There are many considerations and legal processes to navigate when buying or selling a business. Most changes in ownership include incurring some amount of transaction costs for legal fees, due diligence, structuring, investment bankers, employee bonuses, and payouts.

The tax law around deducting transaction costs can be complex, but a basic understanding may help support the current tax deduction of transaction costs and free up cash flows on both buy-side and sell-side.

Treatment of Transaction Costs

Understanding the basic treatment of transaction costs for both bookkeeping and tax is important, which is further detailed below.

GAAP Treatment

For bookkeeping purposes, buy-side transaction costs are generally expensed as incurred or upon transaction close and sell-side costs are recorded through the flow-of-funds as an adjustment to sales proceeds.

Tax Treatment

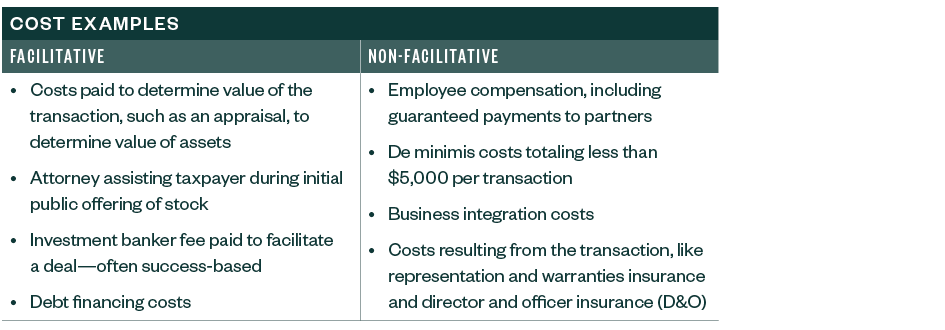

In general, for income tax purposes, any costs paid to facilitate a transaction must be capitalized into the basis of the purchased assets or stock by the buyer or treated as a reduction in sales proceeds by the seller. The taxpayer has the burden of proof to document which transaction costs, if any, can be expensed as non-facilitative.

Frequently Asked Questions

Below are questions to help you navigate the transaction cost process.

What Costs Are Considered Facilitative and Therefore Must Be Capitalized for Income Tax Purposes?

Facilitative costs refer to those paid in the process of investigating or otherwise pursuing the transaction, which is a facts and circumstances test. The fact that the amount would be or would have been paid but for the transaction is relevant, but it’s not always determinative.

The ability to deduct non-facilitative costs can be limited by the information available. For example, an attorney may bill for assisting with drafting a purchase agreement as well as consulting on employee compensation structures for a transaction within the same invoice.

Requesting that your attorney and other service providers include additional detail about the matters consulted on each invoice originally can save a lot of time and provide more accurate information to help claim and substantiate each deduction you are entitled to.

What Is the Process for Analyzing and Deducting Transaction Costs?

Analyzing deductible transaction costs begins with answering the following important questions to help understand the nature and background of each cost and service.

- When was each cost incurred?

- What was the purpose of the cost?

- Who paid for the service?

- Who was the contractual receiver of the service?

- Which parties benefitted from the service and by how much?

- Is the cost success-based (contingent upon the consummation of the transaction)?

- Did the purchase agreement include allocation of costs between buyer, seller, and target?

- Did that allocation match what actually occurred?

- Is there another income tax provision that requires capitalization, such as start-up costs or directors and officers insurance costs that are required to be capitalized and amortized over the life of the contract?

After this initial analysis, additional work must be completed to report deductible and nondeductible costs on the tax returns including mapping to the correct entity, considering elections that may be beneficial, properly capitalizing the costs to either assets or stock basis, amortizing the costs, if available, and adding required disclosures and statements to the tax returns.

What Is the Benefit of Analyzing Transaction Costs?

Sell Side

Proper accounting for transaction costs may reduce taxable gain recognized by the sellers and could also reduce tax paid in the preacquisition return of the target company.

Buy Side

Transaction cost analysis may accelerate deductions that would otherwise be capitalized and, in some cases, may have been amortized over 15 years in an asset purchase or permanently capitalized into stock basis in a stock purchase.

Either Side

There’s a potential cash-flow benefit to pursuing a transaction cost analysis, especially in transactions where costs may be millions of dollars.

What Are the Early Considerations of a Change-in-Ownership Transaction?

Request detailed, itemized invoices for related services from each of your service providers involved in the transaction. Keep transaction costs segregated in a separate expense account. Consult with your tax provider early on for structuring the transaction and when considering any agreements between parties related to the allocation or payment of expenses.

We’re Here to Help

For guidance on transaction costs, contact your Moss Adams professional.