The SEC’s Office of Investor Education and Advocacy issued an Investor Bulletin on December 10, 2020, to educate investors about special purpose acquisition company (SPACs), which have become a popular vehicle for transitioning companies from private to publicly traded.

Certain market participants believe that an acquisition by a SPAC can help a private company become publicly traded with more pricing certainty and deal-term control than a traditional initial public offering (IPO).

Below is a summary of accounting and SEC reporting considerations for acquisition transactions involving public shell companies formed as SPACs.

SPAC Overview

A SPAC is a public shell company created to acquire private operating companies with the intention to bring those private operating companies public.

A SPAC doesn’t have operations or assets—other than cash and limited investments. It offers securities for cash and places substantially all the offering proceeds into a trust or escrow account for future use in the acquisition of one or more private operating companies.

The SPAC will identify target companies and attempt to complete one or more business combination transactions, after which, the SPAC will continue the operations of the acquired company or companies as a public company. A SPAC typically provides an 18-to-24-month period to identify and complete an initial business combination transaction.

Once the SPAC identifies a target company, the shareholders of the SPAC generally receive a proxy statement and vote on the initial business combination transaction. If the transaction is completed and a shareholder decides not to remain with the company, the shareholder has the opportunity to redeem shares of common stock for a pro rata share of the aggregate amount.

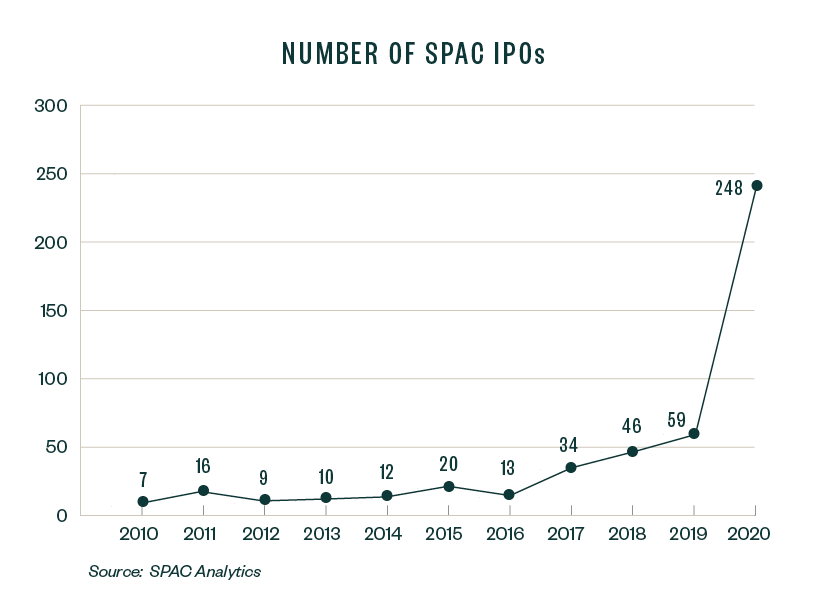

The formation of SPACs increased steadily over the past 10 years, with a spike in 2020 and no expectation to slow down in 2021. As of March 30, 2021, 297 SPAC IPOs were already completed in 2021, according to data compiled by SPAC Analytics.

Determine the Accounting Acquirer

Entities should consider all relevant facts when assessing which entity is the accounting acquirer in an acquisition transaction—which may differ from the legal acquirer.

In accordance with generally accepted accounting principles (GAAP), the entity that obtains control is the accounting acquirer.

In a traditional acquisition the acquirer is typically the entity that transfers the cash or other assets, incurs the liabilities, or issues its equity interests; in an acquisition of the target company by a SPAC the accounting acquirer is often the target company.

Additional Considerations

The pertinent facts and circumstances provided in paragraphs 805-10-55-11 through 55-15 should also be considered when identifying the accounting acquirer in a merger affected by exchanging equity interests, including:

- The relative voting rights in the combined entity after the business combination. The acquirer is usually the combining entity whose owners, as a group, retain or receive the largest portion of the voting rights in the combined entity.

- The existence of a large minority voting interest in the combined entity if no other owner or organized group of owners has a significant voting interest. The acquirer is usually the combining entity whose single owner or organized group of owners holds the largest minority voting interest in the combined entity.

- The composition of the governing body of the combined entity. The acquirer is usually the combining entity whose owners have the ability to elect, appoint, or remove a majority of the members of the governing body of the combined entity.

- The composition of the senior management of the combined entity. The acquirer is usually the combining entity whose former management dominates the management of the combined entity.

- The terms of the exchange of equity interests. The acquirer is usually the combining entity that pays a premium over the precombination fair value of the equity interests of the other combining entity or entities.

Reverse Acquisition Guidance

Subtopic 805-40 provides guidance relating to reverse acquisitions where the legal acquirer, or the SPAC, becomes the accounting acquiree.

In the included scenario, a private operating entity arranges for a public entity to acquire its equity interests in exchange for the equity interests of the public entity. This transaction allows the private operating entity to go public without registering its equity shares.

While the public entity is the legal acquirer—it issued its equity interests—and the private entity is the legal acquiree—its equity interests were acquired—the public entity is determined to be the acquiree. The private entity is determined to be the acquirer for accounting purposes when applying the guidance.

Target Company Is the Accounting Acquirer

If the target company is determined to be the accounting acquirer, the acquisition can only be accounted for as a reverse acquisition if the SPAC—accounting acquiree—meets the definition of a business. However, the SPAC typically won’t meet the definition of a business because its primary precombination assets are cash and investments.

Business Combination

If the SPAC meets the definition of a business, the measurement principles applicable to business combinations under Accounting Standard Codification (ASC) Topic 805 should be applied.

This means that goodwill will be recorded, and the acquired assets and liabilities of the target company should be recognized at their precombination carrying amounts. The assets and liabilities of the SPAC should be recognized at fair value.

Reverse Capitalization

If the SPAC doesn’t meet the definition of a business, the acquisition of the target company would be accounted for as a reverse capitalization—rather than a business combination or asset acquisition. This is equivalent to the target company issuing its stock for the net assets of the SPAC, accompanied by a recapitalization.

The accounting is similar to a reverse acquisition between two operating entities, except no goodwill or intangible assets should be recorded.

It’s common for the acquisition of the target company by a SPAC to be accounted for as a reverse recapitalization where:

- The target company is the accounting acquirer

- The SPAC doesn’t meet the definition of a business

Financial Statement Presentation

After the consummation of the acquisition, and when the target company is determined to be the accounting acquirer, the financial statements should be issued under the name of the SPAC—accounting acquiree—but described in the notes as a continuation of the target company—accounting acquirer.

The financial statements of the target company become those of the registrant and, as such, are required to comply with SEC rules and regulations.

SPAC Is the Accounting Acquirer

If the SPAC is determined to be the accounting acquirer, the acquisition should be accounted for as a business combination if the target company—accounting acquiree—meets the definition of a business.

If the target company meets the definition of a business, the measurement principles applicable to business combinations under Topic 805 should be applied, as described as above.

If the target company doesn’t meet the definition of a business, the acquisition should be accounted for as an asset acquisition, in accordance with Subtopic 805-50.

Financial Statement Presentation

When the SPAC is determined to be the accounting acquirer, the historical financial statements of the target company replace the historical financial statements of the SPAC and become the financial statements of the combined company, a public entity, after the consummation of the acquisition.

This means that the financial statements of the target company must comply with SEC rules and regulations. The predecessor and successor periods—pre- and postacquisition periods, respectively—should be separated by a black line, and the effects of acquisition accounting should be reflected in the successor periods.

Multiple Target Companies

Determining the accounting acquirer is more complex when there are multiple target companies acquired by a SPAC.

As summarized above, all pertinent facts and circumstances should be considered—however, it should be noted that the FASB doesn’t provide a hierarchy to assess the various factors that influence the determination of the accounting acquirer.

Because there’s no single criterion more significant than the others, this may result in the determination being highly judgmental—especially when the factors are mixed.

If the SPAC is determined to be the accounting acquirer, the same guidance should be applied as described above to determine whether the target companies meet the definition of a business and the resulting accounting implications.

If one of the target companies is determined to be the accounting acquirer, this will result in reverse recapitalization of that target company. The resulting transaction would then be a business combination between the target company determined to be the accounting acquirer and the remaining target companies.

Merger Requirements

Once a target company has been identified, the SPAC must solicit shareholder approval.

Prior to soliciting a shareholder vote, the information must be provided to the SEC by filing either:

- A proxy statement on Schedule 14A

- A combined registration statement and proxy statement on Form S-4 when the SPAC intends to register new securities as part of the transaction

The SEC’s Division of Corporation Finance issued CF Disclosure Guidance: Topic Number 11 on December 22, 2020, to provide its views about certain disclosure consideration for SPACs in connection with their IPO and subsequent business combination transactions.

The items outlined in Topic Number 11 should be considered pursuant to filing a proxy statement or registration statement.

Disclosures

The solicitation must disclose all important facts about the acquisition of a target company by a SPAC, including:

- Name, mailing address, and telephone number of the principal executive offices of the SPAC and the target company

- Brief description of the general nature of the business conducted by the SPAC and target company

- Description and terms of the transaction

- Consolidated and audited financial statements

- Supplementary financial information required by Item 302 of Regulation S-K if required

- Historical and pro forma per share data of the SPAC and historical and equivalent per share data of the target company

- Management's discussion and analysis of financial condition and results of operations required by Item 303 of Regulation S-K

- Quantitative and qualitative disclosures about market risk required by Item 305 of Regulation S-K

The amendments in SEC Release Number 33-10890, Management’s Discussion and Analysis, Selected Financial Data, and Supplementary Financial Information—effective February 10, 2021—eliminated the requirement to provide selected financial data in accordance with Item 301 of Regulation S-K.

A summary of the key requirements follows.

Financial Statements

Upon the close of an acquisition by a SPAC, the target company’s financial statements become those of the registrant upon completion of the merger.

An acquisition of the target company by a SPAC is generally the equivalent of an IPO of the target company that would require the proxy statement to include audited financial statements of the target company.