Whether preparing for a round of venture funding, pursuing a private equity cash infusion, or positioning for an acquisition, there are many ways to approach transitioning your tech company—but not all outcomes help business owners and executives achieve personal and professional goals.

Before entering a transaction, it’s critical to plan proactively and analyze potential outcomes—choosing a transition approach that aligns with your business and personal objectives, assembling an effective transition team, preparing for due diligence, reviewing your business’s financial plans, and determining your after-tax cash flow and liquidity needs.

Here’s an approach owners and executives can take to get the most out of a transition.

Get Started with Due Diligence

When it comes to selling all or a portion of your business, there’s no replacement for proactive pretransaction planning and due diligence. Effective preparation not only readies your company for the transaction process and improves the conditions of a sale, it also helps owners and executives lay the groundwork for a sound financial future.

Knowing what you’ll face when due diligence begins—and preparing effectively—can help a company position itself for better negotiations, higher valuations, and stronger outcomes. There are several strategies for approaching due diligence, which we address in the third article of this series, 4 Ways to Prepare for Due Diligence and Help Your Company Secure a Better Deal.

Those strategies include:

- Invest in professional accounting practices—closing books at least quarterly and preparing two-to-three years of reviewed or audited financial statements

- Perform a detailed review of all business and legal contracts

- Reorganize cap tables to reflect the key assets of the business

- Prepare your virtual data room, financial model, product and customer details, sell-side quality of earnings reports, and proof of ongoing audits

- Establish financial acumen between executives and the entire leadership team

But before beginning due diligence, it’s important to have a firm understanding of the personal and professional goals that need to be kept in mind during the due diligence process and achieved through the transaction.

Determine Personal and Professional Goals

A successful transition needs to be managed efficiently while meeting personal goals and business goals.

Personal Goals

Personal goals could include determining timing, opportunities, risks, and the amount you need to earn from the business’s ownership transition to continue living your desired lifestyle and leave behind a legacy. They also include finding ways to effectively reallocate funds and reorganize wealth outside the business, such as:

- Utilizing the options available for qualified small business stock

- Identifying opportunities for early exercise of options where appropriate—83(b) elections

- Transferring equity out of the estate and into trusts and to lower generations

- Analyzing current stock options and reorganizing if necessary

- Determining ideal sale structure, such as cash deals, stock deals, or share swaps

- Defining and optimizing after-tax cash flow and associated liquidity needs

Business Goals

Every member of your business has their own interest in the company, which may or may not align with the long-term needs of the business or the individual goals of company owners or executives.

Developing a leadership team that can align meaningful business goals—and an impactful method for approaching those goals—can help strengthen the company overall. The leadership team often includes the business owner, key stakeholders and executives, and advisors who know your business. Advisors can help leadership effectively analyze the following factors:

- The market-based value of your business and market value drivers

- The business’s growth strategy, identified opportunities, and associated pro forma adjusted financial model

- The management team’s depth, quality, and needed resources

- The approach and analysis of due diligence preparedness

- The business’s transition alternatives

Build Your Management Team

Before purchasing your business, a buyer will need to be confident the company will continue running smoothly once you’ve transitioned out of ownership. Establishing a strong management team early in the pretransition process, and continuing to restructure the team to reflect your business’s growth or changing needs, can help leadership better position for a sale and instill greater buyer confidence.

Successful management teams often include anywhere from two-to-five professionals who have high stakes in the company’s success, such as company owners or members of the board, professionals who compile business data and resources, key sales or product leadership, and people who will play a central role in the post-transition process—interacting with the buyer and helping determine the business’s future trajectory.

The quality of the team determines much of your company’s strength—and therefore much of your company’s value. This means business owners can benefit by assigning team members and beginning to transfer key relationships years before selling. To start this process, leadership can assess the management team, reallocate vital responsibilities, and remove themselves from the company’s daily proceedings.

Create Your Timeline

Building a personal and business planning timeline before you’re ready to sell can help you get the most out of your transition. When determining your timeline, it’s important to optimize your approach from a tax perspective so that you can receive the full after-tax value for your company.

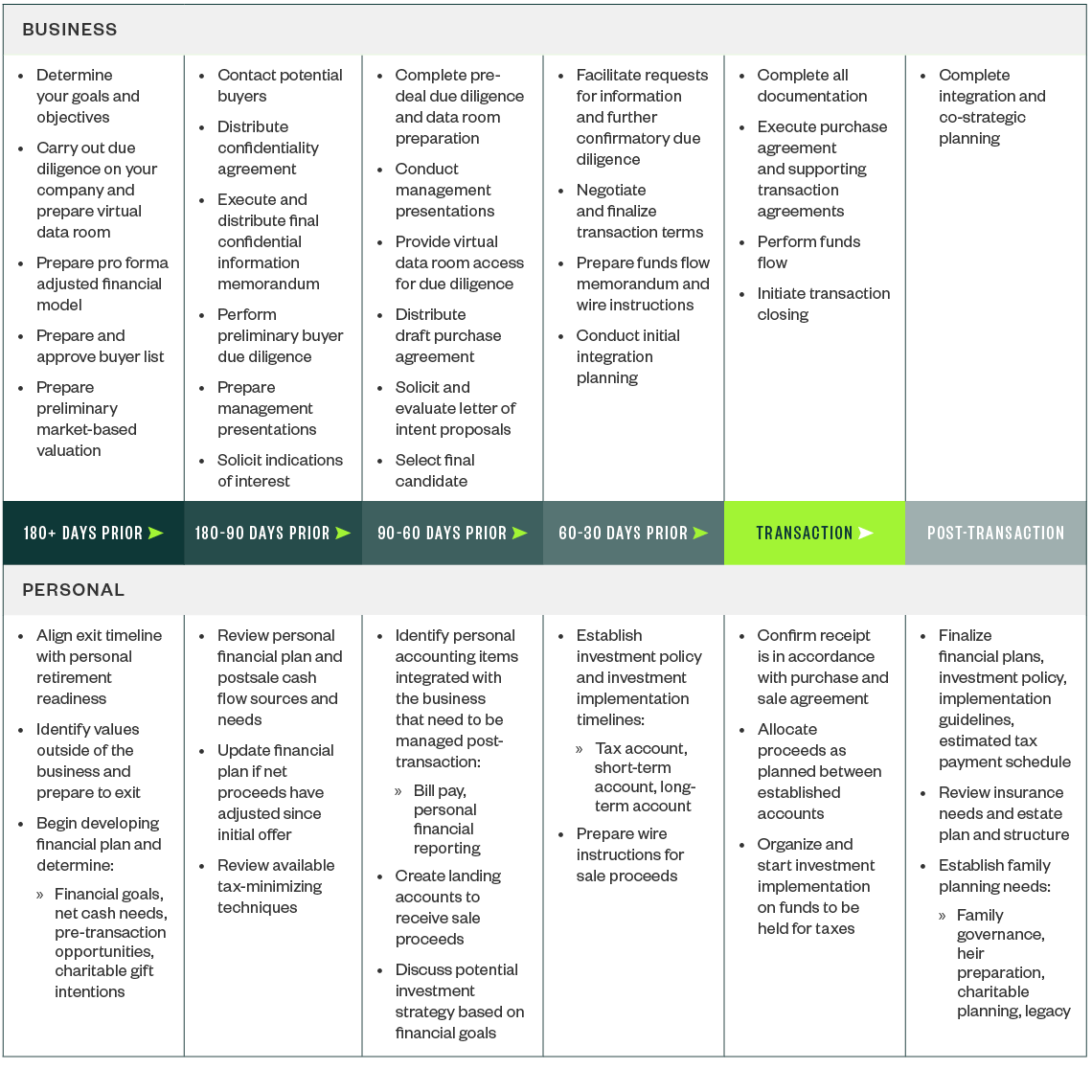

Generally, the closer the transaction is to closing, the more likely planning opportunities will narrow—that means it’s important to make a detailed plan long before beginning the sale. The below graphic demonstrates effective transition timelines, as they pertain to personal goals and business goals.

.png?width=1140&height=1140&ext=.png)

To learn more about the pretransition timeline and the transaction preparedness evaluation, please see A Transaction Preparedness Evaluation Could Help Protect Your Financial Future.

Modify Your Business Plan and Structure

Business Plan

Your business plan should align with both personal and professional business goals. To meet these goals, consider identifying the following:

- Strategic business decisions. Determine the decisions you can make today to help you meet your business’s growth objectives for the future.

- Future opportunities for growth. Most buyers will want to know about potential business opportunities and how you and your management team plan to pursue them.

- Your growth strategy. Being able to articulate your strategy and have a well-prepared pro forma adjusted financial model will help get buyers excited about partnering with, or acquiring, your organization.

Business Structure

Assessing your business’s structure can help you identify possible modifications to increase its future value. These changes could include the following:

- Introducing alterations in management

- Improving processes through new technology

- Enhancing your current entity structure

Making these revisions could help initiate a tax-efficient sale or transition, with a specific focus on industry or market changes—such as those introduced through tax reform, referred to as the Tax Cuts and Jobs Act (TCJA). Some TCJA-introduced changes sellers should be aware of include:

- M&A activity has increased in 2018, and buyers currently have more cash than they did before the TCJA was passed. This means buyers have more options when it comes to making a purchase.

- Business owners can no longer deduct state and local taxes of over $10,000. By limiting this deduction to $10,000 individuals and trusts are no longer able to deduct any additional state tax liability for federal tax purposes. This means individuals and trusts will likely be at a higher effective federal tax rate in most cases.

Determine Your Deal Structure

Whether you’re transitioning to family, selling 100% of your business, or forming an employee stock ownership plan (ESOP), there are many ways to transition your business.

Prior to engaging in discussions with a buyer, it’s important to have answers to the following questions to help you determine the best transaction structure for achieving your goals:

- Am I looking for a cash deal from the transaction, or am I willing and able to take stock in the buyer?

- Post close, which business aspects am I able to manage and control, and which do I want to manage and control?

- What risks am I willing to take on related to the buyer’s ability to execute a strategic plan?

- Does a stock sale, asset sale, or 338H10 election work better for me on an after-tax basis?

- Are there compliance or approval factors I should be aware of?

After determining the answers to these questions, you’ll have a better idea of your transaction priorities and your deal approach—including which portions of the transaction you’re willing to be flexible with, and which portions are imperative to meeting your personal and professional objectives.

Prepare Your Employees and Customers

Open communication between the leadership team and a company’s employees and customers is central to a smooth, successful transition.

During transactions, many employees worry about keeping their jobs, receiving the benefits they’ve come to expect, and continuing to have access to growth opportunities following the transition. Because a company’s success depends on the quality of its employees and customers, a majority of transaction due diligence typically focuses on determining methods for ensuring the current and future stability of those two groups.

While leadership can’t guarantee the direction of future changes, many buyers will offer new opportunities to employees and customers upon closing the transaction. Being able to answer questions about equity, opportunity, and benefits can greatly reduce stressors for employees and customers who are transitioning with the business.

Once the deal is announced, it’s important to continue proactively instilling employee and customer confidence. To do this, leadership can communicate regularly with employees and customers, emphasizing that the quality of service won’t change, and that the transition should strengthen the business—providing customers with better products and services.

Consider Potential Setbacks

From start to finish, fully transitioning a business often takes anywhere from six-to-nine months—and sometimes more than a year. There are several avoidable pitfalls sellers should be aware of before beginning the transaction process.

Taking Shortcuts

Many business owners and executives make the mistake of thinking they can finish the transition more quickly by taking shortcuts or executing the process themselves. This can lead to errors in due diligence that enable buyers to lower their asking price. It can also result in oversights that prevent owners from receiving many of the benefits the sale might otherwise produce.

Becoming Overconfident

Before preparing for the transition, a fast-growing business might receive showings of interest from multiple buyers. This can lead to false confidence that the company will sell quickly or easily, resulting in unrealistic growth or finance expectations, inadequate due diligence preparation, or skipped portions of due diligence all together.

Spending Prematurely

Sellers can make the mistake of investing too much or spending too quickly following a transaction. This can present problems if a seller doesn’t fully understand their after-tax liquidity. To handle money with better clarity following a sale, sellers should consider waiting to spend their earnings until at least three months after the transaction.

Investing Earnings Incorrectly

There are often questions about where sellers should store cash following a sale. Rather than investing in a bank or spending earnings on a new venture, sellers can store significant sums in brokerage accounts. These accounts offer more protections than bank accounts because they don’t lend funds. Depending on the time of the transaction, there can also be opportunities to invest your cash in a way that has long-term yield—such as investing in the US Treasury or in a fixed-income account that comes to maturity around the time taxes are due.

We’re Here to Help

Selling a tech company has substantial implications for owners and executives—not just professionally, but also personally. To learn more about how pretransaction planning and due diligence can help you meet your personal and professional objectives, contact a Moss Adams professional.