes

Capital gain transactions are taxed to your current state of residence.

If you plan to relocate to a lower-tax state for non-tax reasons and have a large capital gain transaction coming up, such as an initial public offering (IPO) or the sale of your company, it might make sense to change your residency before selling your stock.

This could potentially reduce or eliminate your state income and capital gains taxes.

Retirement Income

Similarly, retirement income from a 401(k) plan, an individual retirement account (IRA), and other qualified plans is taxed to your state of residence. A distribution from your IRA as a high-income California resident might be taxed as high as 13.3%. The same distribution as a Nevada resident may incur no state income taxes.

To quantify the impact of these state tax-planning strategies on your portfolio, the example below assumes you have a $1 million income event subject to 20% federal long-term capital gain tax and 13.3% California income tax versus the same event after you successfully established yourself as a Texas resident and don’t pay state income tax.

Compounded Value of State Tax-Planning Strategies

Boost Your Investment Strategy

The state tax planning strategies above demonstrate the value of professional personal financial planning advice. There are other strategies that could increase the amount of capital available for investment in your portfolio.

These could include:

- Charitable giving. Donating appreciated securities into a donor-advised fund could impact your portfolio over time.

- Stock options. Know when and how to exercise your stock options.

- Qualified small business stock (QSBS). Careful planning around QSBS could drastically impact your tax liability.

Even if you only earn market-based returns, you can see how the value of professional advice compounding over time could have a dramatic impact on your portfolio.

We’re Here to Help

Learn more about creating an integrated approach to investments and taxes. For further guidance, contact your Moss Adams professional.

You can also find additional insights at our Private Clients Practice.